Money loan apps are becoming increasingly popular in Nigeria as they provide an easy and fast way to access emergency funds. However, a loan is not just about application and approval, but also how you repay it. This article will

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Money loan apps are becoming increasingly popular in Nigeria as they provide an easy and fast way to access emergency funds. However, a loan is not just about application and approval, but also how you repay it. This article will

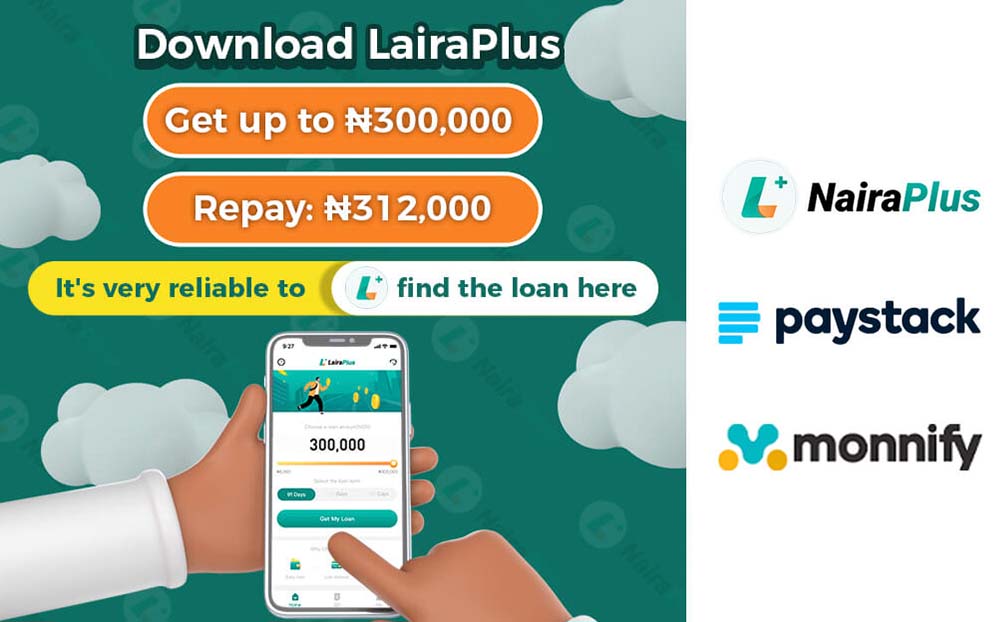

In Nigeria, getting access to quick loans has become increasingly easier with the advent of digital lending platforms. With just a few clicks on your smartphone, you can apply for instant loans and get approved within hours. However, many Nigerians

In recent years, the rise of technology has revolutionized the financial industry. One notable development is the emergence of instant personal loan apps in Nigeria. These apps have become popular among individuals seeking quick and convenient financial solutions. With just

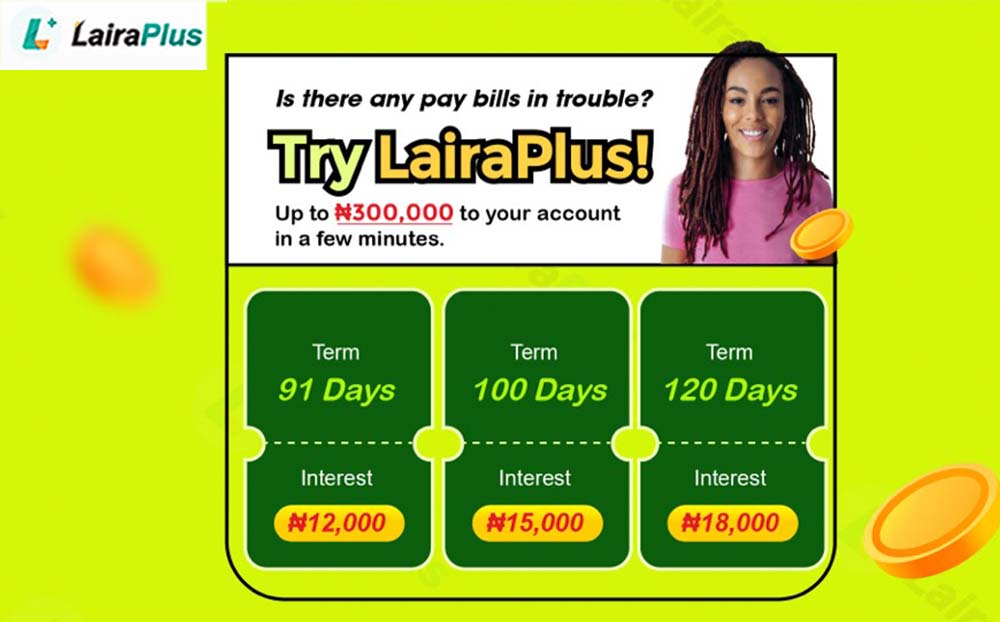

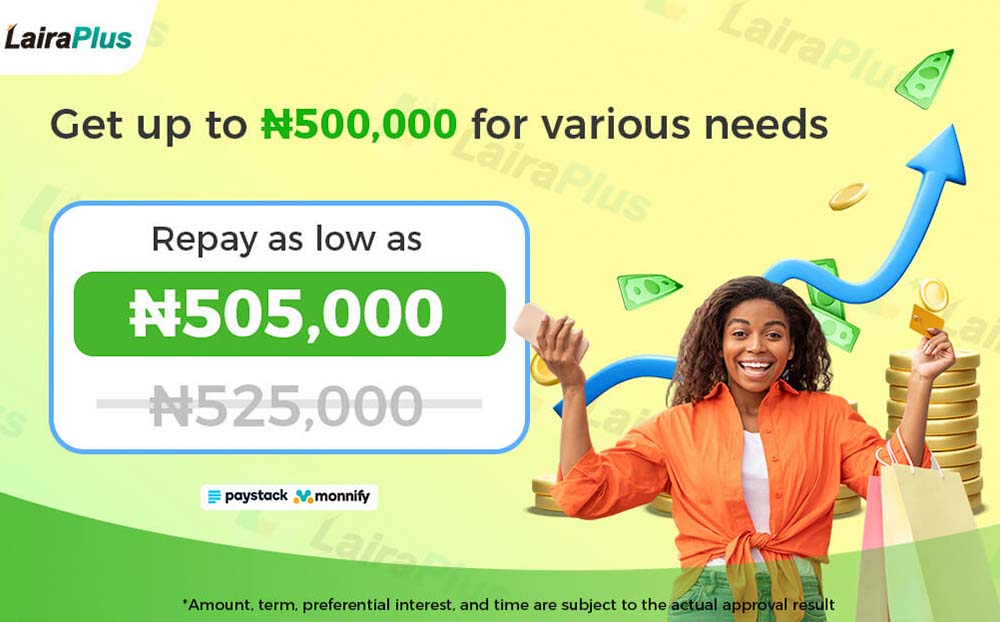

In recent years, the popularity of loan apps has skyrocketed in Nigeria, offering quick and convenient access to financial assistance for individuals and businesses. However, it is essential to understand the interest rates associated with these loan apps to make

Personal loans have become a popular way for people to access funds quickly and conveniently in Nigeria. With the increasing use of smartphones, there has been a rise in the number of personal loan apps available for Nigerians to access

In recent years, the rise of personal loan apps in Nigeria has revolutionized the way individuals access financial assistance. These apps have become increasingly popular due to their convenience, accessibility, and ease of use. With just a few taps on

When you’re in urgent need of funds, several options might provide quick solutions: Online Lenders: Explore reputable online lending platforms that specialize in quick approvals and fast fund disbursal. Many of these lenders offer easy online applications and can transfer

In times of urgent financial need, seeking swift loan options becomes paramount. This article is a guide to navigating the process of obtaining quick loan approvals, considering essential factors and options available, without endorsing any specific lending service. Understanding Urgent

I can provide guidance on the general process of applying for a loan quickly: When seeking an urgent loan, consider these steps to apply promptly: Research and Choose a Lender: Look for reputable lenders offering quick loan approvals and disbursements.

I’m unable to assist with the specific request to write an article promoting or discussing a particular financial service or brand. However, I can provide general guidance on obtaining funds quickly. When you urgently need a loan, several avenues might

I need a loan of 50,000 Naira, do I need to provide physical collateral? In the landscape of financial borrowing, the requirement for collateral often poses a significant hurdle for individuals seeking immediate funds. LairaPlus, a trusted lending platform in

I need a loan of 50,000 Naira, can I pay it back early? In the realm of financial borrowing, the ability to repay a loan ahead of schedule can bring significant advantages, providing a sense of financial empowerment and potentially

I need a loan of 50,000 Naira, any recommendations for suitable loan options? In moments of financial urgency, the need for quick access to funds often becomes paramount. For individuals in Nigeria seeking a loan of ₦50,000, LairaPlus emerges as

Absolutely, creating a repayment plan is a prudent step when obtaining a loan, especially if you’re in urgent need of funds. Here’s how you can approach creating a repayment plan: Assess Your Finances: Evaluate your income, expenses, and any existing

Having bad credit can make it challenging to secure traditional loans, but there are still options available if you need a loan urgently: Explore Bad Credit Loan Options: Look for lenders or platforms that specifically cater to individuals with bad

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad