Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The amount of a personal loan you can get depends on various factors, including your financial situation, creditworthiness, and the specific policies of the lender you approach. Here are some key factors that influence the maximum personal loan amount you may be eligible for:

Credit Score: Your credit score is a significant factor in determining how much you can borrow. A higher credit score generally qualifies you for larger loan amounts. Lenders use your credit score to assess your creditworthiness and risk.

Income and Debt-to-Income Ratio: Lenders consider your income and your debt-to-income ratio (the percentage of your income that goes toward debt payments). A higher income and a lower debt-to-income ratio may allow you to qualify for a larger loan.

Lender Policies: Different lenders have varying policies when it comes to maximum loan amounts. Some lenders specialize in smaller, short-term loans, while others offer larger personal loans. Check with specific lenders to understand their maximum loan limits.

Collateral: If you’re applying for a secured personal loan (one backed by collateral, such as a car or savings account), the value of the collateral may influence the loan amount you can secure.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Purpose of the Loan: Some lenders may have specific limits based on the purpose of the loan. For example, a lender might have a higher limit for debt consolidation loans compared to loans for vacations or weddings.

Credit History: In addition to your credit score, your credit history and credit report play a role. A positive credit history with a history of managing credit responsibly can support your eligibility for larger loan amounts.

Co-Signer: If your credit or income is not strong enough, you may consider using a co-signer with a better credit profile to help you qualify for a larger loan.

It’s important to remember that just because you may be eligible for a certain loan amount doesn’t necessarily mean you should borrow the maximum available. Borrowing should be done responsibly, and you should only take out a loan for an amount you can comfortably afford to repay. Before applying for a personal loan, carefully assess your financial situation, budget for the loan payments, and have a clear plan for how you will use the funds.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

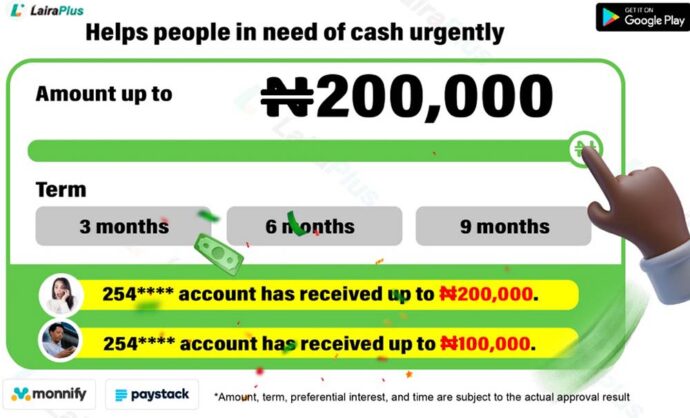

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT