Home » Blog » Loan app without bvn in nigeria, what personal information do you provide for borrowing money?

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In the ever-evolving world of digital finance, loan apps without the Bank Verification Number (BVN) requirement have gained popularity in Nigeria. These apps promise accessibility and ease of borrowing, making them an attractive option for many. But what personal information do you need to provide when using a loan app without BVN in Nigeria? In this article, we will delve into the specifics of the personal information required, the importance of data security, and responsible borrowing.

The Role of BVN and Privacy Concerns:

The Bank Verification Number (BVN) was introduced to enhance security and reduce fraudulent activities in Nigeria’s financial sector. It serves as a unified identifier, linking personal information to bank accounts. However, many individuals have privacy concerns about linking their BVN to loan applications, which has led to the rise of BVN-free loan apps.

Personal Information Required for Loan Apps Without BVN:

While loan apps without BVN offer an alternative to BVN-linked borrowing, they still require certain personal information for verification and credit assessment. Here is the typical set of personal information that you may need to provide:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Full Name: Your legal name is essential for identity verification and legal purposes.

Phone Number: A valid phone number is often required for communication, verification codes, and loan updates.

Email Address: An email address may be necessary for account creation and communication.

Employment Information: Details about your employment status, including your employer’s name, job title, and income, are commonly requested for credit assessment.

Bank Account Details: You’ll need to provide your bank account number for loan disbursement and repayments.

Government-Issued ID: Some apps may require a valid government-issued ID for identity verification, age confirmation, and to meet legal compliance standards.

Alternative Verification Data: Since these apps do not use BVN for credit assessment, they may ask for alternative data, such as transaction history, to determine your creditworthiness.

The Importance of Data Security:

One of the paramount concerns with sharing personal information on loan apps is data security. Here’s how to ensure your data is protected:

Research the App: Choose apps with a reputation for strong data security measures and privacy protection.

Read Privacy Policies: Understand how your data will be used and protected by reviewing the app’s privacy policy.

Use Secure Connections: Ensure that you are using a secure and private internet connection when providing personal information.

Beware of Scams: Be cautious of phishing scams and fraudulent apps. Download apps only from trusted sources.

Regularly Monitor Accounts: Keep a close eye on your bank accounts and financial transactions to detect any unauthorized activities.

Responsible Borrowing:

Regardless of the verification method used by loan apps, responsible borrowing is crucial. Here are some key points to consider:

Borrow What You Need: Only borrow the amount you genuinely need to avoid over-indebtedness.

Understand Loan Terms: Review the terms and conditions of the loan, including interest rates, repayment periods, and any penalties for late payments.

Repayment Capacity: Ensure you can comfortably repay the borrowed amount on time.

Maintain Good Financial Habits: Responsible borrowing and timely repayments can positively impact your creditworthiness.

Loan apps without BVN in Nigeria offer an alternative way to access loans while addressing privacy concerns. When using these apps, it’s essential to provide the required personal information, prioritize data security, and practice responsible borrowing. While they offer convenience, financial responsibility remains paramount for a secure and successful borrowing experience.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

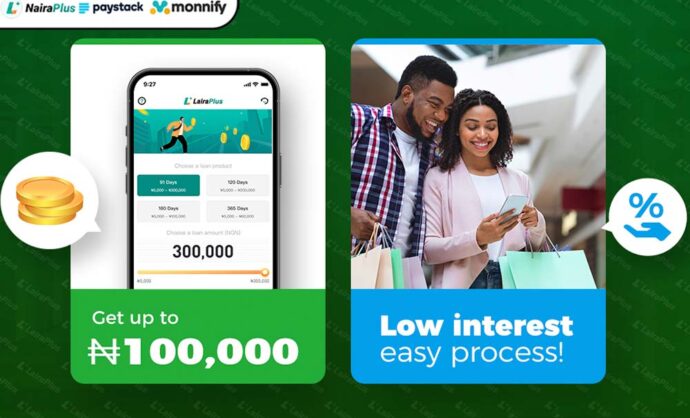

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT