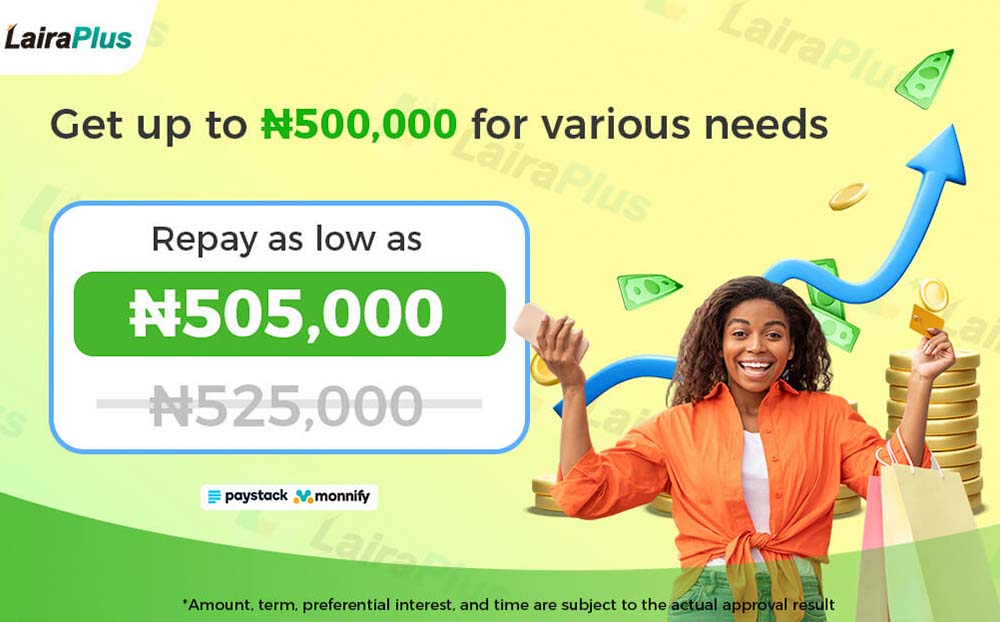

The possibility of applying for a larger amount through a 5 minute online loan can vary among lenders. Some online lending platforms may offer higher loan amounts, but the approval and disbursement duration might extend beyond a few minutes due

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The possibility of applying for a larger amount through a 5 minute online loan can vary among lenders. Some online lending platforms may offer higher loan amounts, but the approval and disbursement duration might extend beyond a few minutes due

The necessity of a good credit history for a 5 minute online loan application can vary among lenders. Some lenders offering quick online loans might not heavily weigh traditional credit scores in their approval processes. They may prioritize other factors

Securing a quick online loan can be a lifesaver during emergencies or urgent financial needs. Many lenders promise swift processing times, with some even advertising approval within minutes. Yet, once your application is approved, the time it takes for the

The time taken for approval of a 5 minute online loan in Nigeria can vary significantly based on the lending institution or platform. However, in ideal circumstances: Instant Approval: Some online lenders offer instant approval. After submitting the application, you

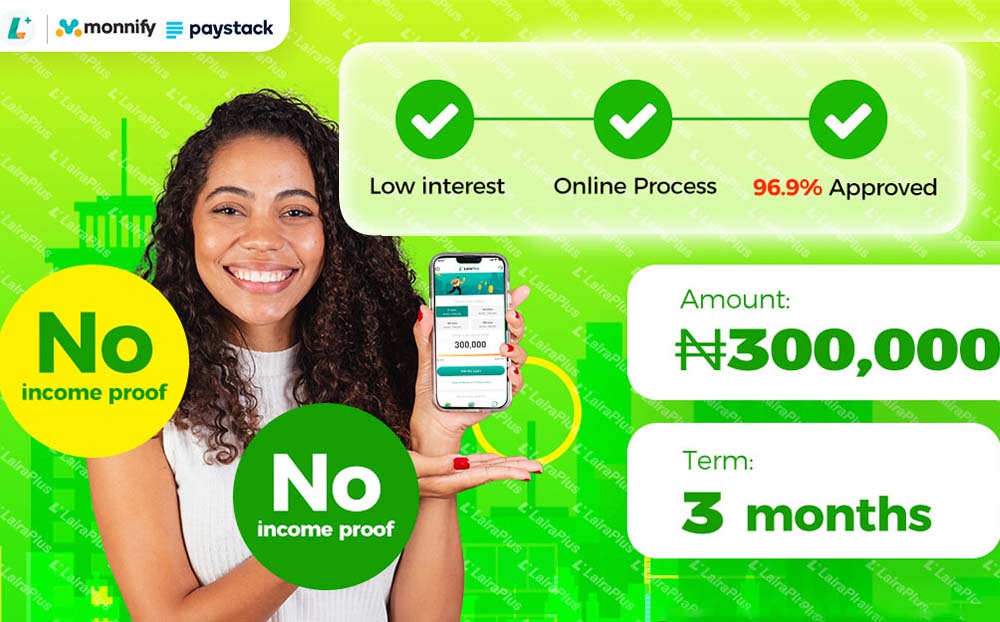

For a 5-minute online loan application in Nigeria, you typically need to provide the following information: Personal Information: Full name, date of birth, contact details (address, phone number, email), and government-issued identification details (like a national ID card, driver’s license,

Applying for an online loan in Nigeria within 5 minutes involves a few key steps: Choose a Reputable Lending Platform: Select a trusted and reliable online lending platform or app that offers quick loan services in Nigeria. Prepare Required Information:

Absolutely, creating a repayment plan is a prudent step when obtaining a loan, especially if you’re in urgent need of funds. Here’s how you can approach creating a repayment plan: Assess Your Finances: Evaluate your income, expenses, and any existing

Having bad credit can make it challenging to secure traditional loans, but there are still options available if you need a loan urgently: Explore Bad Credit Loan Options: Look for lenders or platforms that specifically cater to individuals with bad

If you have outstanding debt and urgently need a loan, it’s crucial to assess your financial situation and consider the following steps: Evaluate Your Debt: Review your outstanding debts, including their amounts, interest rates, and repayment terms. Understanding your existing

For many online loan apps, especially those designed for quick and short-term loans, collateral or a guarantor may not be required. Here’s why: Unsecured Loans: Many online loan apps, including LairaPlus, offer unsecured loans. These loans do not necessitate collateral,

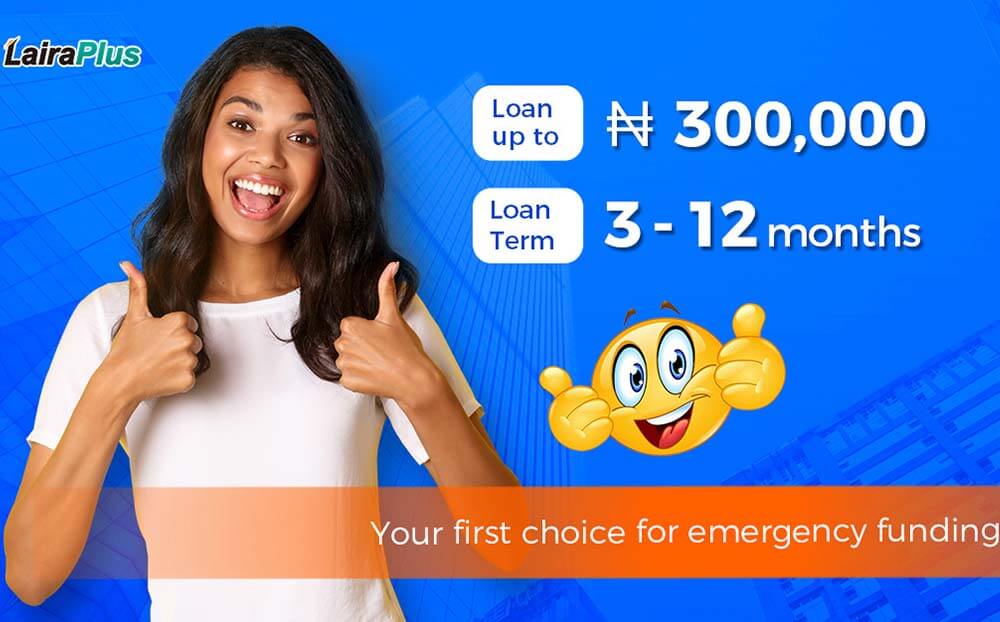

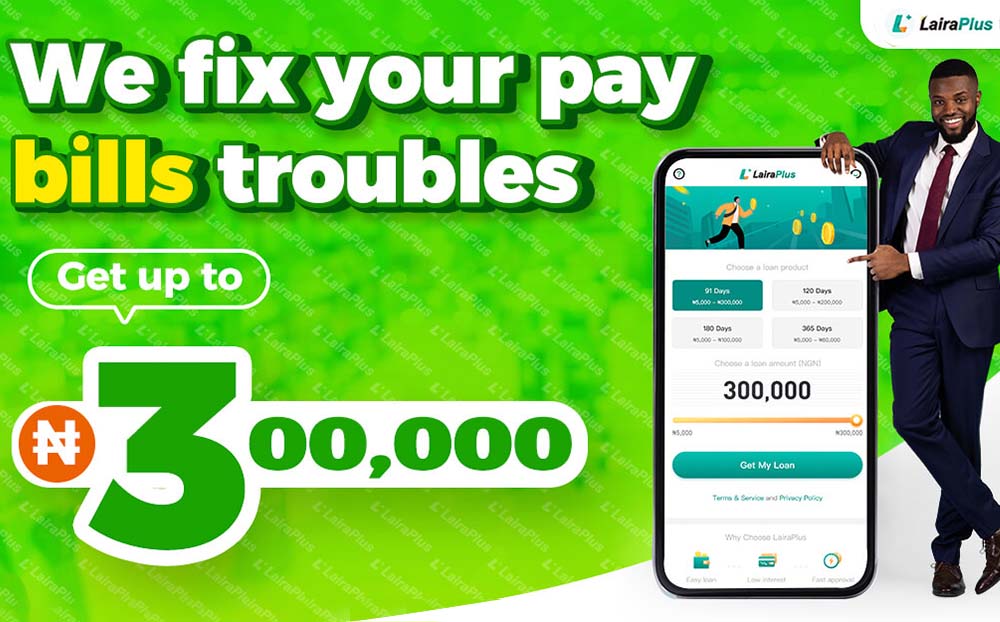

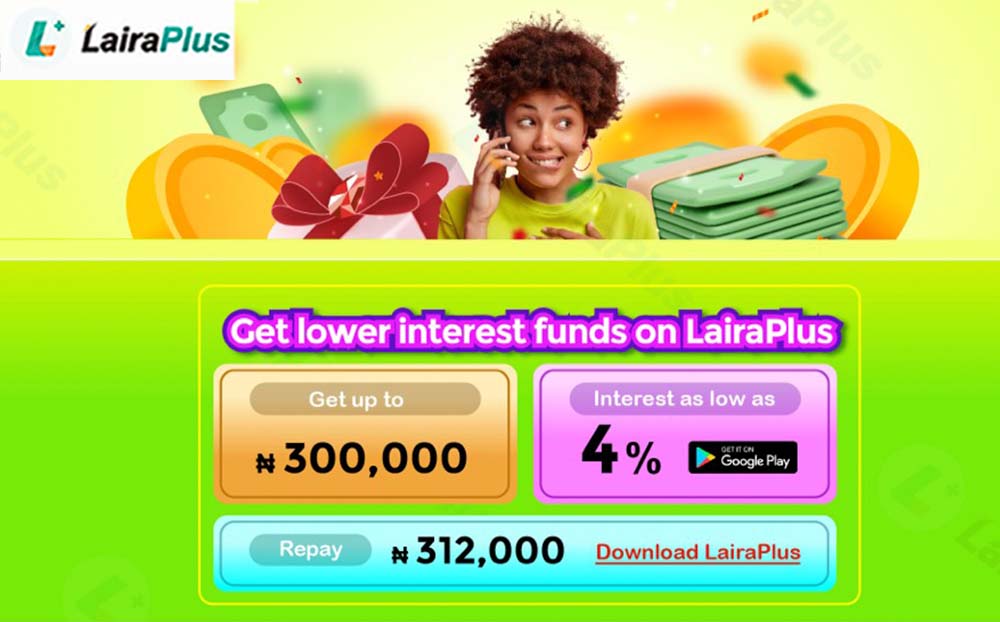

In the dynamic landscape of personal finance, situations often arise where urgent access to funds becomes paramount. Nigeria’s online lending platforms have stepped in to bridge this gap, offering swift and convenient solutions. Among these, LairaPlus stands out as a

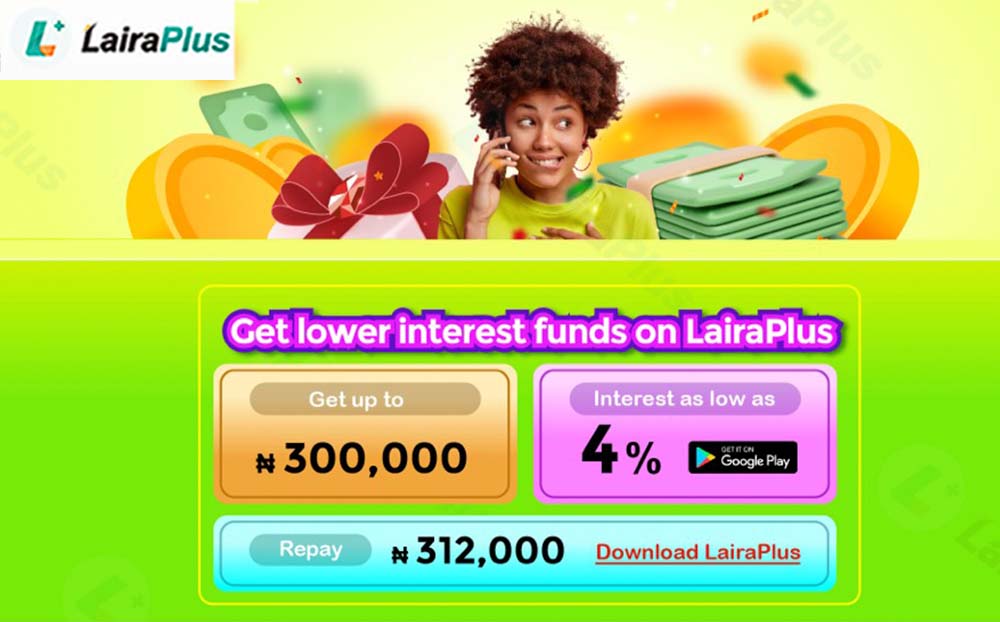

The maximum amount you can borrow at one time varies widely and depends on several factors, including: Lender’s Policy: Different lenders have different maximum loan limits. Some lenders offer small, short-term loans, while others may provide larger amounts based on

In life, unforeseen financial challenges can arise, demanding urgent attention. LairaPlus, an innovative online lending platform, recognizes the importance of swift financial solutions. This article delves into the seamless process of borrowing an urgent loan of 10,000 Naira through LairaPlus,

In a world where time is of the essence, the need for rapid financial solutions has never been more critical. LairaPlus emerges as a beacon of efficiency, providing individuals with a fast cash solution through its innovative approach to instant

In the unpredictable journey of life, unforeseen financial challenges can emerge when least expected. When the need for urgent funds arises, waiting for a traditional loan approval can be impractical. This is where LairaPlus, a leading online lending platform, steps

In the dynamic and bustling financial landscape of Nigeria, access to instant cash loans has become increasingly essential. Whether you’re facing an unforeseen emergency or seizing an opportunity, knowing where to obtain quick funds is a valuable asset. LairaPlus, a

In Nigeria, the financial landscape is evolving, and access to instant loans has become more convenient and streamlined. Instant loan providers offer a lifeline to individuals in need of rapid financial assistance. Among these providers, LairaPlus stands out as a

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad