Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

I need a loan of 50,000 Naira, can I pay it back early?

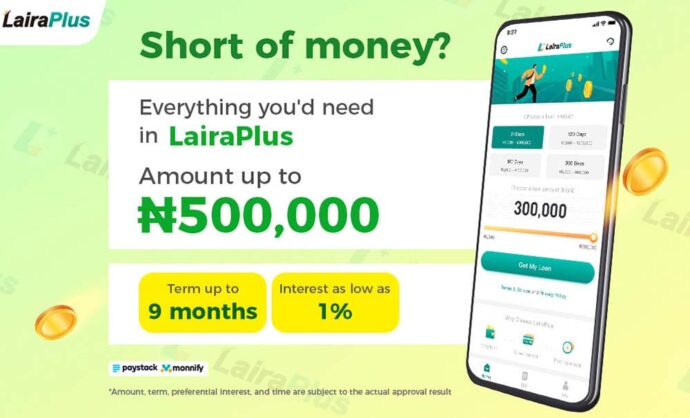

In the realm of financial borrowing, the ability to repay a loan ahead of schedule can bring significant advantages, providing a sense of financial empowerment and potentially saving on interest costs. LairaPlus, a trusted lending platform in Nigeria, not only allows but also encourages early repayment for its ₦50,000 loans, offering borrowers an avenue towards financial freedom.

Freedom to Settle Debt Early: LairaPlus grants borrowers the freedom to settle their ₦50,000 loan before the designated repayment period ends. This flexibility is a testament to their commitment to empowering borrowers, allowing them to manage their finances in a manner that suits their convenience and financial capabilities.

Interest Savings: Early repayment often translates to reduced interest costs. By paying off the loan before the scheduled term, borrowers can potentially save on interest charges, allowing for more efficient use of funds and overall cost savings.

Improved Credit Profile: Timely repayment or early settlement of loans can positively impact credit scores. Demonstrating responsible financial behavior by repaying loans ahead of schedule can enhance one’s credit profile, potentially opening doors to better borrowing opportunities in the future.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Simple and Convenient Process: LairaPlus streamlines the process for early repayment. Borrowers can easily access their loan details and repayment options through the LairaPlus App. The platform offers user-friendly functionalities that enable borrowers to make early payments effortlessly.

No Prepayment Penalties: Notably, LairaPlus does not impose prepayment penalties. Borrowers can settle their ₦50,000 loan early without incurring additional charges or fees, encouraging financial responsibility and rewarding proactive repayment.

Customer Support and Assistance: Should borrowers require any guidance or assistance regarding early repayment, LairaPlus provides a dedicated customer support team. Whether clarifying repayment procedures or offering advice on early settlement, the support team is readily available to assist borrowers.

In essence, LairaPlus stands as a beacon of financial empowerment, allowing borrowers to take control of their financial obligations. The platform’s provision for early repayment of ₦50,000 loans without penalties, coupled with potential interest savings and credit profile enhancement, signifies a commitment to fostering responsible financial behavior and facilitating borrowers’ journeys toward financial freedom and stability.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT