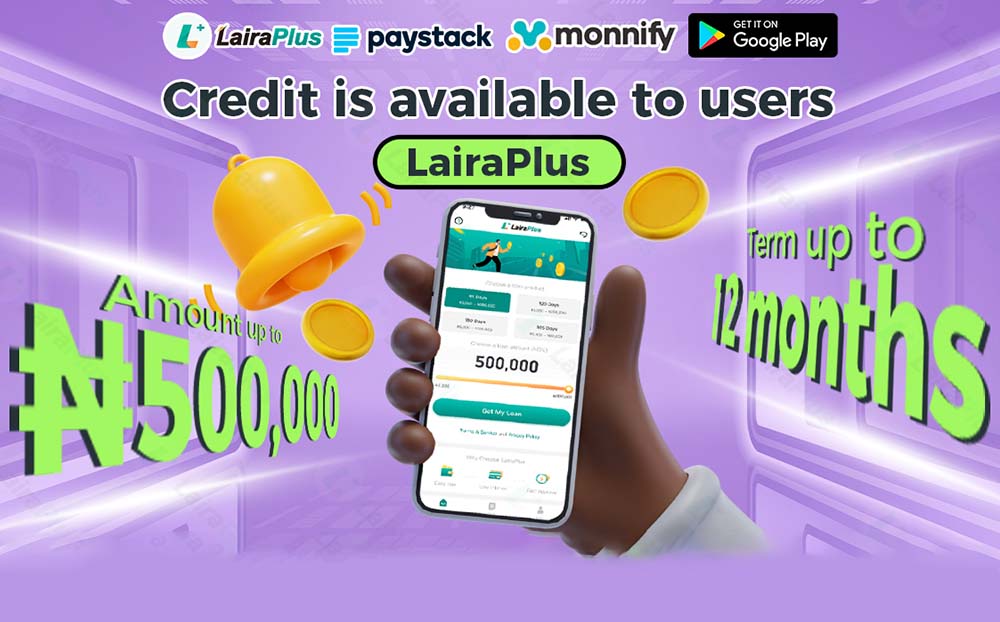

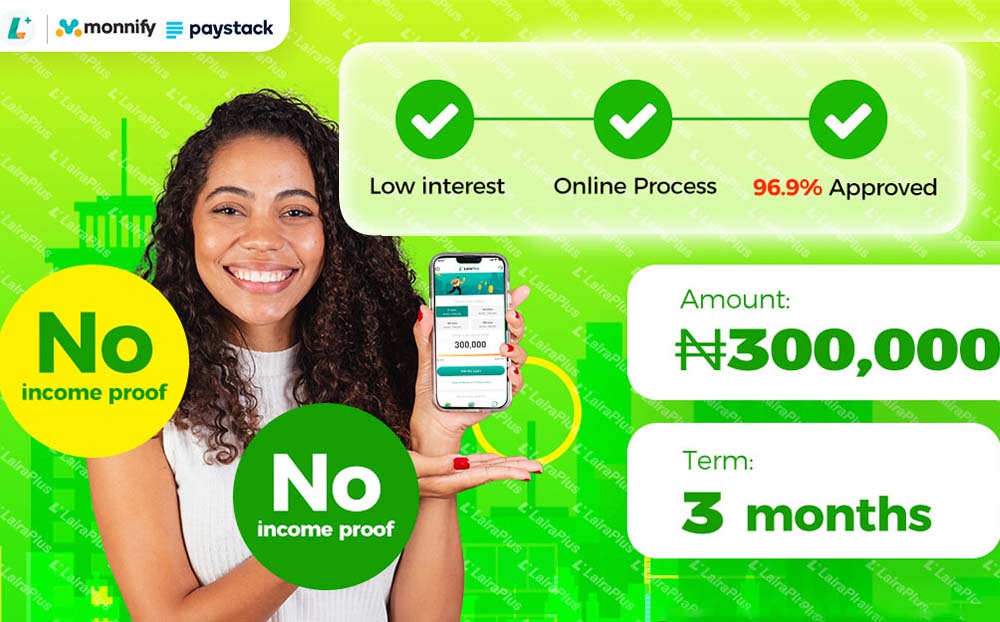

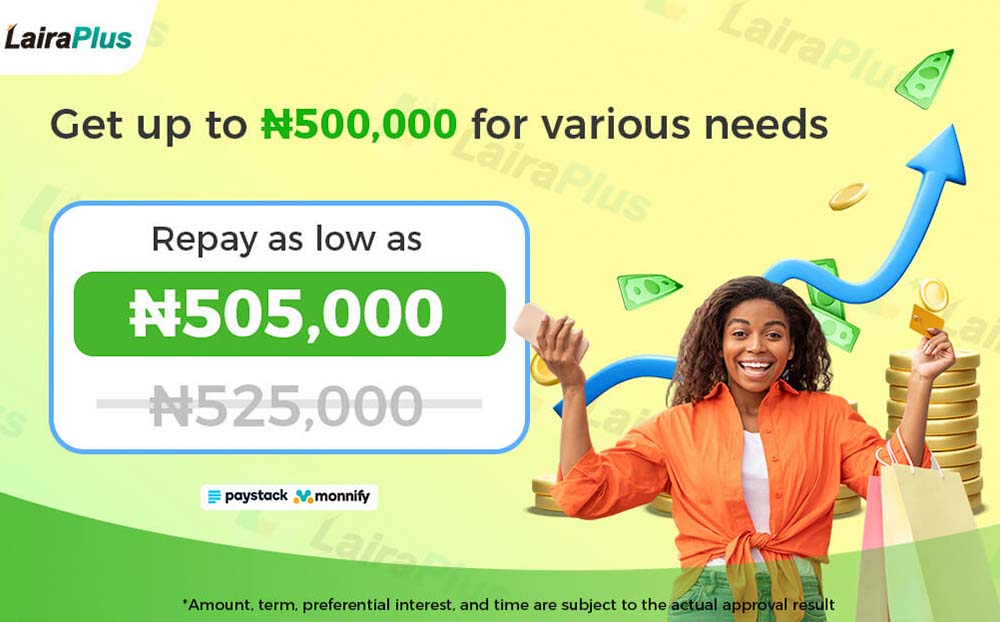

In Nigeria, many people require emergency funds to meet various personal and business needs. Therefore, finding a reliable loan application has become crucial. With the development of technology, loan applications have become a convenient way for people to obtain funds.