Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Is Online Personal Loans a Suitable Solution for Family Emergency Funds?

Family emergencies and unexpected financial needs can arise at any time, and having a plan to address them is crucial for financial stability and peace of mind. Online personal loans have become a convenient option for securing funds quickly, but are they a suitable solution for family emergency funds? we will explore the feasibility of using online personal loans to address family emergencies and how LairaPlus, an innovative personal loan product, can assist in such situations.

Understanding Online Personal Loans

Online personal loans are unsecured loans offered by banks, credit unions, or online lenders. They are typically used for various purposes, including debt consolidation, home improvement, education expenses, or unexpected medical bills. Borrowers receive a lump sum and repay it with interest over a fixed term through regular monthly installments.

The Need for Family Emergency Funds

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Family emergencies can take many forms, such as medical expenses, unexpected home repairs, job loss, or urgent travel needs. Having access to a dedicated emergency fund can provide a safety net during these challenging times. However, not everyone has the financial resources to build and maintain such a fund, making personal loans an option worth considering.

Advantages of Using Online Personal Loans for Emergencies

Speed and Accessibility: Online personal loans offer a quick application and approval process, allowing borrowers to access funds rapidly when facing urgent situations.

Flexible Use of Funds: Borrowers can use personal loan funds for various emergency expenses, including medical bills, car repairs, or unexpected travel costs.

Structured Repayment: Personal loans come with fixed repayment terms, making it easier for borrowers to budget and plan for repayment.

Considerations Before Using Personal Loans for Emergencies

While online personal loans can be a viable solution for family emergencies, several factors should be considered:

Interest Rates: Personal loans may have interest rates that vary based on creditworthiness. Borrowers should evaluate whether the interest cost is manageable within their budget.

Credit Score: A higher credit score often leads to lower interest rates. Borrowers with lower credit scores may face higher borrowing costs.

Loan Term: The loan term affects monthly payments. Shorter terms result in higher monthly payments but lower overall interest costs.

Affordability: Borrowers should assess whether the loan payments are affordable without causing financial strain.

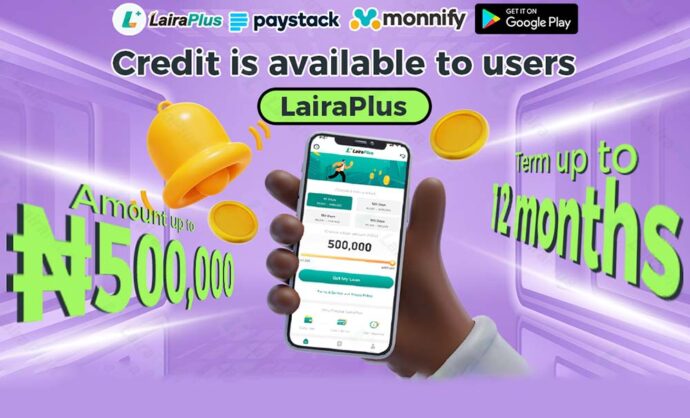

How LairaPlus Can Assist in Emergencies

LairaPlus, as an innovative personal loan product, offers features that can be particularly helpful when dealing with family emergencies:

Quick Approval: LairaPlus provides a streamlined application process, ensuring that borrowers can access funds swiftly when faced with urgent needs.

Competitive Interest Rates: Competitive interest rates from LairaPlus can help borrowers manage the overall cost of the loan, making it a feasible solution for emergencies.

Flexible Terms: LairaPlus offers flexible repayment terms, allowing borrowers to tailor the loan to their specific emergency and financial circumstances.

Transparent Terms: LairaPlus prioritizes transparency in lending, ensuring that borrowers have access to clear and straightforward loan terms, making it easier to understand and manage the loan during a stressful time.

Conclusion: A Valuable Tool for Family Emergencies

Online personal loans, such as LairaPlus, can be a valuable tool for addressing family emergencies and unexpected financial needs. While they offer speed and accessibility, borrowers should carefully evaluate their financial situation and the terms of the loan to ensure it aligns with their ability to repay.

Having a plan for family emergencies is essential for financial security, and online personal loans can serve as a viable solution when immediate access to funds is necessary. By leveraging the benefits of online personal loans and considering the associated costs, borrowers can effectively manage family emergencies and navigate challenging situations with confidence and financial stability.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT