Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

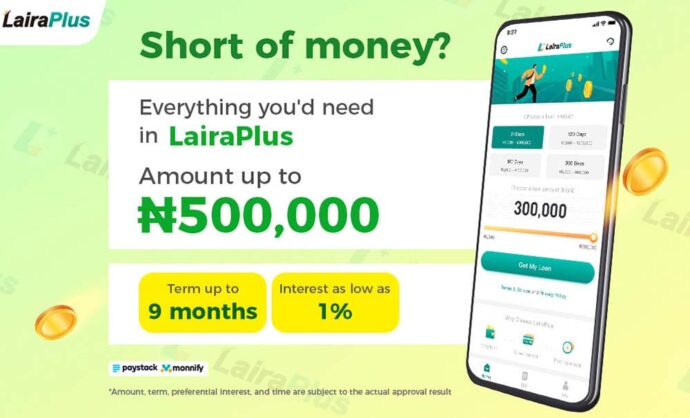

Online borrowing has made accessing financial solutions more convenient than ever. LairaPlus, as an online lending platform, offers a streamlined and user-friendly application process for borrowers. In this article, we will walk you through the step-by-step process of applying for a loan with LairaPlus, covering everything from eligibility criteria to loan approval and disbursement.

1. Eligibility Assessment

Before applying for a loan with LairaPlus or any online lending platform, it’s essential to determine if you meet the eligibility criteria. LairaPlus typically assesses factors such as:

Credit Score: Your creditworthiness plays a significant role in loan approval. A higher credit score often improves your chances of being approved for a loan.

Income and Employment: Lenders may require proof of income and stable employment to ensure you have the means to repay the loan.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Age and Residency: Borrowers usually need to be of legal age and residents of the country where LairaPlus operates.

2. Loan Product Selection

Once you’ve confirmed your eligibility, it’s time to choose the loan product that best suits your needs. LairaPlus offers various loan options, including personal loans, auto loans, and home improvement loans. Consider your financial goals and select the loan type that aligns with your objectives.

3. Online Application

The online application is the heart of the borrowing process. LairaPlus simplifies this step by providing an easy-to-navigate online application form. Here’s what you can expect:

Personal Information: You’ll be asked to provide personal details such as your name, address, date of birth, and contact information.

Financial Information: LairaPlus will request information about your income, employment status, and monthly expenses. This helps assess your ability to repay the loan.

Loan Amount and Term: Specify the loan amount you require and choose a suitable repayment term based on your preferences and financial capacity.

4. Documentation Submission

To support the information provided in your application, you may need to submit documentation. Commonly requested documents include:

Proof of Identity: A government-issued ID or passport.

Proof of Income: Pay stubs, bank statements, or tax returns to verify your income.

Address Verification: Utility bills or a lease agreement to confirm your residential address.

5. Credit Check

LairaPlus and most online lenders perform a credit check to assess your creditworthiness. This involves reviewing your credit history and credit score. A good credit history can increase your chances of approval and potentially lead to more favorable loan terms.

6. Loan Approval and Offer

Upon reviewing your application and credit report, LairaPlus will make a lending decision. If approved, you will receive a loan offer outlining the terms and conditions of the loan, including the interest rate, repayment schedule, and any associated fees. Take the time to review this offer carefully.

7. Acceptance and E-Signature

If you are satisfied with the loan offer, you can accept it electronically by e-signing the loan agreement. E-signatures are secure and legally binding, streamlining the process without the need for physical paperwork.

8. Loan Disbursement

Once you have accepted the loan offer and provided all necessary documentation, LairaPlus will initiate the loan disbursement. Depending on the loan type and method of disbursement, funds can be deposited directly into your bank account or used to pay for the specific purpose, such as a car purchase or home improvement project.

9. Repayment

After receiving the loan, you will begin making regular payments according to the agreed-upon schedule. LairaPlus typically offers multiple repayment options, including automatic bank transfers and online payments, for your convenience.

10. Customer Support and Servicing

Throughout the loan term, LairaPlus provides customer support to address any inquiries or concerns you may have. They can assist with loan servicing, payment adjustments, and any necessary account maintenance.

Conclusion

The online borrowing application process with LairaPlus is designed to be straightforward and accessible. By following the steps outlined in this guide, borrowers can navigate the process with confidence, from determining eligibility to receiving funds and managing loan repayments. LairaPlus aims to provide a seamless and convenient borrowing experience for individuals seeking financial solutions online.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT