Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Reconsideration Opportunity After Loan Application Rejection

When seeking a loan, applicants may sometimes face the disappointment of a rejection. However, some lending platforms may provide a reconsideration opportunity to allow borrowers to reevaluate and improve their applications. As LairaPlus, we understand the setbacks borrowers might encounter and offer them a chance to address the rejection and reassess their applications. In this article, we will delve into LairaPlus’s reconsideration opportunity following a loan application rejection.

Before discussing the reconsideration opportunity, let’s first understand some potential reasons for loan application rejection. These reasons might include:

Insufficient Credit History: Lending institutions typically review applicants’ credit histories. If there’s insufficient credit history or adverse records, the application could be declined.

Inadequate Repayment Capacity: Lenders assess applicants’ income and expenses to determine their repayment capacity. If the capacity is deemed inadequate, the application may be rejected.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Incomplete or Inaccurate Information: Failure to provide all necessary information or inaccurate details can lead to application rejection.

Excessive Debt Burden: If applicants already have a substantial debt burden, lenders might worry about their repayment ability, leading to rejection.

LairaPlus acknowledges that rejection can be disheartening and frustrating for borrowers. Thus, we provide a reconsideration opportunity to empower borrowers to address the rejection and potentially enhance their applications.

1. Reassessment of Application: If your loan application is rejected, you can opt for reconsideration. During this process, we’ll reassess your application while considering any new information or improvements.

2. Provision of Additional Information: In case of rejection, you might consider providing supplementary details such as income, employment status, or other relevant information. These additional inputs could bolster your chances of success.

3. Application Enhancement: The reconsideration opportunity enables you to refine your application. You can review your application, identify areas for improvement, and make necessary adjustments.

While LairaPlus offers a reconsideration opportunity, success isn’t guaranteed. The outcome of reconsideration hinges on the supplementary information provided, the enhanced application, as well as your credit and repayment capacity.

To apply for reconsideration, you can reach out to us via LairaPlus’s official website or customer service. Our team will guide you through the reconsideration process and provide the necessary guidance and support.

LairaPlus is committed to offering borrowers multiple chances to assess and enhance their applications. We understand the disappointment that can accompany a rejection, and therefore encourage borrowers to use the reconsideration opportunity thoughtfully, making necessary adjustments as needed. Regardless of the outcome, we will continue to provide support and address inquiries to ensure borrowers make informed financial decisions.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

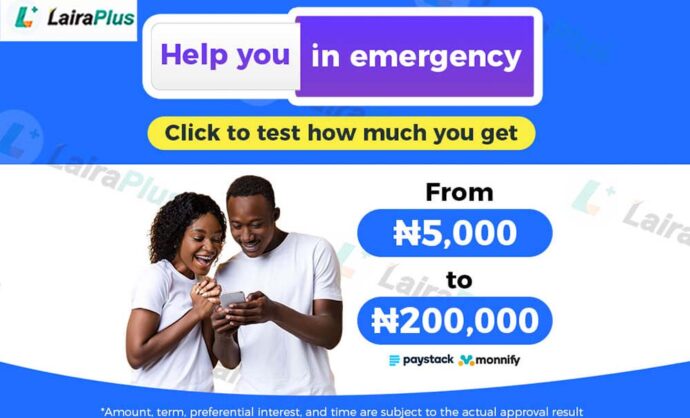

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT