Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Personal loans are a financial lifeline for individuals facing various financial needs, from consolidating debt to funding unexpected expenses. However, before diving into the world of personal loans, it’s essential to grasp the distinction between secured and unsecured personal loans. In this comprehensive 1000-word article, we’ll explore the concepts of secured and unsecured personal loans, and introduce LairaPlus as an innovative financial solution for borrowers.

Secured Personal Loans: Fortified by Collateral

Secured personal loans are a category of loans fortified by collateral. Collateral is an asset, such as a vehicle, real estate, or a savings account, which the borrower pledges as security for the loan. If the borrower fails to repay the loan, the lender has the legal right to take possession of the collateral as compensation for the outstanding debt.

Key Characteristics of Secured Personal Loans:

Collateral Requirement: Borrowers must provide a valuable asset as collateral to secure the loan. This asset serves as a safety net for the lender, reducing the risk associated with lending.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Lower Interest Rates: Because lenders have a higher level of security due to the collateral, secured personal loans often come with lower interest rates compared to unsecured loans.

Risk of Collateral Loss: If the borrower defaults on the loan, the lender can seize the collateral to recover their losses. This risk adds a layer of responsibility for borrowers.

Common Uses of Secured Personal Loans

Secured personal loans are commonly used for significant financial endeavors, including:

Home Renovations: Homeowners may use their property as collateral to finance home improvement projects, increasing the value of their residence.

Automobile Purchases: Car loans are often secured by the vehicle being financed, providing lenders with security in case of default.

Debt Consolidation: Borrowers may use secured loans to consolidate high-interest debts, such as credit card balances, into a single, more manageable loan.

Unsecured Personal Loans: No Collateral, Higher Risk

Unsecured personal loans, in contrast, do not require borrowers to provide collateral. Instead, these loans are approved based on the borrower’s creditworthiness, which is determined by factors such as credit scores, credit history, and income.

Key Characteristics of Unsecured Personal Loans:

No Collateral Requirement: Unsecured loans are not tied to any specific asset or property, making them accessible to a broader range of borrowers.

Credit-Based Approval: Lenders evaluate borrowers based on their creditworthiness. Those with higher credit scores and a history of responsible financial behavior are more likely to qualify.

Higher Interest Rates: Unsecured personal loans typically come with higher interest rates compared to secured loans. Lenders charge higher rates to compensate for the increased risk they assume.

Common Uses of Unsecured Personal Loans

Unsecured personal loans are often sought after for various purposes, including:

Emergency Expenses: When unexpected financial challenges arise, such as medical bills or car repairs, unsecured loans can provide quick access to funds.

Debt Consolidation: Borrowers with good credit may use unsecured loans to consolidate debts and streamline their repayment process.

Small-Scale Projects: Financing smaller projects, such as a vacation, wedding, or minor home repairs, can be achieved through unsecured personal loans.

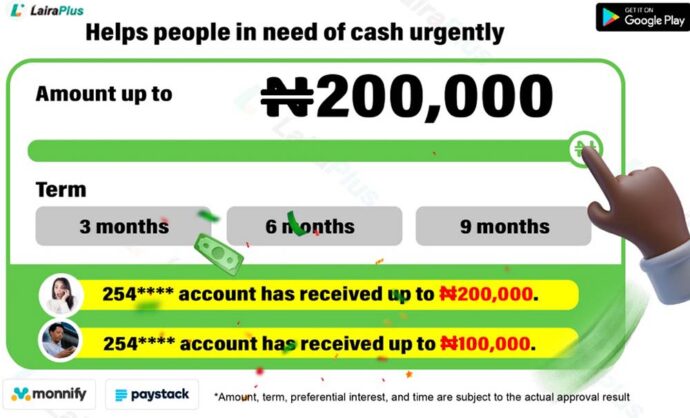

Introducing LairaPlus: A Balanced Approach

LairaPlus is a groundbreaking financial product designed to provide borrowers with a balanced approach to personal loans. It combines the benefits of secured and unsecured loans, offering a unique solution for various financial needs.

Key Features of LairaPlus:

Collateral Flexibility: LairaPlus allows borrowers to choose whether to secure their loan with collateral or opt for an unsecured loan. This flexibility empowers borrowers to tailor their borrowing experience to their specific circumstances.

Competitive Interest Rates: Borrowers who choose to secure their loans with collateral can enjoy competitive interest rates, potentially lowering the overall cost of borrowing.

Credit-Based Options: For borrowers who prefer not to provide collateral, LairaPlus offers credit-based approval, making it accessible to those with good credit histories.

Customized Loan Terms: LairaPlus offers customized loan terms, enabling borrowers to select repayment plans that align with their financial goals and budget.

Selecting the Right Loan Type with LairaPlus

LairaPlus empowers borrowers to make informed decisions by offering a choice between secured and unsecured personal loans. Here are some considerations to help borrowers select the right loan type:

Collateral Availability: If borrowers have valuable assets they are willing to use as collateral, they can opt for a secured loan to potentially secure lower interest rates.

Credit History: Borrowers with strong credit histories may choose an unsecured loan, while those with less robust credit profiles may opt for secured options.

Financial Goals: LairaPlus offers customized loan terms, allowing borrowers to tailor their loans to meet specific financial goals, whether it’s consolidating debt, funding a project, or managing an unexpected expense.

Risk Tolerance: Borrowers should assess their comfort level with risk and their willingness to provide collateral before making a decision.

Conclusion: A New Era in Personal Lending

Secured and unsecured personal loans serve distinct purposes and come with unique advantages and considerations. With the introduction of LairaPlus, borrowers have the flexibility to choose the loan type that best aligns with their financial situation and objectives. This innovative financial product represents a new era in personal lending, offering borrowers a balanced approach to achieve their financial goals while managing risk responsibly. Whether securing their loan with collateral or relying on their creditworthiness, borrowers now have more control and choice in their personal loan experience.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT