Applying for an instant loan in Nigeria can be a convenient way to access funds quickly, but it’s essential to consider the pros and cons before proceeding. Here’s a breakdown of the advantages and disadvantages: Pros of Applying for an

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for an instant loan in Nigeria can be a convenient way to access funds quickly, but it’s essential to consider the pros and cons before proceeding. Here’s a breakdown of the advantages and disadvantages: Pros of Applying for an

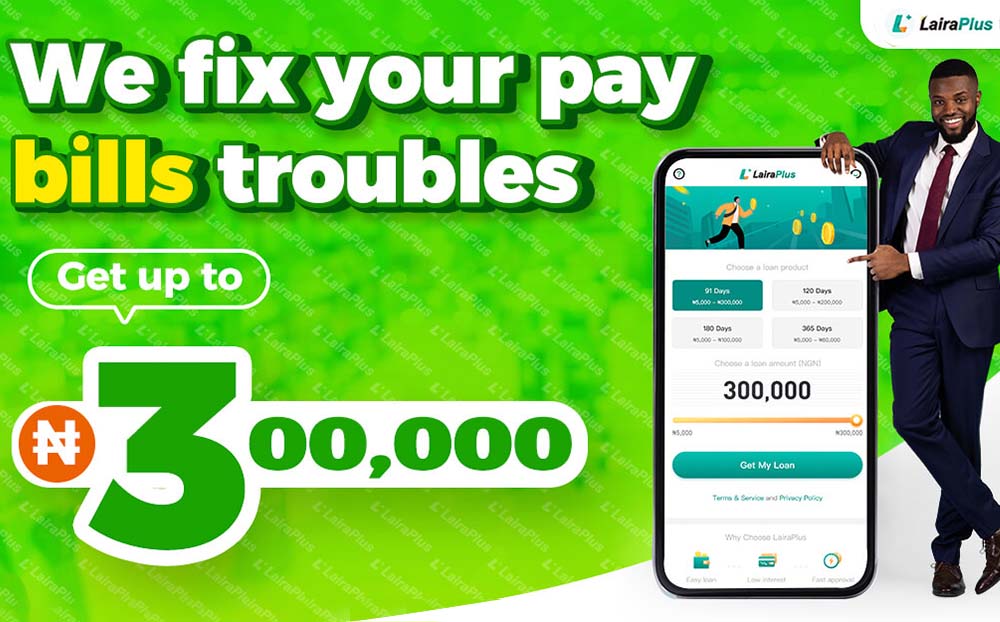

When financial emergencies strike, securing a loan quickly can be a lifesaver. In Nigeria, the need for instant loans is common, and innovative online lending platforms like LairaPlus have recognized the importance of providing accessible and convenient solutions. If you’re

Emergencies and unexpected financial needs can arise at any moment, leaving you in search of quick solutions. If you’re in Nigeria and require an instant loan, you’re in luck because you have access to convenient online lending platforms like LairaPlus.

When financial needs arise, it’s common to explore multiple options for securing a personal loan. However, many borrowers wonder whether they can apply for personal loans from different institutions simultaneously. LairaPlus, a prominent online lending platform in Nigeria, recognizes the

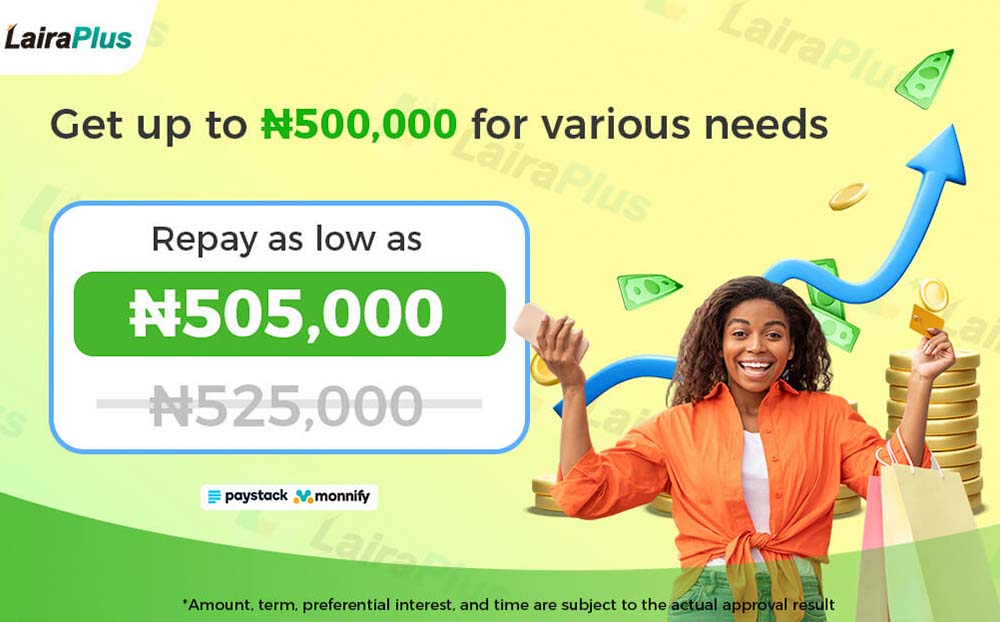

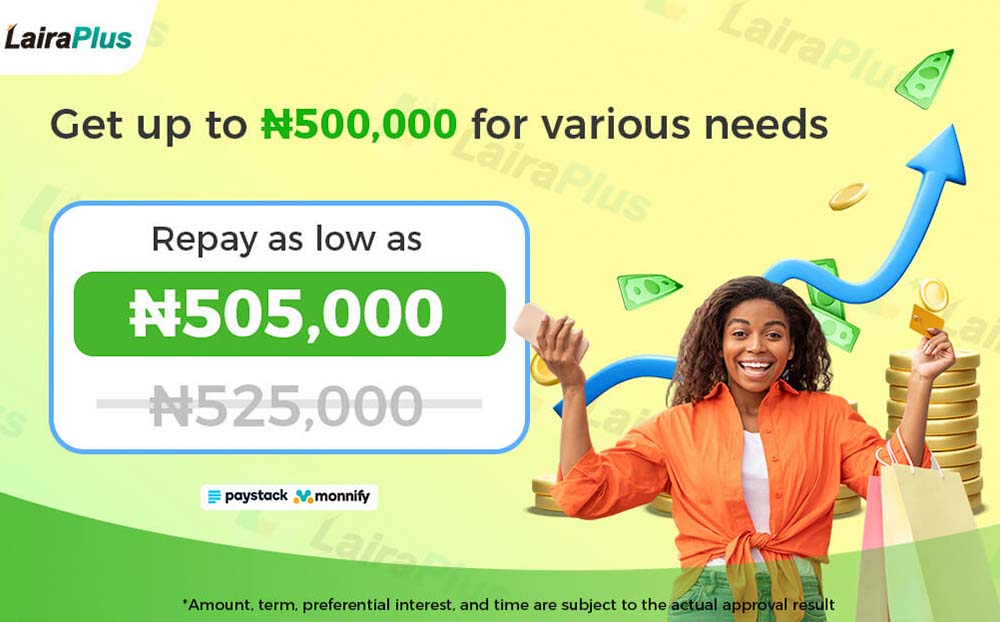

When you need a personal loan, finding the lowest interest rate is a top priority. Lower interest rates can significantly reduce the overall cost of borrowing and make repayments more manageable. In Nigeria, where financial needs vary widely, having access

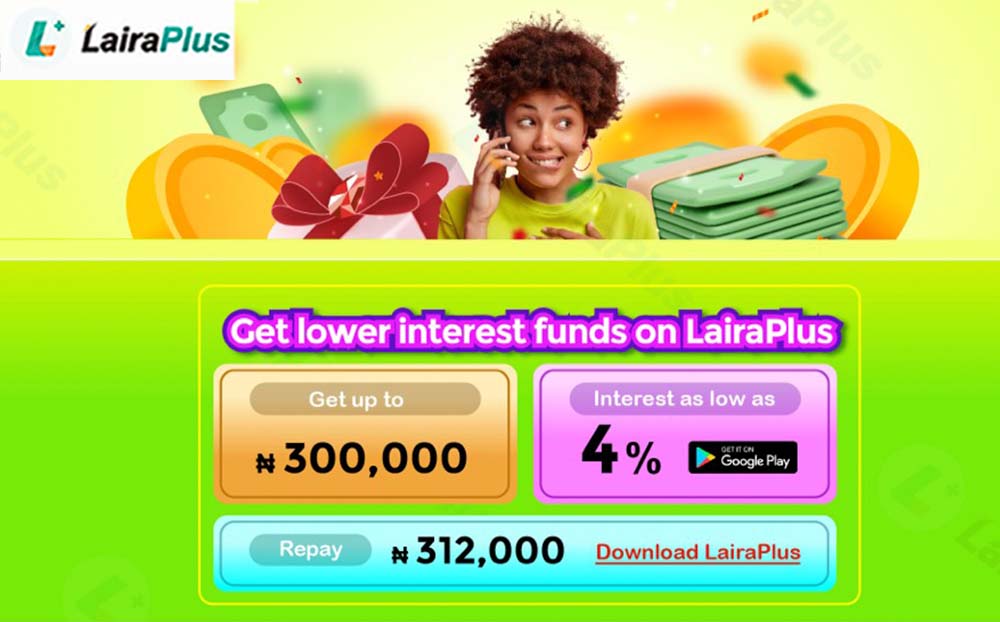

In a fast-paced world where financial needs can arise at any moment, the importance of instant personal loans cannot be overstated. These loans are designed to provide rapid financial relief when unexpected expenses or opportunities come your way. LairaPlus, a

In a world where financial needs vary greatly and the unexpected can happen at any time, having a reliable partner for borrowing money is essential. LairaPlus, a leading online lending platform, has become a household name for Nigerians seeking financial

In Nigeria’s rapidly evolving financial landscape, the demand for personal loans has never been greater. Whether it’s starting a business, pursuing higher education, or addressing unexpected financial challenges, access to a reliable online platform for personal loans is essential. LairaPlus,

In today’s digital age, the process of securing an instant personal loan in Nigeria has been revolutionized. The days of lengthy paperwork, extended waiting periods, and countless visits to traditional financial institutions are now behind us. With the emergence of

In the fast-paced and dynamic financial landscape of Nigeria, access to personal loans has become an essential tool for individuals looking to fulfill various financial needs. Whether it’s starting a business, investing in education, or addressing unexpected expenses, having a

Emergencies don’t wait for a convenient time to strike. Whether it’s unexpected medical bills, urgent home repairs, or a sudden job loss, having access to emergency personal loans can make a world of difference in alleviating financial stress. LairaPlus, a

Education is the key to unlocking one’s potential, and in Nigeria, students often require financial assistance to pursue their academic dreams. With tuition fees, textbooks, and living expenses on the rise, access to student loans has become essential. LairaPlus, a

In the fast-paced world of personal finance, the need for quick loans is a common reality for many Nigerians. Whether it’s a sudden medical expense, an unexpected bill, or a unique opportunity, the ability to access funds promptly is crucial.

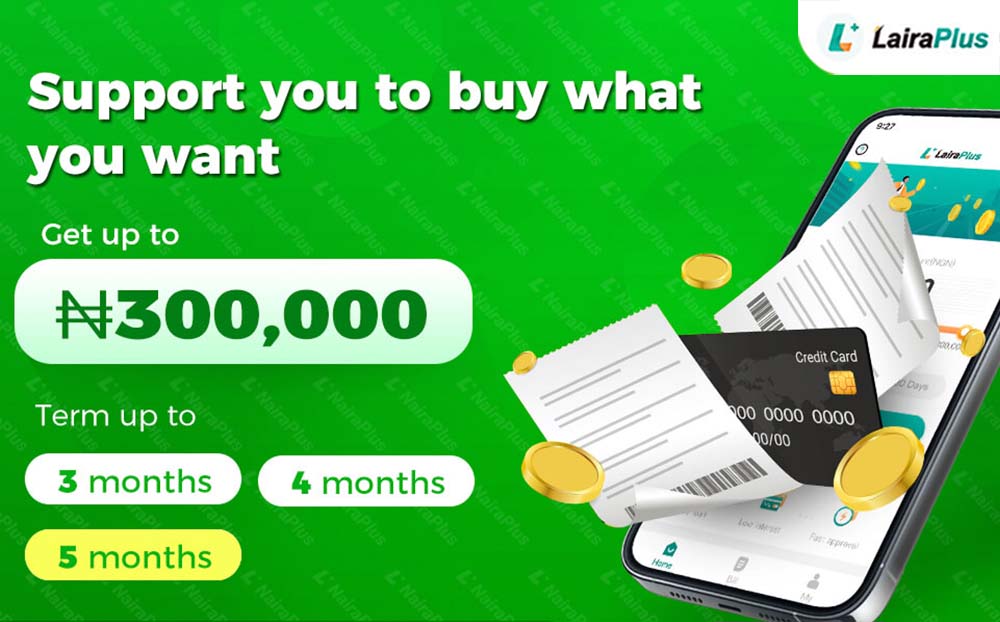

Instant loan apps in Nigeria work by providing individuals with quick access to short-term loans through a streamlined and digital application process. These apps have become increasingly popular as they offer a convenient way to secure funds for various purposes.

In the ever-evolving financial landscape of Nigeria, the demand for accessible and trustworthy loan apps is on the rise. With numerous options available, it’s essential to choose the best loan app that suits your specific financial needs. In this article,

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad