Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Easy cash loans can be an option for emergencies in Nigeria, but it’s crucial to approach them with caution and understanding of the local lending landscape. Here are some key points to consider:

Urgent Access to Funds: Easy cash loans can provide quick access to funds, which can be helpful in emergencies such as medical expenses, unexpected car repairs, or other urgent needs.

Limited Regulation: In Nigeria, the regulatory framework for lending might vary, and some lenders may operate with less oversight. This could lead to higher interest rates, hidden fees, or predatory lending practices.

High Interest Rates: Many easy cash loans come with high-interest rates, making them expensive in the long run. Borrowers should carefully assess whether the urgency of the situation justifies the high cost of borrowing.

Risk of Debt Cycle: Using easy cash loans frequently, especially without the means to repay them promptly, can lead to a cycle of debt and financial stress.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Consider Alternatives: Before opting for an easy cash loan, explore other options such as borrowing from family or friends, negotiating payment plans, or seeking assistance from local charitable organizations or government programs.

Careful Selection of Lenders: If considering an easy cash loan, research reputable lenders, read reviews, and thoroughly understand the terms and conditions before accepting any loan offer.

Financial Planning: It’s essential to have a financial plan in place to manage the borrowed funds effectively and ensure timely repayment to avoid additional charges or penalties.

In summary, easy cash loans can serve as a solution for emergencies in Nigeria, but they should be approached cautiously. Assess the urgency of the situation, explore alternative options, and carefully evaluate the terms and conditions of any loan before making a decision. Being well-informed and borrowing responsibly is key to avoiding potential pitfalls associated with these loans.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

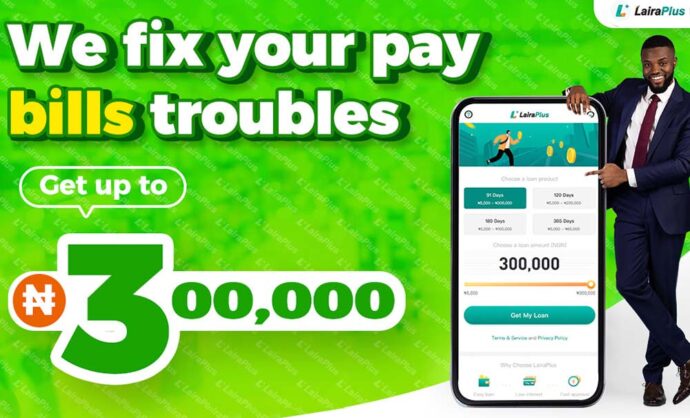

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT