Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In today’s digital age, online personal loans have become a convenient and accessible way to secure funds for various financial needs. Whether you’re facing unexpected expenses, consolidating debt, or pursuing a personal project, online personal loans can offer a swift and flexible solution. However, successfully applying for these loans requires careful preparation. In this comprehensive 1000-word article, we will explore the key steps to prepare for an online personal loan application, with a special focus on LairaPlus, an innovative personal loan product.

1. Assess Your Financial Situation

Before you begin the loan application process, it’s essential to assess your financial situation thoroughly. This includes:

A clear understanding of your financial situation will help you determine the loan amount and terms that best align with your needs.

2. Check Your Credit Score

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Your credit score plays a crucial role in the loan application process. Lenders use it to evaluate your creditworthiness and determine the interest rate and terms you’ll qualify for. Obtain a copy of your credit report and review it for any inaccuracies or negative marks. If your credit score is lower than desired, take steps to improve it before applying for a loan. This may include paying down outstanding debts and making sure all your bills are paid on time.

3. Gather Necessary Documentation

Online lenders, like LairaPlus, typically require specific documentation to process your loan application efficiently. While the exact requirements may vary from one lender to another, you can expect to provide the following:

Having these documents ready in advance will streamline the application process and expedite your loan approval.

4. Research Lenders and Loan Products

Not all online lenders are the same, and loan products can vary widely. Take the time to research different lenders and loan options to find the one that best suits your needs. Consider factors such as:

5. Complete the Online Application

Once you’ve chosen a lender and loan product, it’s time to complete the online application. Be prepared to provide the information and documentation requested by the lender accurately. Pay close attention to the application’s instructions and ensure all fields are filled out correctly. Double-check the provided information to minimize errors that could delay the approval process.

6. Review the Loan Agreement

Before accepting a loan offer, carefully review the loan agreement provided by the lender. Pay attention to:

Understanding the terms of the loan agreement is crucial to ensure you are comfortable with the terms before proceeding.

7. Accept the Loan Offer

If you are satisfied with the terms and conditions outlined in the loan agreement, accept the loan offer according to the lender’s instructions. This may involve electronically signing the agreement and providing any additional requested documentation.

8. Receive Your Funds

Once your loan is approved and accepted, the lender will disburse the funds to your designated bank account. The time it takes to receive the funds can vary depending on the lender and the specific loan product. Some lenders, like LairaPlus, offer rapid fund disbursement to ensure you receive the money quickly.

9. Manage Your Loan Responsibly

After receiving the funds, it’s essential to manage your loan responsibly. Make timely monthly payments to avoid late fees and negative impacts on your credit score. If possible, consider paying more than the minimum payment to pay off the loan faster and reduce the overall interest costs.

Conclusion: Preparing for a Successful Online Personal Loan Application

Online personal loans, such as LairaPlus, offer a convenient and flexible way to access funds for various financial needs. However, careful preparation and research are key to a successful loan application. By assessing your financial situation, checking your credit score, gathering necessary documentation, researching lenders, and completing the online application accurately, you can increase your chances of securing the loan that best suits your needs. Remember to review the loan agreement carefully and manage your loan responsibly once the funds are disbursed to ensure a positive borrowing experience.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

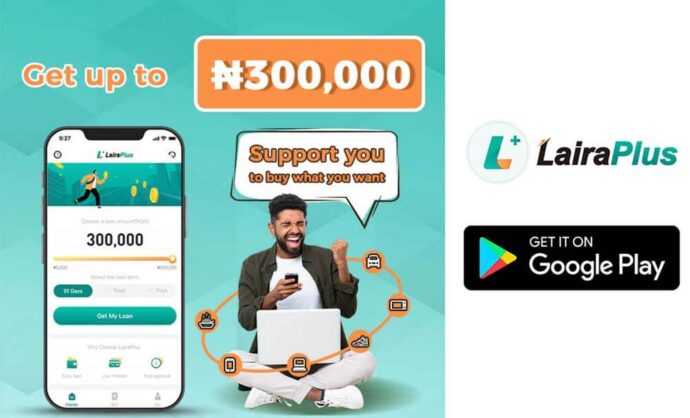

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT