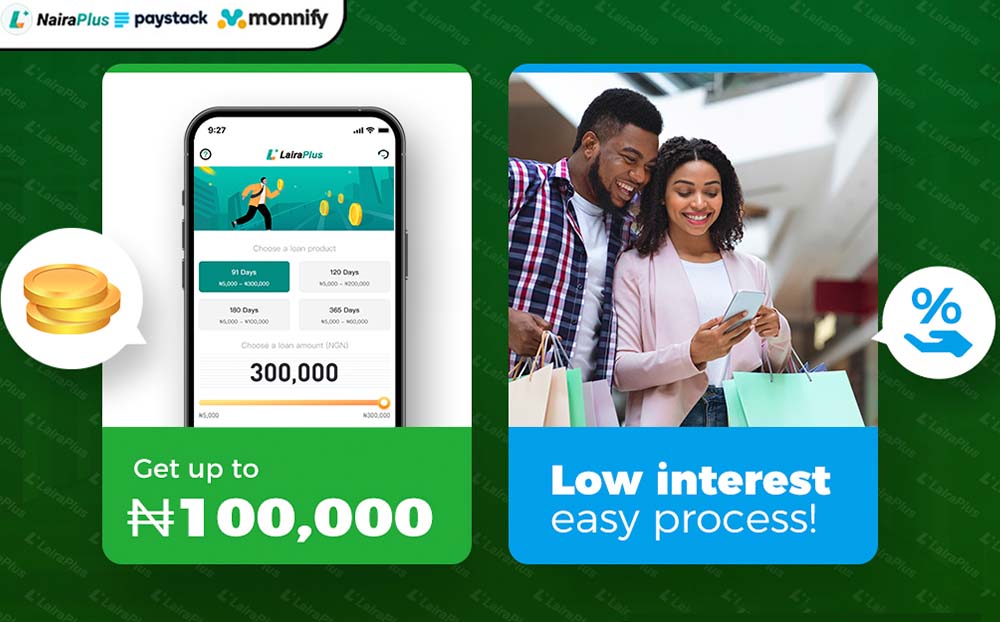

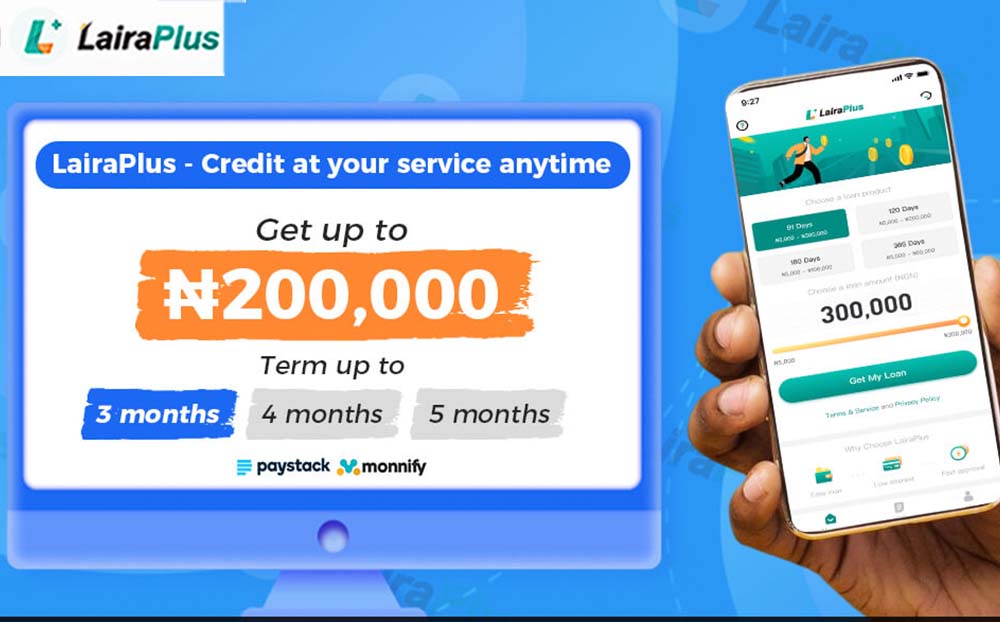

What urgent needs can I meet with LairaPlus loan? Life is unpredictable, and unexpected financial challenges can arise at any moment. LairaPlus, an online loan platform, steps in to provide a solution for individuals facing urgent financial needs. In this