Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

LairaPlus Emergency Loans: Understanding Loan Fees and Interest Rates

LairaPlus is known for its commitment to helping individuals facing financial emergencies with quick access to cash through emergency loans. However, as with any loan product, it’s essential to understand the associated costs and interest rates before proceeding. In this comprehensive article, we’ll explore how LairaPlus structures its loan fees and interest rates, empowering you to make informed borrowing decisions.

1. Loan Fees:

a. Application Fees:

LairaPlus typically doesn’t charge application fees. This means that you can apply for a loan without incurring any upfront costs, making it accessible to a broader range of borrowers.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

b. Processing Fees:

LairaPlus may charge a processing fee when your loan is approved and you accept the terms. The processing fee covers the administrative costs of reviewing your application and disbursing the funds. It’s important to review your loan agreement to understand the exact processing fee and ensure it aligns with your budget.

c. Late Payment Fees:

It’s crucial to understand LairaPlus’ policy on late payment fees. If you miss a scheduled payment, you might incur a late fee. These fees can vary, so it’s important to be aware of the consequences of missing a payment and to strive to repay on time to avoid additional costs.

2. Interest Rates:

a. Annual Percentage Rate (APR):

LairaPlus often expresses its interest rates in terms of an Annual Percentage Rate (APR). The APR is a standardized way to represent the annual cost of borrowing, including both interest and fees. This rate is a helpful tool for comparing the cost of borrowing between different lenders and loan products.

b. Fixed vs. Variable Interest Rates:

LairaPlus typically offers fixed interest rates. This means that the interest rate remains constant throughout the life of the loan, providing predictability and stability in your monthly payments.

c. Interest Rate Determinants:

LairaPlus considers several factors when determining your interest rate, including your creditworthiness, loan amount, loan term, and prevailing market conditions. Generally, borrowers with stronger credit histories may qualify for lower interest rates.

d. Transparent Disclosure:

LairaPlus is committed to transparent disclosure of loan terms and interest rates. Before accepting a loan offer, you will receive a loan agreement that clearly outlines the interest rate, APR, and all associated costs. It’s crucial to review this agreement carefully and ask any questions to ensure you fully understand the terms.

3. Repayment Terms:

a. Loan Duration:

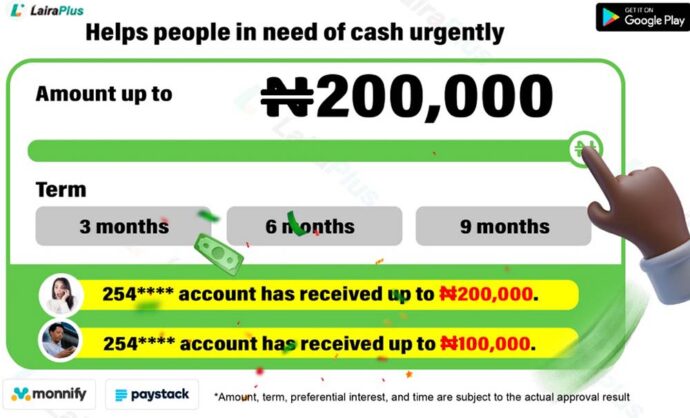

LairaPlus typically offers short to medium-term loans, depending on your specific needs and eligibility. The loan duration can vary, but it’s important to choose a loan term that aligns with your financial capacity to make regular repayments.

b. Early Repayment:

LairaPlus generally allows borrowers to repay their loans early without incurring prepayment penalties. This flexibility can be advantageous if you’re in a position to pay off your loan sooner than originally planned.

4. Loan Calculators:

LairaPlus may offer loan calculators on their website or within their app to help you estimate your potential loan costs, including monthly payments and the total repayment amount. Using these calculators can provide valuable insights into the financial commitment you’re considering.

In conclusion, understanding the fees and interest rates associated with LairaPlus emergency loans is essential to making informed financial decisions. LairaPlus strives to provide clear and transparent terms, empowering borrowers to access funds quickly while knowing the costs involved. As with any financial product, it’s crucial to read and understand the loan agreement fully, including all associated fees and interest rates, before proceeding with your loan application. This knowledge will enable you to manage your finances responsibly and make repayments on time, maintaining your financial stability.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT