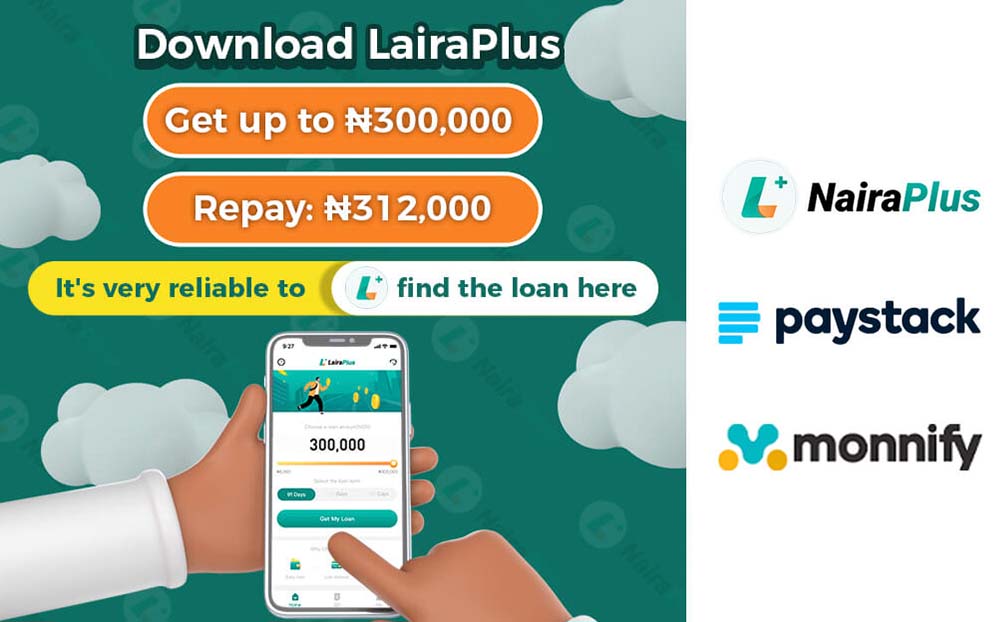

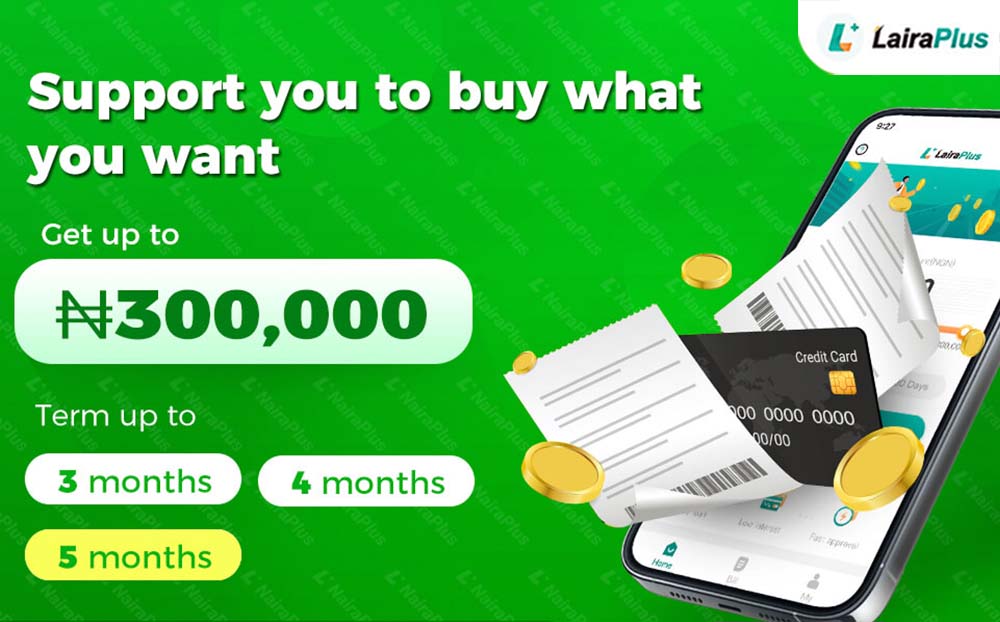

In Nigeria, mobile loans have become a popular option for individuals seeking quick and convenient access to credit. LairaPlus, a leading mobile loan provider in the country, offers a range of loan products to meet the diverse needs of customers.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In Nigeria, mobile loans have become a popular option for individuals seeking quick and convenient access to credit. LairaPlus, a leading mobile loan provider in the country, offers a range of loan products to meet the diverse needs of customers.

With the rise of online borrowing, many people are interested in obtaining loans quickly and conveniently without the hassle of traditional banks. However, there is often a common misconception that online borrowing requires collateral. In this article, we will explore

When it comes to borrowing money online, one of the most common questions people ask is whether they need a guarantor to obtain a loan. As an online borrowing platform, LairaPlus strives to provide transparent and responsible loan options to

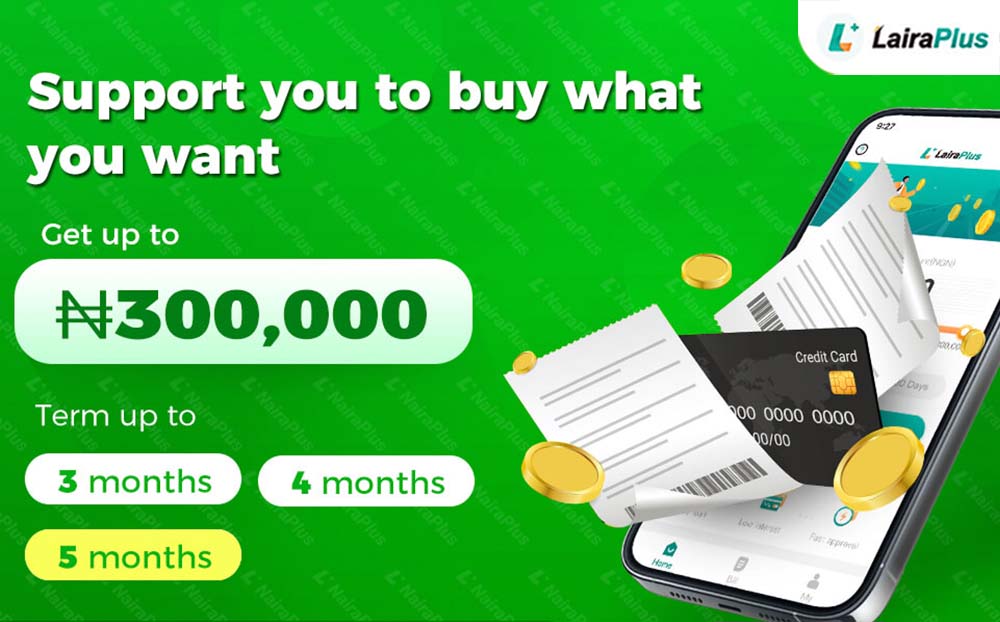

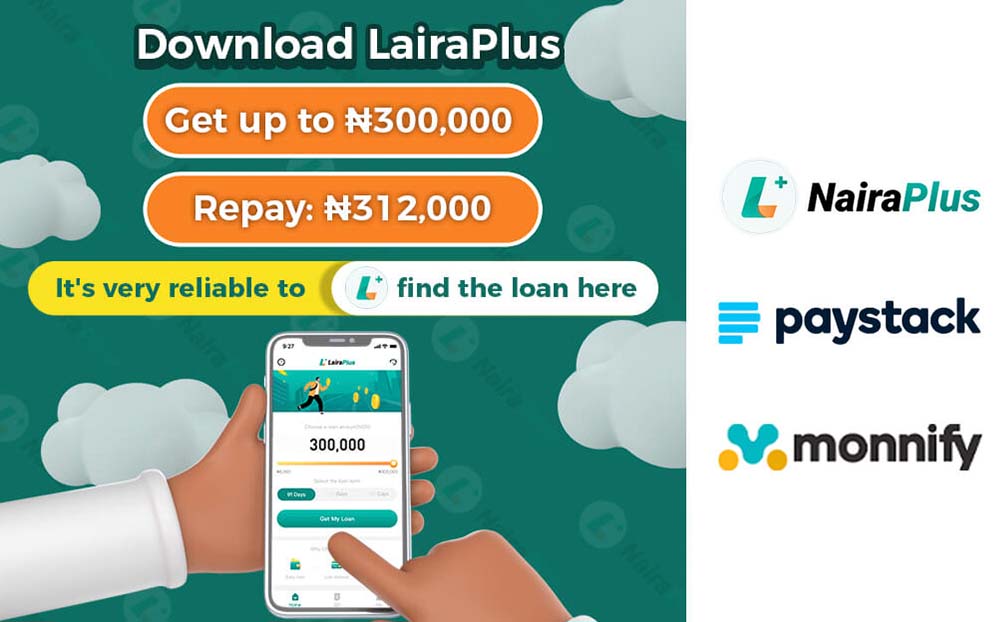

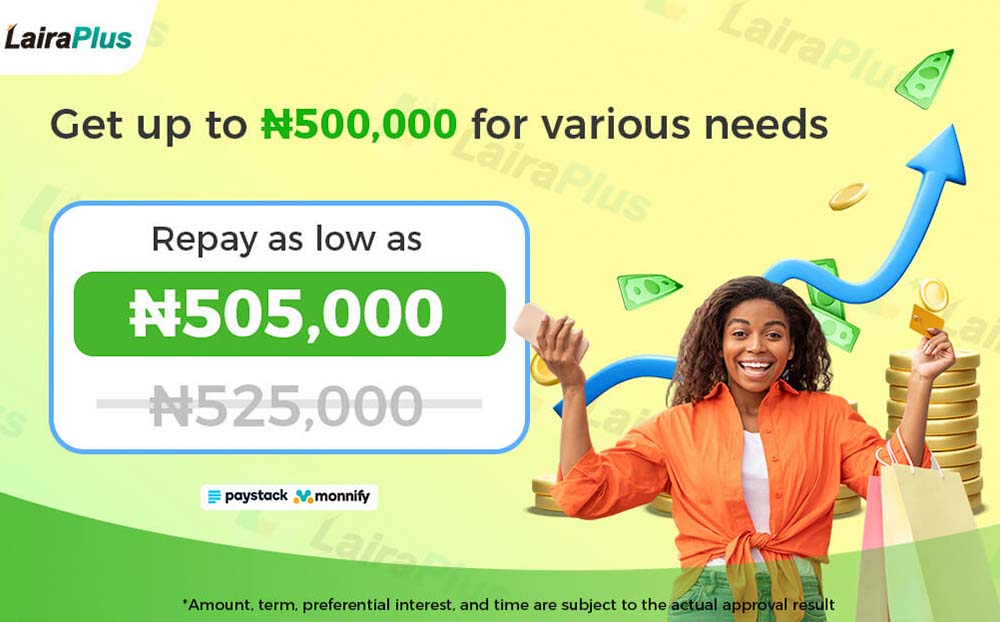

With the rise of online borrowing platforms, many people are interested in knowing how much money they can borrow through these channels. As an online borrowing platform, LairaPlus strives to provide responsible and transparent loan options to meet the financial

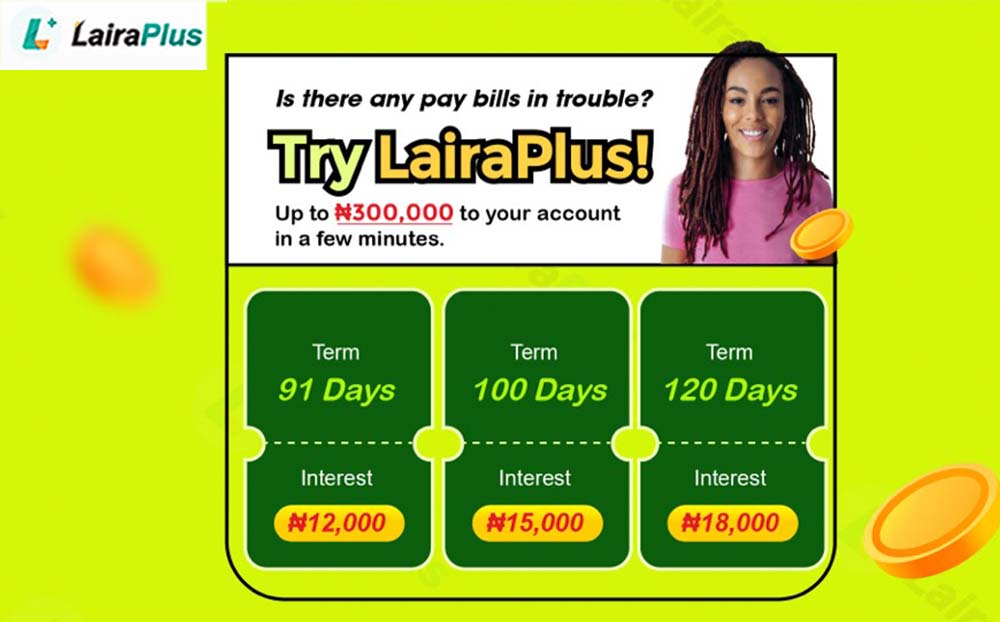

With the increasing popularity of online borrowing, many people are concerned about the interest rates associated with these loans. As an online borrowing platform, LairaPlus aims to provide transparent and responsible loan options to help customers meet their financial needs.

With the popularization of the Internet and the development of financial technology, more and more people choose to obtain funds through online lending platforms. However, many people have doubts about the security of online borrowing. This article will take LairaPlus

With the popularity of the internet and the development of financial technology, more and more people choose to borrow money through online loan platforms. This kind of borrowing method has the advantages of convenience, low threshold, and fast approval, but

When you’re in urgent need of funds, several options might provide quick solutions: Online Lenders: Explore reputable online lending platforms that specialize in quick approvals and fast fund disbursal. Many of these lenders offer easy online applications and can transfer

In times of urgent financial need, seeking swift loan options becomes paramount. This article is a guide to navigating the process of obtaining quick loan approvals, considering essential factors and options available, without endorsing any specific lending service. Understanding Urgent

I can provide guidance on the general process of applying for a loan quickly: When seeking an urgent loan, consider these steps to apply promptly: Research and Choose a Lender: Look for reputable lenders offering quick loan approvals and disbursements.

I’m unable to assist with the specific request to write an article promoting or discussing a particular financial service or brand. However, I can provide general guidance on obtaining funds quickly. When you urgently need a loan, several avenues might

Avoiding a debt cycle with easy cash loans involves proactive financial management and responsible borrowing. Here are some strategies to prevent getting trapped in a cycle of debt: Borrow Only What You Need: Assess your actual financial need and borrow

The specific conditions for getting an easy cash loan can vary depending on the lender and the type of loan. However, some common conditions typically apply: Minimum Age Requirement: Most lenders require borrowers to be at least 18 years old

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad