Applying for a 5-minute instant cash loan can potentially impact your credit record in several ways: Hard Inquiry on Your Credit Report: When you apply for a loan, the lender usually performs a hard inquiry (or hard pull) on your

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for a 5-minute instant cash loan can potentially impact your credit record in several ways: Hard Inquiry on Your Credit Report: When you apply for a loan, the lender usually performs a hard inquiry (or hard pull) on your

I need a loan of 50,000 Naira, do I need to provide physical collateral? In the landscape of financial borrowing, the requirement for collateral often poses a significant hurdle for individuals seeking immediate funds. LairaPlus, a trusted lending platform in

I need a loan of 50,000 Naira, can I pay it back early? In the realm of financial borrowing, the ability to repay a loan ahead of schedule can bring significant advantages, providing a sense of financial empowerment and potentially

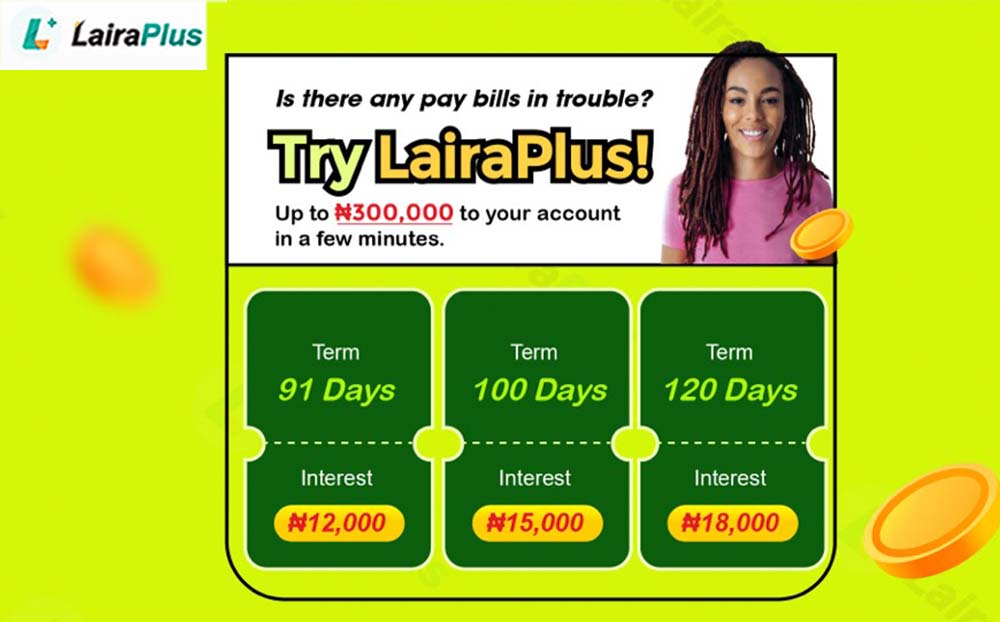

I need a loan of 50,000 Naira, any recommendations for suitable loan options? In moments of financial urgency, the need for quick access to funds often becomes paramount. For individuals in Nigeria seeking a loan of ₦50,000, LairaPlus emerges as

Online urgent loan 10,000, LairaPlus your emergency funding partner In life’s unpredictable journey, unforeseen financial emergencies can arise, demanding immediate attention and quick access to funds. LairaPlus emerges as a steadfast ally, offering seamless and swift online urgent loans of

Online urgent loan 10,000, no mortgage required, fast approval In times of urgent financial need, securing immediate funds can be a pressing concern for many individuals. Platforms like LairaPlus have revolutionized the lending landscape by offering quick and accessible online

What is the application process for online urgent loan 10,000? In the realm of financial uncertainties, the need for immediate funds can often arise unexpectedly. To address such urgent financial requirements, platforms like LairaPlus offer a streamlined and accessible application

In the labyrinth of life’s financial uncertainties, unexpected situations often demand immediate attention. For many, the unexpected expenses or emergencies can create a pressing need for quick funds. In such scenarios, online loans emerge as a beacon of hope, offering

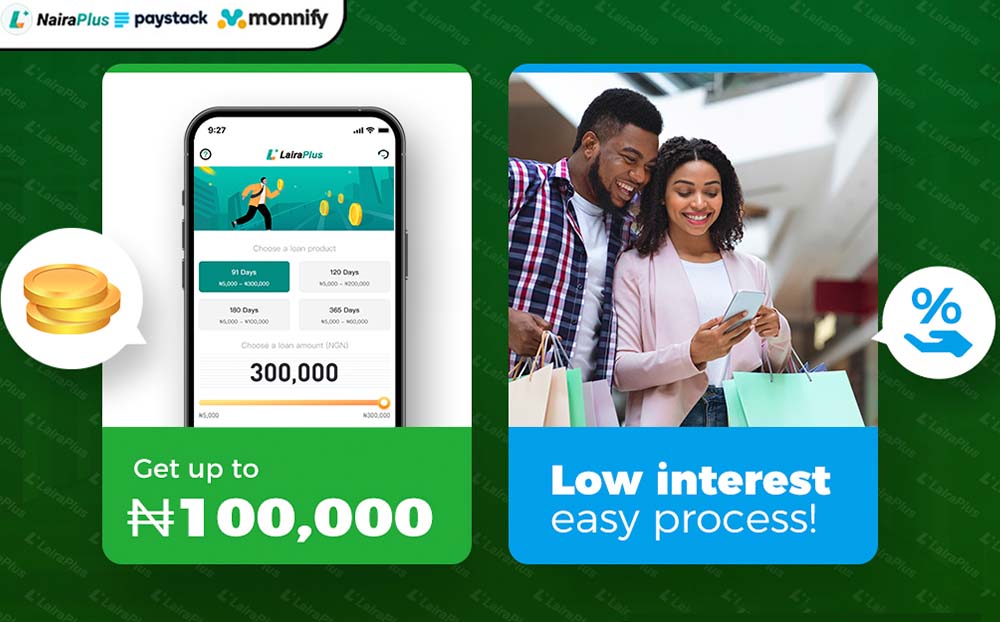

LairaPlus, an esteemed online loan platform in Nigeria, offers users a convenient and accessible way to apply for and manage loans through their mobile app. Let’s delve into the user experience aspects of the LairaPlus loan app. 1. User-Friendly Interface

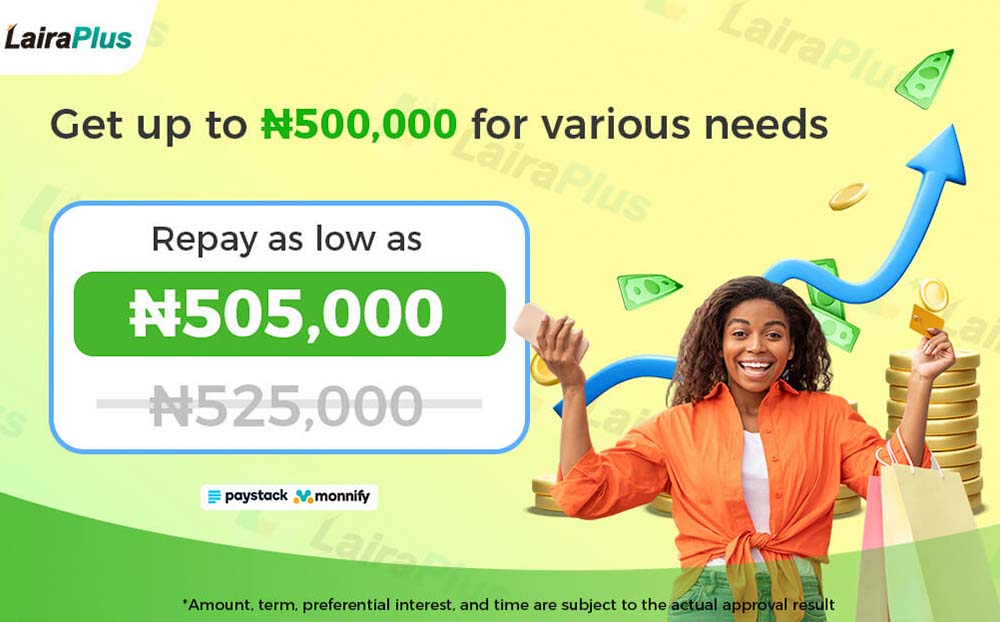

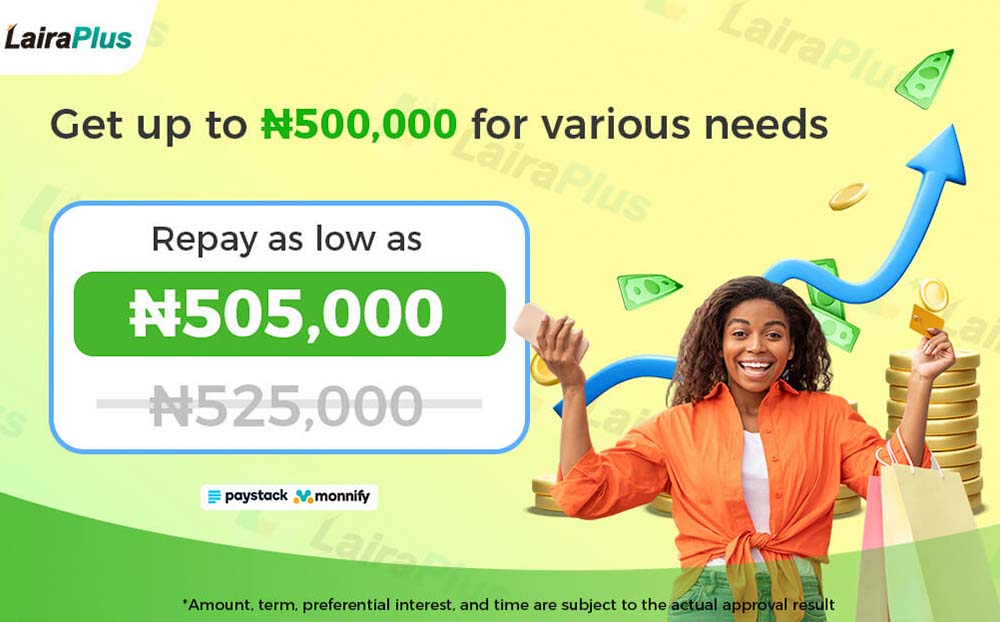

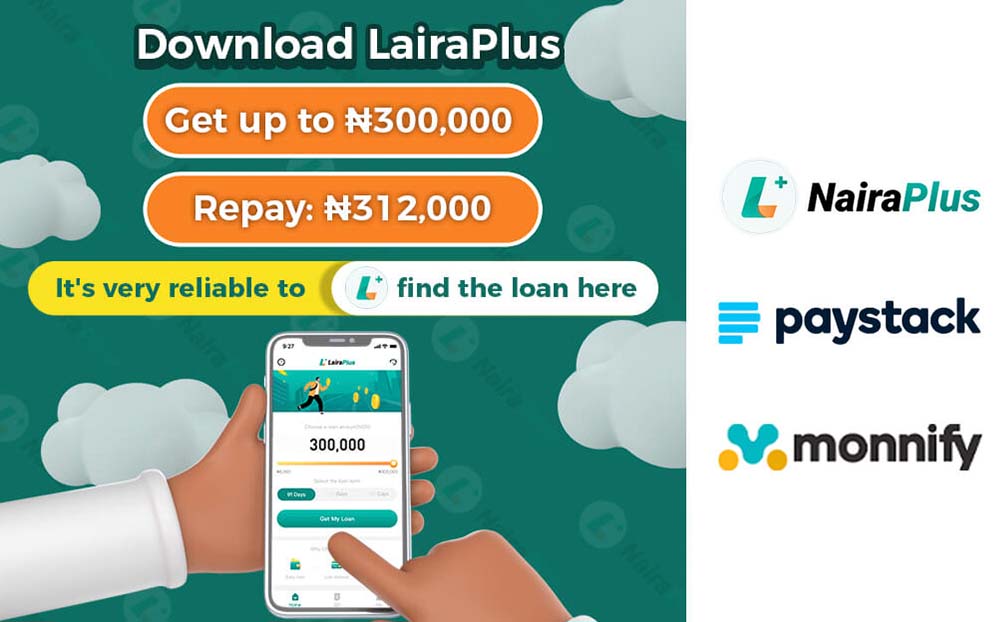

Absolutely! Here’s an article detailing the maximum loan amount offered by the LairaPlus loan app in Nigeria: LairaPlus Loan App: Maximum Loan Amount Offered in Nigeria Introduction LairaPlus, a prominent online loan platform in Nigeria, caters to individuals in need

Certainly! Here’s a guide tailored for Android users on how to install the LairaPlus loan app in Nigeria: Step-by-Step Guide to Install LairaPlus Loan App for Android Users in Nigeria Step 1: Access Google Play Store Open the Google Play

LairaPlus loan app is specifically designed for Android users, offering an efficient and convenient way to access loans on mobile devices running the Android operating system. Here’s a detailed guide on how Android users can download and utilize the LairaPlus

To download the LairaPlus loan app in Nigeria on your mobile phone, follow these steps: Step 1: Access the App Store or Google Play Store Unlock your mobile phone and find the “Google Play Store” for Android users. Step 2:

Downloading a credit loan app via an APK file can carry some risks if not obtained from trusted sources. Here are insights into the safety concerns and potential risks associated with downloading credit loan app APK files: Safety Concerns: Source

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad