LairaPlus is a popular online loan app in Nigeria that offers quick and hassle-free loans. Once you apply for a loan on the app, it’s important to check the status of your application to know if it has been approved

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Loans are a common financial tool used by individuals and businesses alike to fund various expenses. With the advent of technology, loan apps have become increasingly popular in Nigeria, providing easy access to quick loans. However, not all loan apps

In today’s fast-paced world, accessing credit has become essential for many individuals and businesses. Fortunately, with the advent of digital technology, applying for a loan has become easier than ever. One such convenient platform is the LairaPlus Credit Loan App,

In recent years, the popularity of mobile loan apps has skyrocketed in Nigeria, with many individuals seeking quick and convenient access to financial assistance. Among these apps, one name stands out as the most popular choice for Nigerians in need

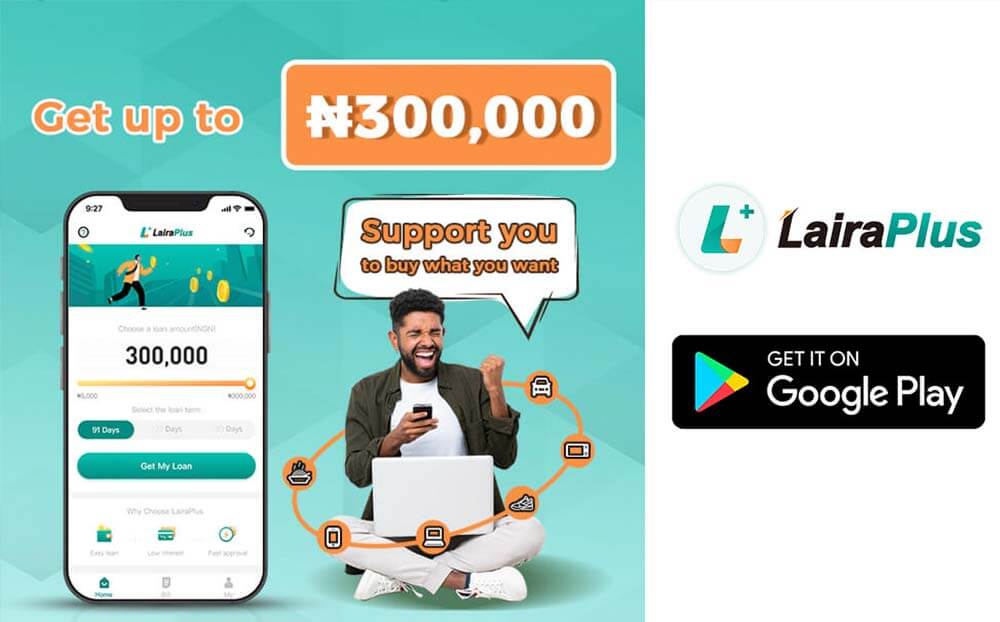

When applying for a loan through a loan application, one of the most important factors to consider is the loan amount. The loan amount range offered by different loan applications can vary greatly. In this article, we will explore the

Fast loan applications have become increasingly popular in recent years, providing individuals with a quick and convenient way to access funds when they need them most. Whether it’s an unexpected expense or a financial emergency, fast loan applications offer a

When it comes to seeking quick financial assistance, fast loan applications have become increasingly popular. These applications offer borrowers the convenience of obtaining funds swiftly, but it’s crucial to understand the associated interest rates and fees before committing to any

When you need emergency funds to cope with unexpected expenses, instant loan applications can become your lifeline. These applications provide a convenient and fast borrowing method, allowing users to complete the entire loan application and repayment process on their mobile

In today’s fast-paced world, where financial needs often arise unexpectedly, instant loan applications have become increasingly popular. These applications provide quick and convenient access to funds, allowing individuals to meet their urgent financial requirements without any hassle. However, it is

A Step-by-Step Guide to Downloading and Installing the LairaPlus Loan App In today’s digital age, mobile applications have revolutionized the way we manage our finances. One such application, LairaPlus, offers the convenience of accessing loans at your fingertips. If you’re

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad