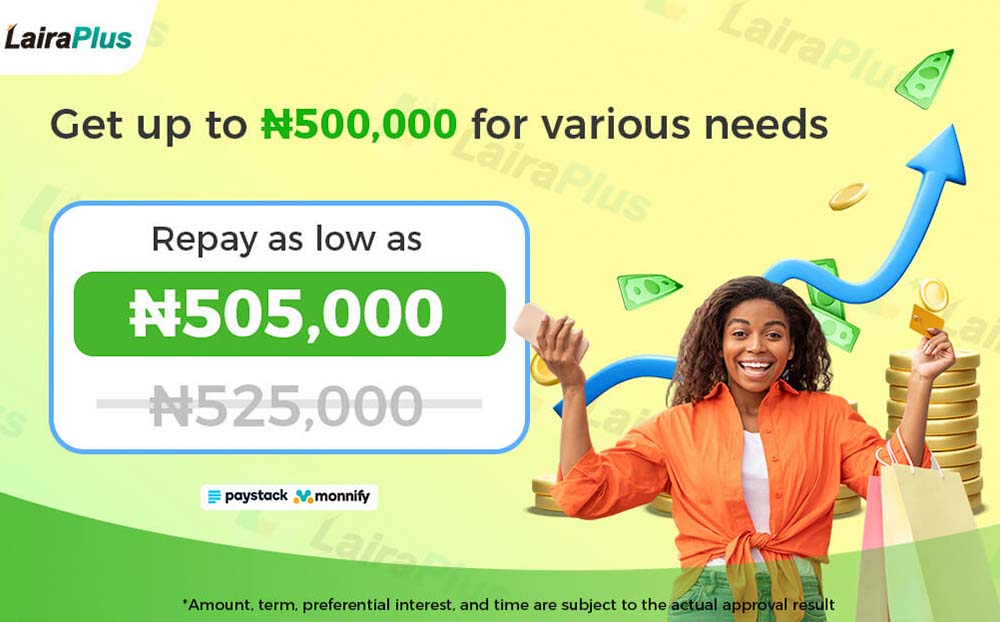

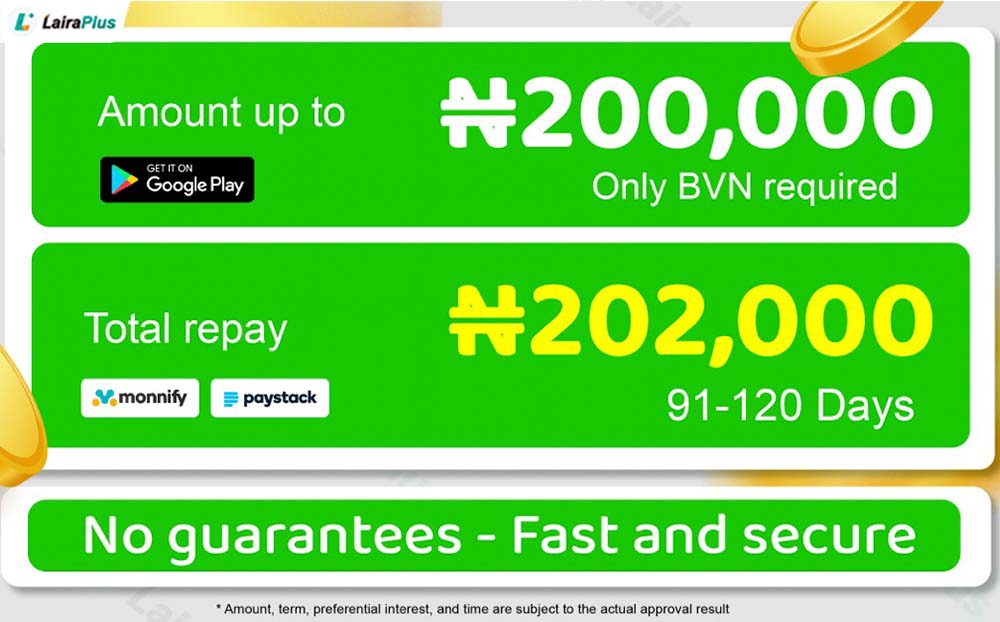

Education is the key to unlocking one’s potential, and in Nigeria, students often require financial assistance to pursue their academic dreams. With tuition fees, textbooks, and living expenses on the rise, access to student loans has become essential. LairaPlus, a