Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Fast loans are a powerful tool for accessing funds in emergencies, but using them incorrectly can lead to financial hardships. We will explore how to use fast loans wisely, avoiding financial difficulties, with a focus on FairKash+.

1. Confirm Urgency:

Before applying for a fast loan, make sure your situation is genuinely urgent. Fast loans are typically associated with higher interest rates and fees, so they should be reserved for genuine emergencies, such as medical bills or urgent repairs.

2. Plan Repayments:

Before accepting a loan, creating a repayment plan is crucial. Understand the amount you need to repay each month and the due dates, ensuring you have the ability to repay on time.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

3. Borrow the Minimum Needed:

Avoid borrowing more funds than you actually need. Choose the minimum loan amount necessary to make repayment more manageable and reduce loan costs.

4. Compare Different Loan Options:

Research and compare different loan options, including interest rates and fees from various lenders. FairKash+ provides transparent fee information to help you make an informed choice.

5. Carefully Read the Contract:

Before accepting a loan, carefully read and understand the loan contract. Comprehend all the terms of the loan, including interest rates, fees, repayment schedules, and any potential penalties.

6. Understand Loan Costs:

In addition to interest rates, understand any other loan-related costs. These costs may include early repayment fees or late payment charges. Make sure you are aware of these costs and factor them into your decision.

7. Avoid the Cycle of Borrowing:

Don’t fall into the trap of a borrowing cycle, where you take out a new loan before paying off an existing one. This can lead to accumulating debt and increased financial pressure.

8. Manage Your Budget:

Continue to manage your financial budget after borrowing. Ensure you have enough funds to cover loan payments, everyday expenses, and savings goals.

9. Seek Financial Advice:

If you find it difficult to make repayments, seek financial advice and assistance promptly. Work with a financial advisor or credit counseling agency to find solutions.

10. Early Repayment:

If you have the capability, consider repaying the loan ahead of schedule. This will reduce the interest you pay and expedite getting out of debt.

11. Build an Emergency Fund:

To avoid future financial emergencies, establish an emergency fund. This can help you handle unforeseen expenses without relying on loans.

12. Use Credit Wisely:

Use fast loans wisely. Stick to your repayment plan, maintain a good credit record, and ensure you only use them for genuine emergencies.

Fast loans are a vital tool for addressing urgent financial needs, but misusing them can lead to financial difficulties. Through prudent borrowing and repayment planning, as well as choosing a reputable lender like FairKash+, you can ensure access to funds in emergencies while maintaining financial stability. FairKash+ is committed to responsible lending practices, ensuring borrowers can safely address urgent expenses while minimizing the risk of financial hardship.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

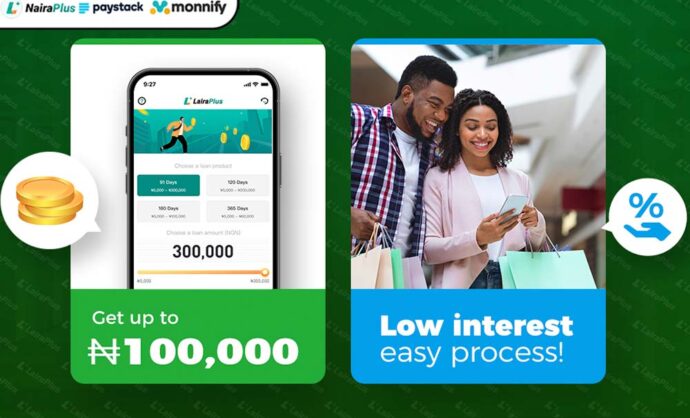

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT