In today’s fast-paced world, people often need access to quick cash to meet their financial needs. This is where loan apps come in handy as they provide a convenient and easy way to get access to loans. There are several

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In today’s fast-paced world, people often need access to quick cash to meet their financial needs. This is where loan apps come in handy as they provide a convenient and easy way to get access to loans. There are several

In recent years, the use of loan applications has become increasingly popular in Nigeria. These apps provide individuals with quick and convenient access to loans, eliminating the need for traditional banking processes. However, before using a loan application, there are

Loans are an essential aspect of personal and business finance. In Nigeria, the Bank Verification Number (BVN) was introduced by the Central Bank of Nigeria (CBN) as a means of identifying individuals and reducing identity theft in banking transactions. However,

The Nigeria Bank Verification Number (BVN) loan application has gained popularity due to its convenience and accessibility. However, many users have questions about the process, eligibility, and requirements. In this article, we will address common questions and provide comprehensive answers

In the digital age, financial technology has revolutionized the way people access loans. With the advent of loan applications that do not require Bank Verification Numbers (BVN), the process of obtaining credit has become more convenient for many individuals. However,

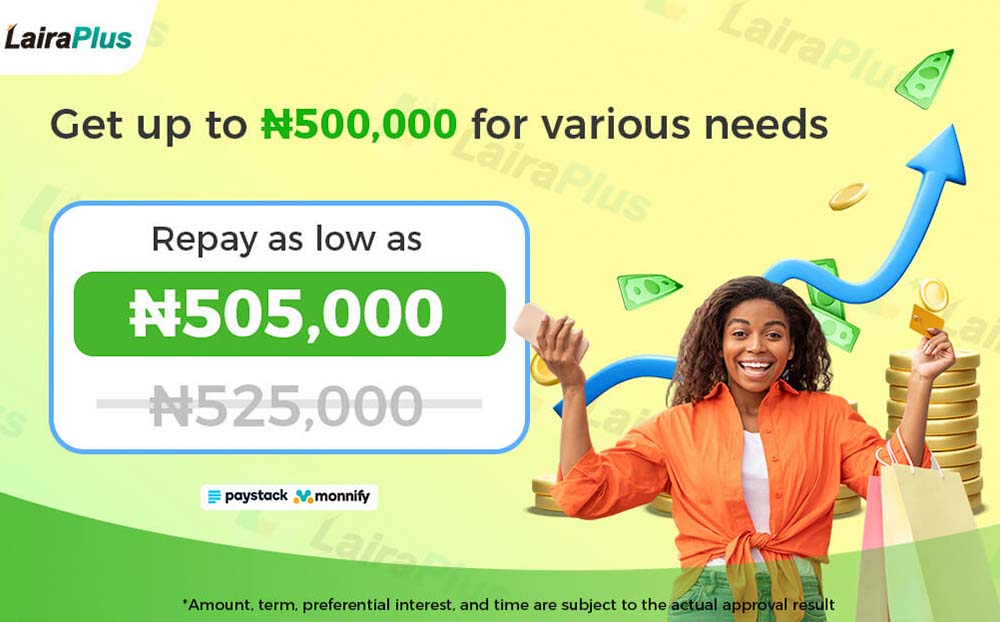

In the dynamic landscape of personal finance, situations often arise where urgent access to funds becomes paramount. Nigeria’s online lending platforms have stepped in to bridge this gap, offering swift and convenient solutions. Among these, LairaPlus stands out as a

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad