Instant Loan App

LairaPlus Loan App

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

LairaPlus APP

Best loan app

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In today’s fast-paced world, quick access to funds can be a game-changer, especially when faced with urgent financial needs or unexpected expenses. Traditional loan application processes are often time-consuming and cumbersome, which doesn’t align with the fast-paced nature of life. LairaPlus, a leading instant loan app in Nigeria, has redefined the lending experience, offering users the ability to secure funds swiftly and effortlessly. In this article, we’ll explore why LairaPlus stands out as the top choice for those seeking instant loans in Nigeria.

The Need for Instant Loan Apps:

Nigeria’s financial landscape is marked by its unique challenges and opportunities, where financial needs can arise suddenly and require immediate attention. Whether it’s dealing with medical emergencies, pursuing business opportunities, or managing unexpected bills, the ability to secure instant loans is invaluable. Recognizing this, LairaPlus has emerged as a reliable partner, providing quick, transparent, and accessible financial solutions.

Why Choose LairaPlus as Your Instant Loan App in Nigeria?

LairaPlus Loan App

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Lightning-Fast Approval:

When it comes to instant loans, timing is everything. LairaPlus uses advanced algorithms to ensure swift approval. Users often receive loan approval within minutes, ensuring that they can access the funds they need promptly.

Minimal Documentation:

Traditional loans often involve a significant amount of paperwork, which can be daunting. LairaPlus simplifies the process by minimizing documentation requirements, making it easy for users to apply for loans without the hassle of extensive paperwork.

Transparent Fee Structure:

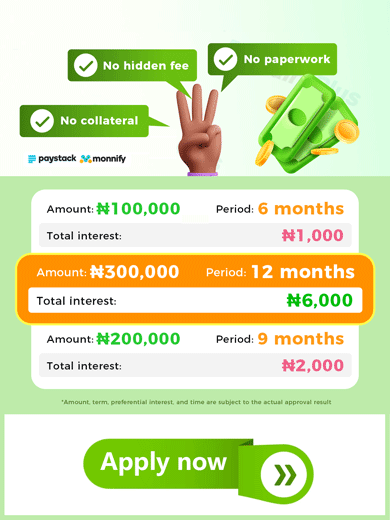

LairaPlus places a strong emphasis on transparency. Users are provided with a clear fee structure, ensuring that they fully understand the interest rates, fees, and repayment terms associated with their loans. This transparency empowers users to make well-informed financial decisions.

User-Friendly Interface:

The app is designed with a user-friendly interface that caters to both tech-savvy individuals and those new to digital financial services. The intuitive layout ensures that the loan application process is effortless for all.

No Collateral Required:

LairaPlus primarily offers unsecured loans, meaning users can access funds without pledging valuable assets as collateral, making the process hassle-free.

Flexible Repayment Options:

Recognizing that users have diverse financial situations, LairaPlus provides flexible repayment options. Users can select a plan that aligns with their financial capacity, making it easier to manage and meet loan obligations.

Data Security and Privacy:

In an era where data security is paramount, LairaPlus places a strong emphasis on safeguarding personal and financial information. Stringent security measures are in place to protect user data, ensuring confidentiality and privacy.

LairaPlus has made accessing instant loans in Nigeria a quick and accessible reality. Whether you’re addressing an unforeseen financial challenge or seizing an opportunity, LairaPlus ensures that you can access the funds you need with ease and confidence.

Choose LairaPlus as your instant loan app in Nigeria and experience a hassle-free borrowing process that aligns with the fast-paced nature of life. In a world where time is of the essence, LairaPlus remains your reliable partner for instant financial assistance.

Articles

- What is an instant loan app in Nigeria?

- How do instant loan apps in Nigeria work?

- What are the advantages of using an instant loan app in Nigeria?

- Can individuals with bad credit use instant loan apps in Nigeria?

- What are the typical requirements for using an instant loan app in Nigeria?

- How do I repay a loan obtained through an instant loan app in Nigeria?

- Are instant loan apps in Nigeria safe to use?

- Can I use multiple instant loan apps in Nigeria simultaneously?