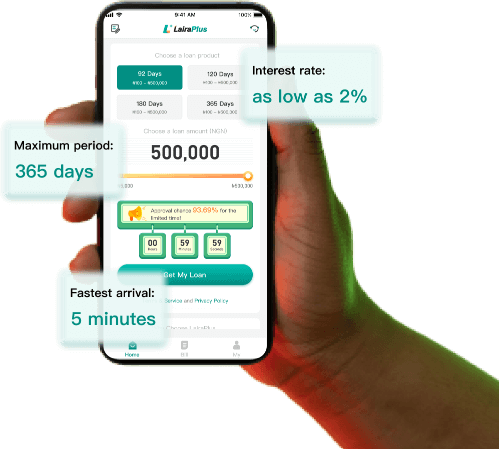

Having a good credit score is crucial when it comes to obtaining loans and financial assistance. LairaPlus is a legitimate loan app that offers various loan options to individuals. In this article, we will discuss effective strategies to improve your