Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

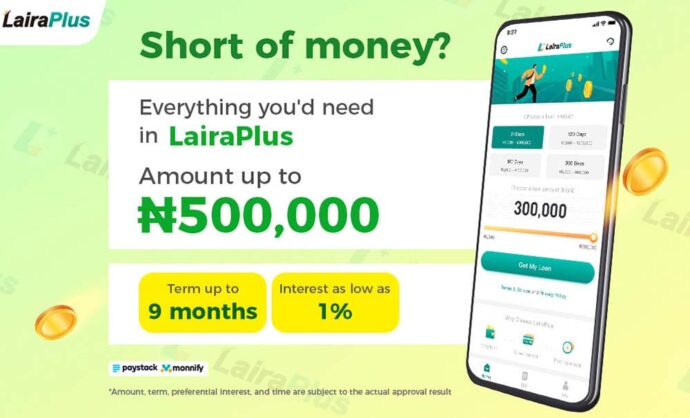

When you’re facing an urgent need for funds, quick and convenient online loans can be a lifesaver. LairaPlus, a popular loan app, offers the possibility of securing a ₦50,000 loan. But do you need collateral for online loans, especially through LairaPlus? In this article, we’ll explore the concept of collateral in the context of online loans and whether it’s required when applying for a loan with LairaPlus.

Understanding Collateral: What Is It?

Collateral refers to an asset or property that a borrower pledges to a lender as security for a loan. If the borrower fails to repay the loan as agreed, the lender can take possession of the collateral to recover their losses. Collateral can take various forms, including real estate, vehicles, jewelry, or even savings accounts.

Collateral Requirements for Traditional Loans

In traditional lending, such as bank loans, collateral is often a common requirement, especially for larger loan amounts. Banks may require borrowers to provide collateral to mitigate the lender’s risk, ensuring that they have a valuable asset to recoup their funds if the borrower defaults on the loan. This can make it challenging for individuals without valuable assets to access loans.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Online Loans and Collateral

Online lenders, like LairaPlus, have revolutionized the lending landscape by offering a more accessible and flexible borrowing experience. Many online lenders, including LairaPlus, offer unsecured loans, meaning they do not require collateral. Instead, they assess a borrower’s creditworthiness based on factors such as credit history, income, and repayment capacity.

LairaPlus’s Approach: No Collateral Needed

LairaPlus typically offers unsecured loans, which means you can apply for a loan without the need for collateral. Instead, LairaPlus evaluates your eligibility based on the information provided during the application process. This can include details about your employment, income, and other financial factors.

What LairaPlus May Require Instead

While LairaPlus doesn’t require collateral, they may have certain requirements to assess your creditworthiness:

Credit History: LairaPlus may check your credit history to determine your borrowing and repayment history. A positive credit history can enhance your chances of loan approval.

Income Verification: Providing proof of a stable income source is crucial. LairaPlus may request documents such as payslips or bank statements to verify your income.

Bank Account: You’ll typically need an active bank account for loan disbursement. LairaPlus will deposit the approved loan amount directly into your account.

Tips for Securing Loan Approval with LairaPlus

To increase your chances of approval for a ₦50,000 loan with LairaPlus, consider these tips:

Provide Accurate Information: Ensure all the information you provide in your loan application is accurate and up to date.

Maintain a Good Credit Profile: If possible, work on improving your credit score by paying off existing debts on time.

Borrow Responsibly: Only borrow what you can comfortably repay within the agreed-upon terms.

Complete Documentation: If LairaPlus requests additional documentation, provide it promptly and in full.

In conclusion, when seeking a ₦50,000 loan urgently with LairaPlus, you typically do not need collateral. LairaPlus offers a more accessible and flexible lending option by assessing your creditworthiness through factors such as credit history and income verification. By adhering to responsible borrowing practices and providing accurate information, you can enhance your chances of securing the funds you need, even in urgent situations. Remember to review the terms and conditions of the loan carefully before proceeding with your application.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT