Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

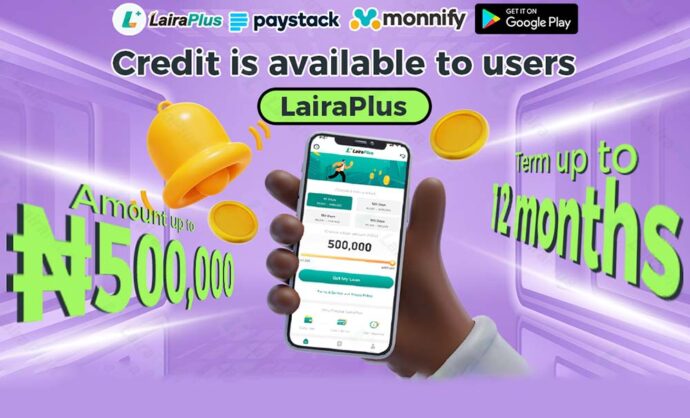

In today’s digital age, online cash lending platforms have gained popularity as convenient and accessible solutions for individuals seeking quick financial assistance. However, not all online lending platforms are created equal, and selecting a reliable one is crucial to ensure a safe and responsible borrowing experience. In this comprehensive article, we’ll explore the key factors to consider when choosing a trustworthy online cash lending platform, with a focus on LairaPlus.

The Importance of Choosing a Reliable Lending Platform

Before delving into the selection criteria, it’s essential to understand why choosing a reliable online cash lending platform matters:

Security: A reliable platform prioritizes the security and privacy of your personal and financial information.

Fair Terms: Trusted platforms offer fair and transparent terms, including interest rates, fees, and repayment schedules.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Customer Support: Reliable lenders have responsive customer support teams to assist borrowers with inquiries and concerns.

Legal Compliance: Reputable platforms adhere to relevant financial regulations and laws to protect borrowers’ rights.

Responsible Lending: Trusted lenders assess borrowers’ ability to repay loans responsibly, reducing the risk of overindebtedness.

Selecting a Reliable Online Cash Lending Platform – The LairaPlus Approach

LairaPlus is committed to providing a reliable and responsible lending experience. Here are the essential factors to consider when choosing an online cash lending platform like LairaPlus:

1. Credibility and Reputation

Research the platform’s credibility and reputation. Look for customer reviews, ratings, and testimonials from previous borrowers. Reliable platforms have positive feedback and a history of responsible lending practices.

2. Regulatory Compliance

Ensure that the platform is licensed and operates within the legal framework of your country. LairaPlus complies with all relevant financial regulations, offering borrowers peace of mind.

3. Transparency

A trustworthy platform provides clear and transparent information about loan terms, interest rates, fees, and repayment schedules. Read and understand all terms and conditions before applying for a loan.

4. Security Measures

Check the platform’s security measures to protect your personal and financial data. LairaPlus employs robust encryption and data protection protocols to keep your information safe.

5. Customer Support

Test the responsiveness of customer support. Reach out to LairaPlus customer support with questions or concerns to gauge their willingness and ability to assist borrowers.

6. Loan Terms

Evaluate the loan terms offered by the platform, including interest rates, repayment periods, and loan amounts. Ensure they align with your financial needs and capacity.

7. Application Process

Assess the ease and convenience of the loan application process. Reliable platforms like LairaPlus offer user-friendly mobile apps or websites for hassle-free applications.

8. Eligibility Criteria

Understand the platform’s eligibility criteria. LairaPlus aims to make loans accessible to a broad range of borrowers while maintaining responsible lending standards.

9. Repayment Flexibility

Check if the platform offers repayment flexibility, such as the option to extend loan terms if needed. LairaPlus works with borrowers facing temporary financial difficulties to find suitable solutions.

10. Reviews and Recommendations

Consult online resources, forums, or financial advisors for recommendations on reputable lending platforms. Peer insights can be valuable in your decision-making process.

Selecting a reliable online cash lending platform is a crucial step in ensuring a positive borrowing experience. LairaPlus exemplifies the qualities of a trustworthy lending platform, offering security, transparency, responsible lending practices, and customer-centric support. By considering the factors mentioned in this guide and conducting thorough research, you can make an informed decision when choosing an online cash lending platform like LairaPlus, leading to a secure and responsible borrowing journey. Remember, responsible borrowing begins with selecting a lending platform that puts your financial well-being first.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT