Having bad credit can make it challenging to secure traditional loans, but there are still options available if you need a loan urgently: Explore Bad Credit Loan Options: Look for lenders or platforms that specifically cater to individuals with bad

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Having bad credit can make it challenging to secure traditional loans, but there are still options available if you need a loan urgently: Explore Bad Credit Loan Options: Look for lenders or platforms that specifically cater to individuals with bad

If you have outstanding debt and urgently need a loan, it’s crucial to assess your financial situation and consider the following steps: Evaluate Your Debt: Review your outstanding debts, including their amounts, interest rates, and repayment terms. Understanding your existing

For many online loan apps, especially those designed for quick and short-term loans, collateral or a guarantor may not be required. Here’s why: Unsecured Loans: Many online loan apps, including LairaPlus, offer unsecured loans. These loans do not necessitate collateral,

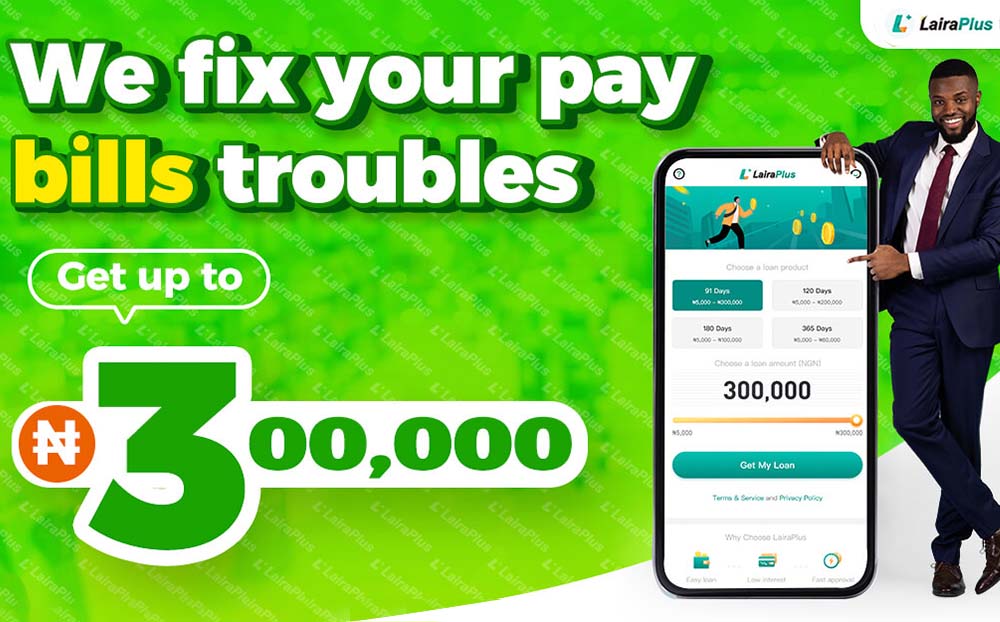

In the dynamic landscape of personal finance, situations often arise where urgent access to funds becomes paramount. Nigeria’s online lending platforms have stepped in to bridge this gap, offering swift and convenient solutions. Among these, LairaPlus stands out as a

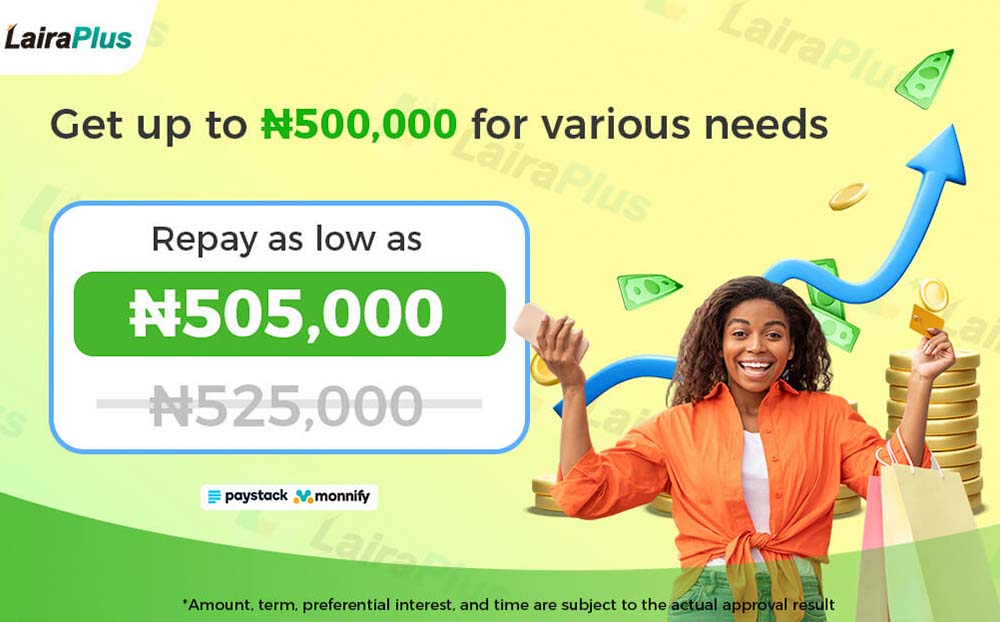

The maximum amount you can borrow at one time varies widely and depends on several factors, including: Lender’s Policy: Different lenders have different maximum loan limits. Some lenders offer small, short-term loans, while others may provide larger amounts based on

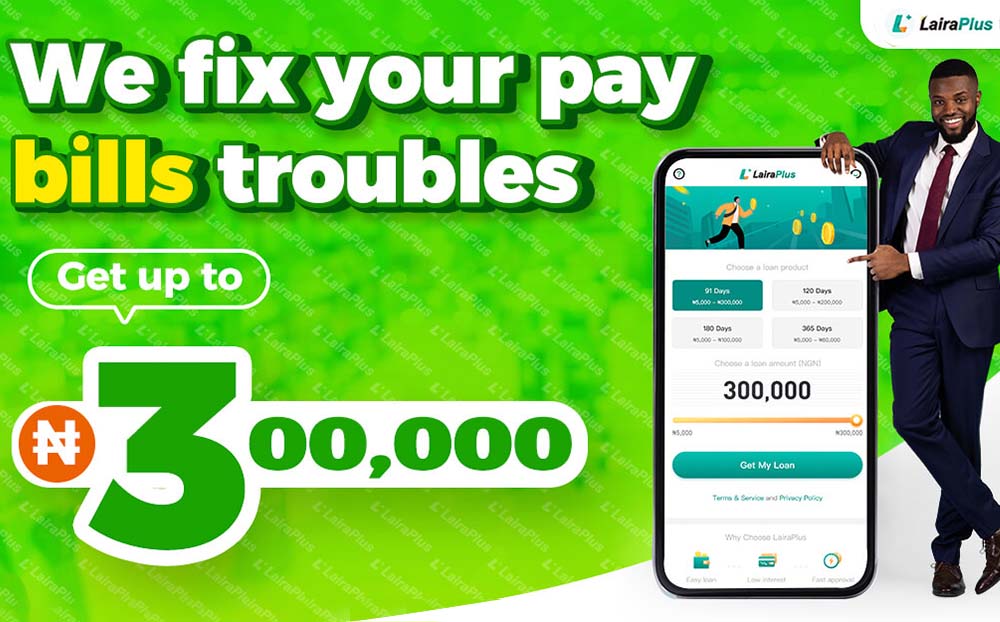

In life, unforeseen financial challenges can arise, demanding urgent attention. LairaPlus, an innovative online lending platform, recognizes the importance of swift financial solutions. This article delves into the seamless process of borrowing an urgent loan of 10,000 Naira through LairaPlus,

In a world where time is of the essence, the need for rapid financial solutions has never been more critical. LairaPlus emerges as a beacon of efficiency, providing individuals with a fast cash solution through its innovative approach to instant

In the unpredictable journey of life, unforeseen financial challenges can emerge when least expected. When the need for urgent funds arises, waiting for a traditional loan approval can be impractical. This is where LairaPlus, a leading online lending platform, steps

In the dynamic and bustling financial landscape of Nigeria, access to instant cash loans has become increasingly essential. Whether you’re facing an unforeseen emergency or seizing an opportunity, knowing where to obtain quick funds is a valuable asset. LairaPlus, a

In Nigeria, the financial landscape is evolving, and access to instant loans has become more convenient and streamlined. Instant loan providers offer a lifeline to individuals in need of rapid financial assistance. Among these providers, LairaPlus stands out as a

Applying for an instant loan in Nigeria can be a convenient way to access funds quickly, but it’s essential to consider the pros and cons before proceeding. Here’s a breakdown of the advantages and disadvantages: Pros of Applying for an

When financial emergencies strike, securing a loan quickly can be a lifesaver. In Nigeria, the need for instant loans is common, and innovative online lending platforms like LairaPlus have recognized the importance of providing accessible and convenient solutions. If you’re

Emergencies and unexpected financial needs can arise at any moment, leaving you in search of quick solutions. If you’re in Nigeria and require an instant loan, you’re in luck because you have access to convenient online lending platforms like LairaPlus.

When financial needs arise, it’s common to explore multiple options for securing a personal loan. However, many borrowers wonder whether they can apply for personal loans from different institutions simultaneously. LairaPlus, a prominent online lending platform in Nigeria, recognizes the

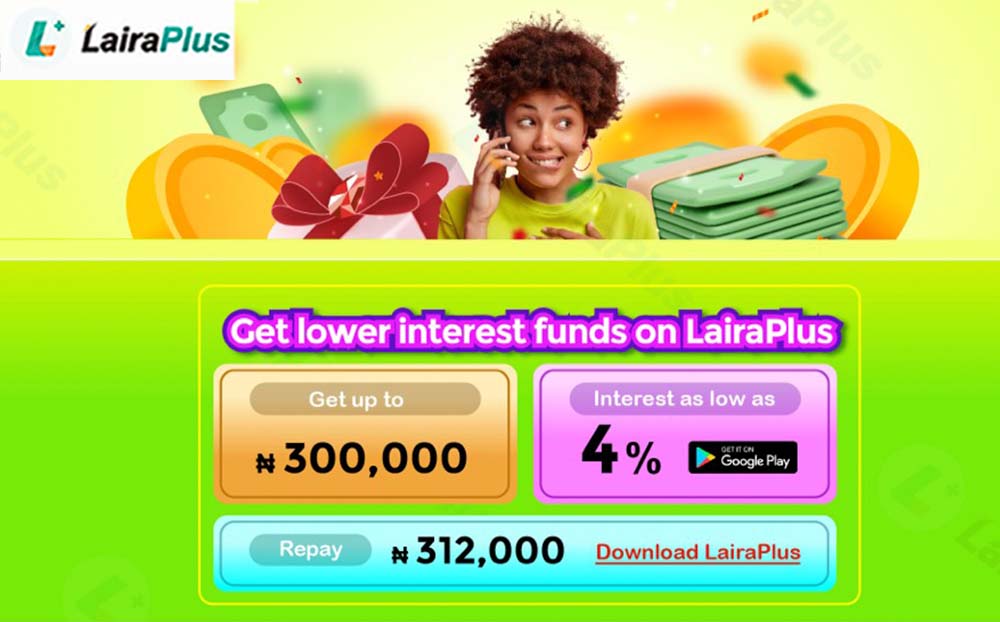

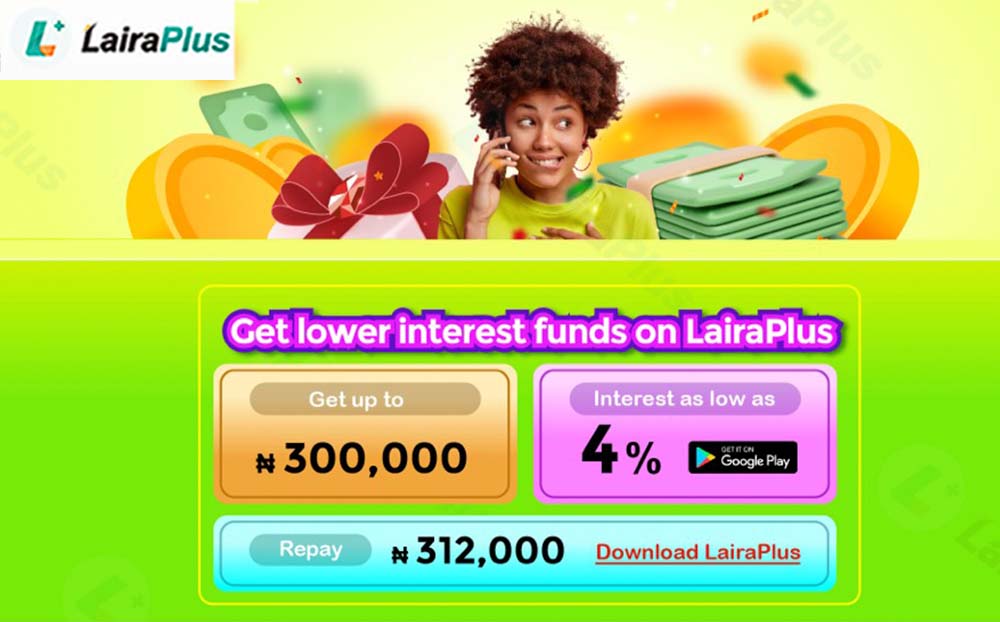

When you need a personal loan, finding the lowest interest rate is a top priority. Lower interest rates can significantly reduce the overall cost of borrowing and make repayments more manageable. In Nigeria, where financial needs vary widely, having access

In a fast-paced world where financial needs can arise at any moment, the importance of instant personal loans cannot be overstated. These loans are designed to provide rapid financial relief when unexpected expenses or opportunities come your way. LairaPlus, a

In a world where financial needs vary greatly and the unexpected can happen at any time, having a reliable partner for borrowing money is essential. LairaPlus, a leading online lending platform, has become a household name for Nigerians seeking financial

In Nigeria’s rapidly evolving financial landscape, the demand for personal loans has never been greater. Whether it’s starting a business, pursuing higher education, or addressing unexpected financial challenges, access to a reliable online platform for personal loans is essential. LairaPlus,

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad