Best Loan App

LairaPlus Loan App

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

LairaPlus APP

Best loan app

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In Nigeria’s evolving financial landscape, access to quick and reliable loans is crucial for individuals facing various financial needs. The best loan app in Nigeria should be a blend of accessibility, transparency, and flexibility, addressing the unique financial challenges of its users. LairaPlus, a reputable online lending platform, has emerged as the epitome of these qualities, making it the best loan app in Nigeria. In this article, we’ll explore why LairaPlus shines as the go-to choice for individuals seeking financial solutions.

Understanding the Need for the Best Loan App:

Nigeria’s diverse financial landscape demands a financial partner that can adapt to the ever-changing needs of its users. From addressing urgent medical bills to seizing business opportunities, the best loan app should simplify the borrowing process. LairaPlus has recognized these challenges and offers a platform that ensures quick access to funds, coupled with transparent and flexible terms.

Why Choose LairaPlus as the Best Loan App in Nigeria?

Swift Approval and Disbursement:

LairaPlus Loan App

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Timing is crucial in the financial world, especially when urgent financial needs arise. LairaPlus employs advanced algorithms to expedite the approval process, often delivering approval within minutes. This ensures that borrowers can access the funds they need promptly.

Minimal Documentation Requirements:

Traditional loans can involve an overwhelming amount of paperwork. LairaPlus, on the other hand, streamlines the application process by minimizing the required documentation. This simplicity enhances accessibility for a wide range of borrowers.

No Collateral Required:

Unlike secured loans that demand collateral, LairaPlus primarily offers unsecured loans. This means that borrowers can access funds without the burden of pledging assets, making the process hassle-free.

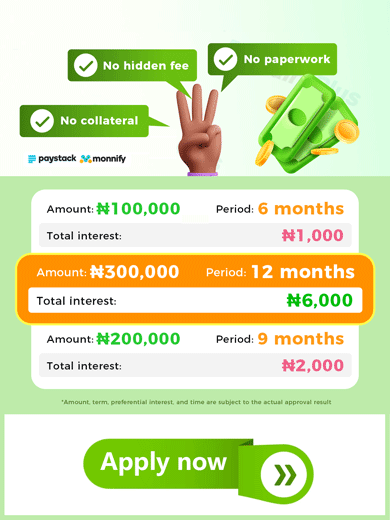

Transparent Fee Structure:

LairaPlus places a strong emphasis on transparency. Borrowers are presented with a clear fee structure, ensuring that they fully comprehend the interest rates, fees, and repayment terms associated with their loans. This transparency empowers borrowers to make well-informed financial decisions.

User-Friendly Interface:

The app is designed with a user-friendly interface, ensuring that the loan application process is accessible to both tech-savvy users and those new to digital financial services. The intuitive layout simplifies the borrowing process.

Flexible Repayment Options:

Recognizing that borrowers have diverse financial situations, LairaPlus provides flexible repayment options. Borrowers can select a plan that aligns with their financial capacity, enabling them to manage their loan obligations conveniently.

Data Security and Privacy:

In an age where data security is paramount, LairaPlus places a strong emphasis on safeguarding personal and financial information. Stringent security measures are in place to protect user data, ensuring confidentiality and privacy.

LairaPlus, the best loan app in Nigeria, is more than just a lending platform. It is a financial ally, empowering individuals to address financial challenges and pursue their aspirations. With its accessibility, transparency, and flexibility, LairaPlus simplifies the borrowing process, ensuring that you can access the funds you need with ease and confidence.

When financial challenges or opportunities arise, choose LairaPlus as your go-to loan app in Nigeria and experience a borrowing process that adapts to your unique financial needs. In a world filled with financial possibilities and challenges, LairaPlus remains a steadfast financial partner.

Articles

- What is the best loan app?

- How can I find the best loan app for my needs?

- What factors should I consider when choosing the best loan app?

- Are loan apps safe to use?

- Can I get the best loan app with bad credit?

- What types of loans are available through loan apps?

- How do I repay a loan obtained through a loan app?

- What is the average approval time for loans through loan apps?

- Are there fees associated with using loan apps?

- How do I know if a loan app is the best fit for me?