Nigeria’s financial industry has been experiencing a lot of growth in recent years, especially in the area of fintech. One of the most notable developments is the emergence of loan apps that have revolutionized the way Nigerians access loans. Among

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Nigeria’s financial industry has been experiencing a lot of growth in recent years, especially in the area of fintech. One of the most notable developments is the emergence of loan apps that have revolutionized the way Nigerians access loans. Among

In Nigeria, the proliferation of loan apps has provided individuals and businesses with convenient access to financial assistance. These apps offer varying loan limits and interest rates, catering to the diverse needs of borrowers. Understanding the range of options available

In today’s fast-paced world, people are always looking for quick and efficient solutions to their financial needs. This is where loan apps come in handy. With the advent of technology, many loan apps have emerged in the market, providing Nigerians

When it comes to obtaining loans in Nigeria, technology has come to the rescue with various loan applications designed to make the process easier. These applications have become increasingly popular among the populace due to their convenience and fast processing

In Nigeria, many people require emergency funds to meet various personal and business needs. Therefore, finding a reliable loan application has become crucial. With the development of technology, loan applications have become a convenient way for people to obtain funds.

In today’s fast-paced world, the need for quick and convenient financial solutions is more important than ever. For individuals and businesses in Nigeria, securing timely access to loans can be a crucial factor in achieving their goals. Fortunately, the rise

In today’s fast-paced world, people often need access to quick cash to meet their financial needs. This is where loan apps come in handy as they provide a convenient and easy way to get access to loans. There are several

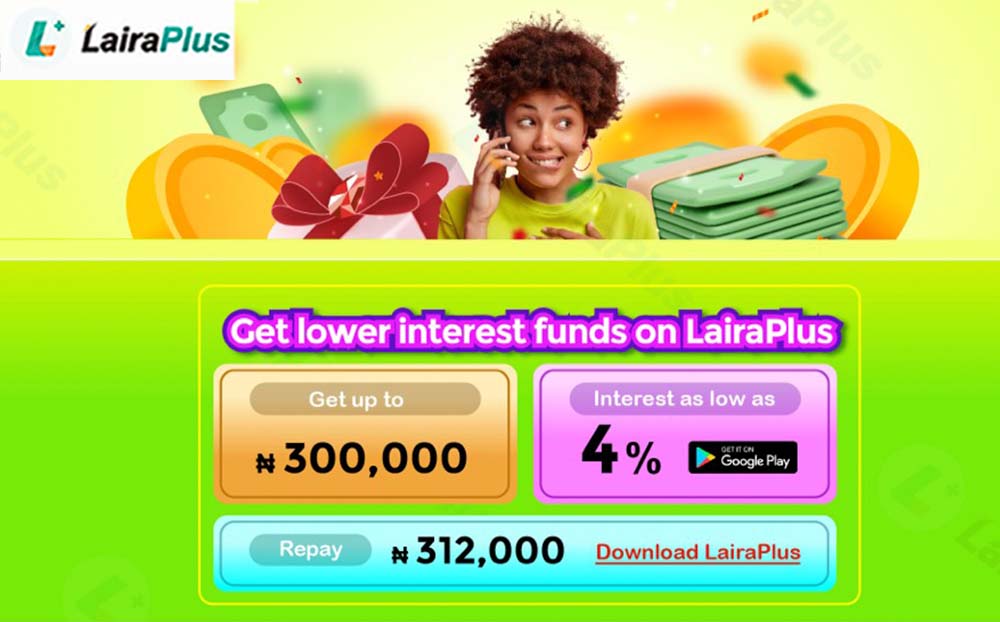

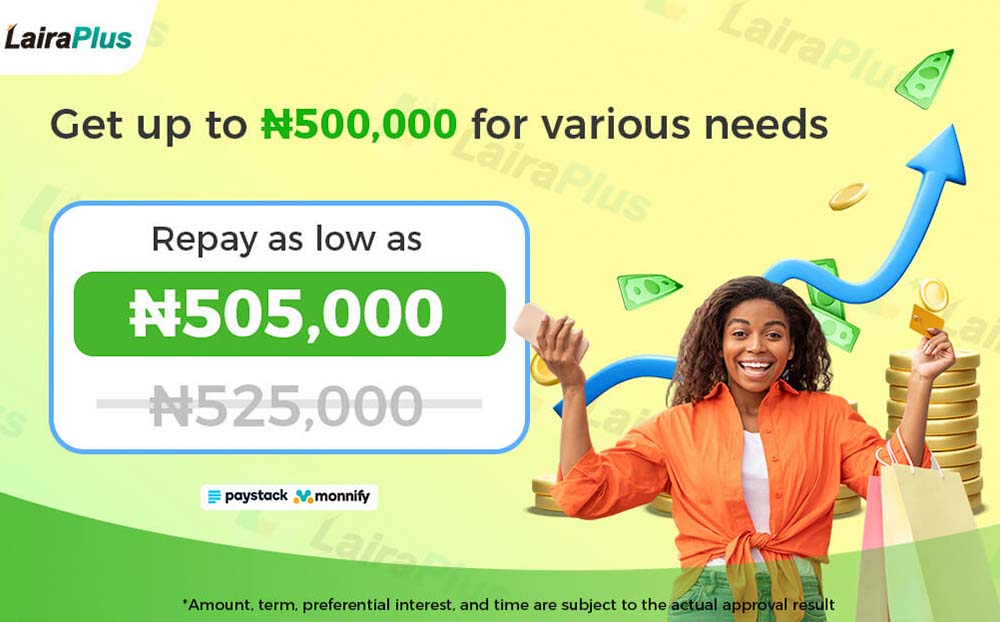

Absolutely! Here’s an article detailing the maximum loan amount offered by the LairaPlus loan app in Nigeria: LairaPlus Loan App: Maximum Loan Amount Offered in Nigeria Introduction LairaPlus, a prominent online loan platform in Nigeria, caters to individuals in need

In Nigeria, the financial landscape is evolving, and access to instant loans has become more convenient and streamlined. Instant loan providers offer a lifeline to individuals in need of rapid financial assistance. Among these providers, LairaPlus stands out as a

Applying for an instant loan in Nigeria can be a convenient way to access funds quickly, but it’s essential to consider the pros and cons before proceeding. Here’s a breakdown of the advantages and disadvantages: Pros of Applying for an

When financial emergencies strike, securing a loan quickly can be a lifesaver. In Nigeria, the need for instant loans is common, and innovative online lending platforms like LairaPlus have recognized the importance of providing accessible and convenient solutions. If you’re

Emergencies and unexpected financial needs can arise at any moment, leaving you in search of quick solutions. If you’re in Nigeria and require an instant loan, you’re in luck because you have access to convenient online lending platforms like LairaPlus.

In the ever-evolving financial landscape of Nigeria, the demand for accessible and trustworthy loan apps is on the rise. With numerous options available, it’s essential to choose the best loan app that suits your specific financial needs. In this article,

Selecting the best low-interest loan app in Nigeria involves careful consideration of several factors to ensure you make an informed choice. Here’s a guide on how to choose the best low-interest loan app in Nigeria: Interest Rate: Compare the interest

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad