Loan Apps

LairaPlus Loan App

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

LairaPlus APP

Best loan app

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

LairaPlus: Simplifying Borrowing with an Online Loan App in Nigeria

Nigeria finds itself at the forefront of the digital financial revolution, with an increasing demand for loans. In this age of information, borrowing no longer necessitates lengthy bank procedures or cumbersome paperwork. LairaPlus, Nigeria’s leading online loan application, provides a quick and convenient solution for individuals in urgent need of funds.

A Fast and Streamlined Loan Application Process

One of LairaPlus’s primary advantages is its fast and streamlined loan application process. Borrowers simply need to download and install the LairaPlus application on their mobile phones, followed by registering an account. After filling in the necessary personal information and verification materials, you can start the loan application.

No Collateral and Tedious Documentation

LairaPlus Loan App

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Unlike traditional loan methods, LairaPlus doesn’t require borrowers to provide collateral or cumbersome documents. This means you can avoid unnecessary hassles and waiting times during the loan process. In just a matter of minutes, you can complete the application process without leaving your doorstep.

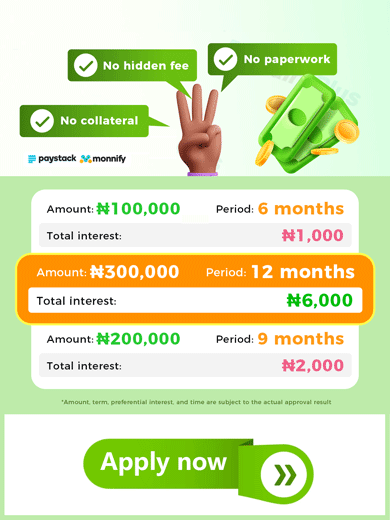

Transparent Fees and Reasonable Interest Rates

LairaPlus is committed to providing transparent loan fees. During the loan application process, you’ll clearly understand the interest and associated fees you’ll need to pay, ensuring you have a full grasp of the total cost of the loan. Additionally, LairaPlus offers competitive interest rates, allowing you to access the needed funds at a reasonable cost.

Personalized Repayment Options

LairaPlus understands that every borrower has different needs, which is why it offers personalized repayment options. You can choose a repayment plan that suits your financial situation, ensuring that repayments won’t be burdensome. This flexibility makes managing loans more straightforward, with minimal impact on your daily life.

Protection of Information and Privacy

In the digital age, safeguarding information and privacy is of paramount importance. LairaPlus employs stringent security measures to ensure that your personal information remains confidential and is not misused. You can rest assured knowing that your privacy is well protected.

A Reliable Borrowing Choice for Nigerians

LairaPlus has become a reliable borrowing choice for Nigerians. Whether you need emergency cash, business capital, or have other loan requirements, LairaPlus can meet your needs. Without the need for waiting in lines or dealing with tedious bank procedures, you can access LairaPlus anytime, anywhere to fulfill your loan requirements.

LairaPlus has changed the way borrowing works in Nigeria, making it simpler, more convenient, and transparent. Whether you are an individual in urgent need of funds or a business seeking capital, LairaPlus provides a reliable choice. It represents the future of digital finance, helping Nigerians achieve their financial goals without the burden of complex processes and lengthy waits.

In Nigeria, where access to financial services is a vital need, the

LairaPlus: Your Quick Loan App Solution in Nigeria In Nigeria, the need

In today’s fast-paced world, quick access to funds can be a game-changer,

LairaPlus: Your Trusted Online Loan App in Nigeria In today’s digital age,

In today’s fast-paced world, the need for easy and accessible financial solutions

In Nigeria’s evolving financial landscape, access to quick and reliable loans is

In Nigeria’s dynamic financial landscape, access to credit can be a game-changer