Applying for an instant loan in Nigeria can be a convenient way to access funds quickly, but it’s essential to consider the pros and cons before proceeding. Here’s a breakdown of the advantages and disadvantages: Pros of Applying for an

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for an instant loan in Nigeria can be a convenient way to access funds quickly, but it’s essential to consider the pros and cons before proceeding. Here’s a breakdown of the advantages and disadvantages: Pros of Applying for an

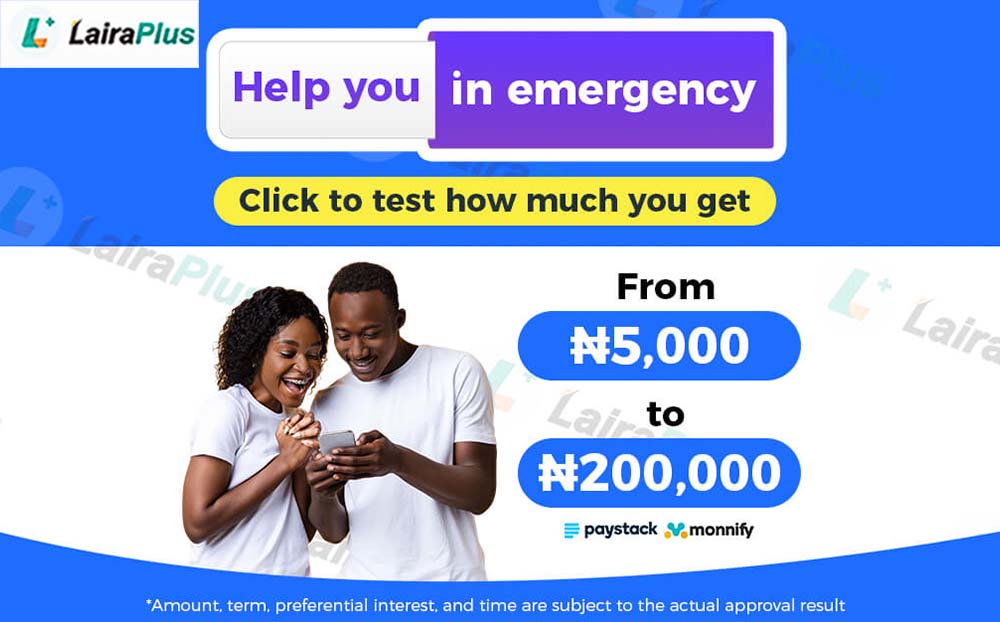

Emergencies and unexpected financial needs can arise at any moment, leaving you in search of quick solutions. If you’re in Nigeria and require an instant loan, you’re in luck because you have access to convenient online lending platforms like LairaPlus.

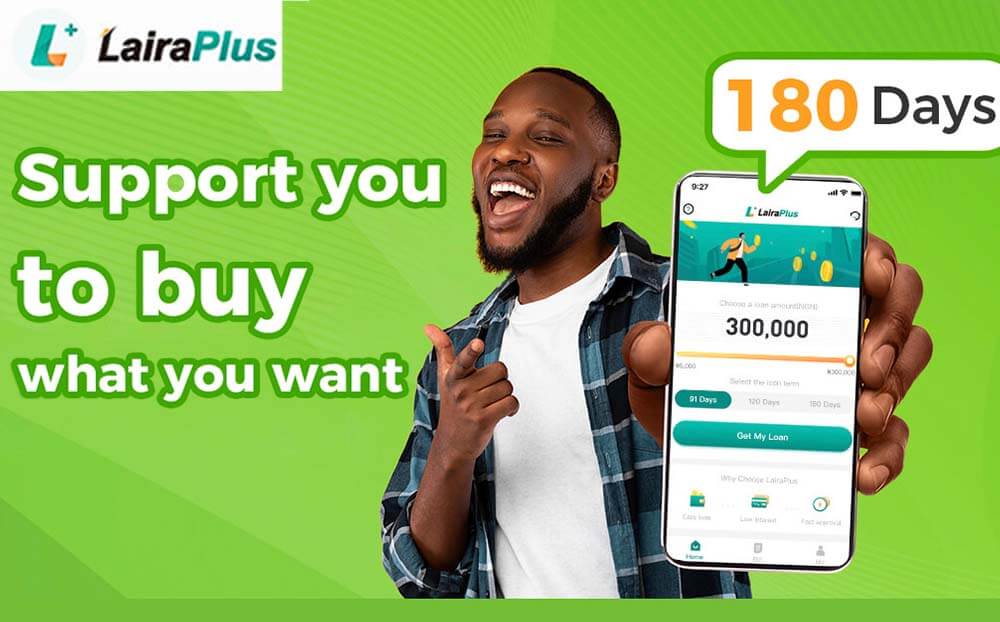

In a fast-paced world where financial needs can arise at any moment, the importance of instant personal loans cannot be overstated. These loans are designed to provide rapid financial relief when unexpected expenses or opportunities come your way. LairaPlus, a

In today’s fast-paced world, financial emergencies can arise at any moment, requiring immediate solutions. Whether it’s an unexpected medical bill, a car repair, or any other unforeseen expense, having access to quick cash can be a lifesaver. That’s where LairaPlus,

Life is full of unexpected twists and turns, and sometimes these surprises come with a hefty price tag. Whether it’s a medical emergency, a sudden car repair, or any other unforeseen expense, having access to fast cash can make all

Life is unpredictable, and financial circumstances can change unexpectedly. When you’ve taken out a personal loan with LairaPlus and find it challenging to meet the repayment deadline due to unforeseen circumstances, you may wonder if there’s an option for extending

Avoiding Personal Loan Traps: Smart Borrowing and Debt Management Personal loans are a significant financial tool that can help individuals address emergencies, fulfill dreams, and meet various financial needs. However, if not approached with caution, personal loans can also become

Applying for Multiple Instant Loans on LairaPlus: LairaPlus is a platform that offers instant loan services, allowing you to access much-needed funds whenever required. However, whether you can apply for multiple instant loans simultaneously involves certain rules and considerations. In

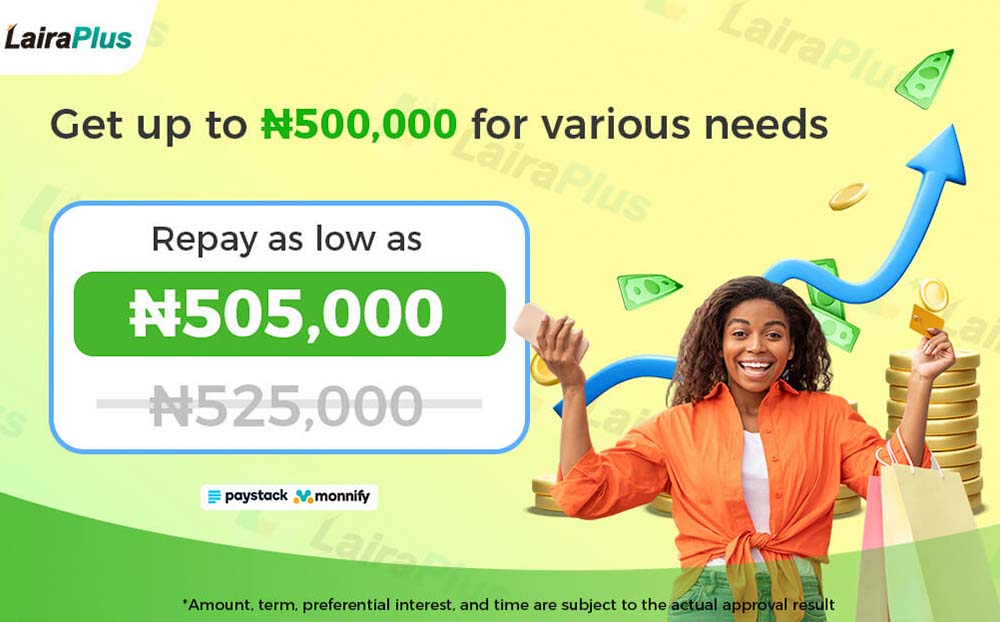

Instant Loan Amounts on LairaPlus App: LairaPlus is a widely-used loan platform that allows users to apply for instant loans through its user-friendly app. However, there may be many questions regarding how much you can borrow as an instant loan

Reconsideration Opportunity After Loan Application Rejection When seeking a loan, applicants may sometimes face the disappointment of a rejection. However, some lending platforms may provide a reconsideration opportunity to allow borrowers to reevaluate and improve their applications. As LairaPlus, we

Online Simple Borrowing: A New Way to Easily Access Funds In the digital age, with the rapid advancement of financial technology, traditional lending methods are undergoing a transformation. Online simple borrowing, as an innovative financial service, is changing the way

LairaPlus: What Online Borrowers Should Do When Facing Repayment Difficulties Online loan platforms like LairaPlus provide convenient and swift loan services to borrowers. However, there are times when borrowers might encounter difficulties with their loan repayments. This article will explore

In times of financial need, having access to instant funds can be a crucial lifeline. If you’re looking for an app that can provide you with ₦50,000 instantly, look no further than “LairaPlus.” This innovative online lending platform has garnered

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad