Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Easy cash loans and traditional bank loans differ in several key aspects, including:

Accessibility and Speed: Easy cash loans, often offered by online lenders or alternative financial institutions, are designed for quick accessibility. The application process is streamlined, and funds can be disbursed rapidly, sometimes within minutes of approval. In contrast, traditional bank loans usually involve a more extended application process, including paperwork, verification, and might take several days or weeks for approval and disbursement.

Credit Requirements: Easy cash loans might have more relaxed credit requirements compared to traditional bank loans. Some lenders offering easy cash loans perform minimal credit checks or consider alternative data for approval. Traditional bank loans typically have stricter credit criteria and might require a good credit score or collateral.

Interest Rates and Fees: Easy cash loans often come with higher interest rates and fees compared to traditional bank loans. The convenience and quick accessibility of easy cash loans often come at the cost of higher interest rates, whereas traditional bank loans might offer more competitive rates, especially for borrowers with good credit.

Loan Amount and Terms: Easy cash loans generally offer smaller loan amounts for shorter terms compared to traditional bank loans. Traditional bank loans may provide larger sums for longer durations, allowing for more flexibility in repayment.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Regulation and Oversight: Traditional bank loans are typically subject to more stringent regulations and oversight by financial authorities. Easy cash loans, especially those offered by online lenders or alternative financial institutions, might operate in a less regulated environment, which can sometimes lead to less transparency or higher risk for borrowers.

Purpose and Usage: Easy cash loans are often used for immediate and urgent needs or emergencies due to their quick accessibility. Traditional bank loans might be used for various purposes, including larger investments, home purchases, or business financing, and are often more structured in terms of purpose and usage.

Understanding these differences is crucial when considering borrowing options. Both types of loans have their advantages and disadvantages, and choosing the right one depends on individual financial needs, creditworthiness, and the urgency of the situation.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

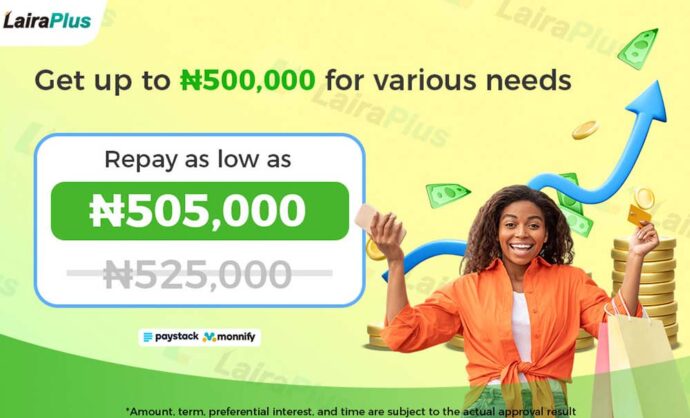

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT