Nigeria’s financial industry has been experiencing a lot of growth in recent years, especially in the area of fintech. One of the most notable developments is the emergence of loan apps that have revolutionized the way Nigerians access loans. Among

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Nigeria’s financial industry has been experiencing a lot of growth in recent years, especially in the area of fintech. One of the most notable developments is the emergence of loan apps that have revolutionized the way Nigerians access loans. Among

In today’s fast-paced world, accessing financial assistance has become easier than ever with the advent of loan applications. For those residing in Nigeria, finding a reliable and trustworthy loan application is crucial. This article aims to introduce the best loan

In today’s fast-paced world, people are always looking for quick and efficient solutions to their financial needs. This is where loan apps come in handy. With the advent of technology, many loan apps have emerged in the market, providing Nigerians

When it comes to obtaining loans in Nigeria, technology has come to the rescue with various loan applications designed to make the process easier. These applications have become increasingly popular among the populace due to their convenience and fast processing

In Nigeria, many people require emergency funds to meet various personal and business needs. Therefore, finding a reliable loan application has become crucial. With the development of technology, loan applications have become a convenient way for people to obtain funds.

In today’s fast-paced world, the need for quick and convenient financial solutions is more important than ever. For individuals and businesses in Nigeria, securing timely access to loans can be a crucial factor in achieving their goals. Fortunately, the rise

In recent years, the use of loan applications has become increasingly popular in Nigeria. These apps provide individuals with quick and convenient access to loans, eliminating the need for traditional banking processes. However, before using a loan application, there are

Loans are an essential aspect of personal and business finance. In Nigeria, the Bank Verification Number (BVN) was introduced by the Central Bank of Nigeria (CBN) as a means of identifying individuals and reducing identity theft in banking transactions. However,

In Nigeria, the lack of a Bank Verification Number (BVN) poses significant challenges to the security and privacy of loan applications. Without a BVN, individuals are unable to access traditional bank loans. This has led to the rise of alternative

In the digital age, financial technology has revolutionized the way people access loans. With the advent of loan applications that do not require Bank Verification Numbers (BVN), the process of obtaining credit has become more convenient for many individuals. However,

Instant Loan App without BVN in Nigeria: Quick Money Release? In Nigeria, the concept of an instant loan app without BVN (Bank Verification Number) has become increasingly popular. These apps promise quick and convenient access to credit, often without the

Instant Loan App without BVN in Nigeria: How to Apply? Instant loan apps without BVN have become a popular alternative to traditional loans in Nigeria. These apps provide quick and convenient access to credit, often without the need for extensive

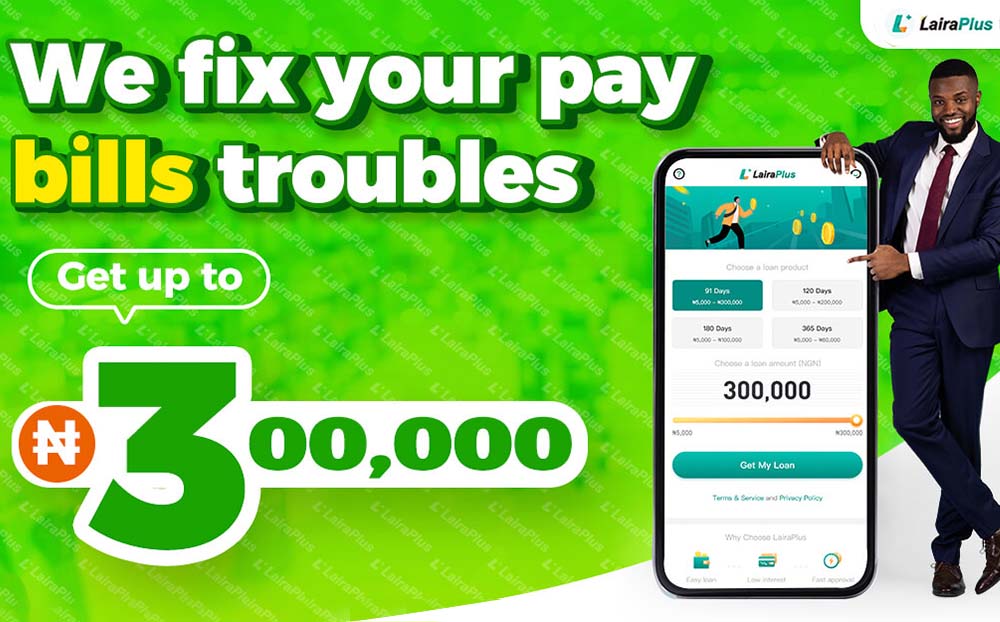

LairaPlus, an esteemed online loan platform in Nigeria, offers users a convenient and accessible way to apply for and manage loans through their mobile app. Let’s delve into the user experience aspects of the LairaPlus loan app. 1. User-Friendly Interface

Instant loan apps in Nigeria work by providing individuals with quick access to short-term loans through a streamlined and digital application process. These apps have become increasingly popular as they offer a convenient way to secure funds for various purposes.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad