Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

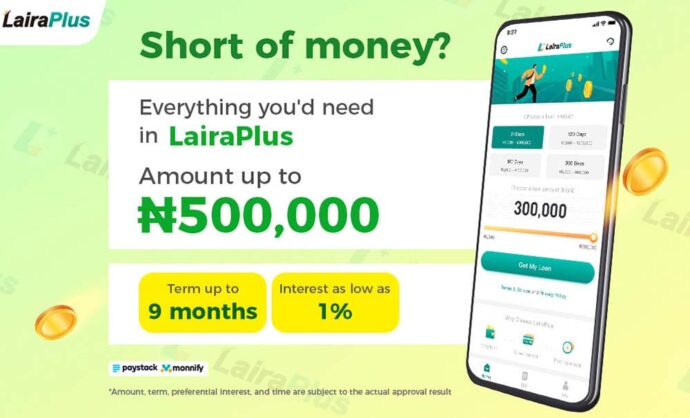

Borrowing ₦50,000: Exploring Loan Options with LairaPlus

In our daily lives, unforeseen financial needs often arise, requiring additional funds to meet these demands. LairaPlus, a Nigerian fintech company, offers a variety of loan products to assist with such borrowing needs, including loans of ₦50,000. This article delves into how LairaPlus can address urgent financial requirements when seeking a ₦50,000 loan in Nigeria.

1. Understanding the Borrowing Need

First and foremost, borrowers need to identify their borrowing needs. Borrowing ₦50,000 can be utilized for various purposes such as emergency medical expenses, home repairs, educational expenses, or investment opportunities. It is essential to clarify the purpose of the loan before applying for it.

2. LairaPlus’s Loan Products

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

LairaPlus provides a range of loan products that can cater to different types of borrowing needs. Here are some loan products that may be suitable for borrowing ₦50,000:

Emergency Cash Loans: These loans typically feature rapid approval and disbursement, making them ideal for urgent requirements. Borrowers can access the desired ₦50,000 within a short period.

Personal Convenience Loans: This is a flexible loan option usually used to address various financial needs. Borrowers can choose loan terms and repayment plans according to their repayment capacity and requirements.

Mobile App Loans: LairaPlus offers a convenient mobile app that allows borrowers to submit loan applications anytime, anywhere. This is particularly handy for those in need of quick access to funds.

3. The Loan Application Process

Borrowing ₦50,000 typically involves the following steps:

Selecting a Loan Product: Borrowers should choose an appropriate loan product based on their needs. Different products may have varying interest rates and loan terms.

Completing the Application: Fill out the loan application on LairaPlus’s mobile app or website. This generally requires providing personal information, financial details, and the purpose of the loan.

Approval and Disbursement: LairaPlus will review the application and conduct a credit assessment. If the application is approved, borrowers will receive the loan amount within a short timeframe.

Repayment Plan: Borrowers need to create a repayment plan in accordance with the requirements of the chosen loan product and ensure timely repayments.

4. Affordability of the Loan

Borrowing ₦50,000 is a significant decision, and borrowers should assess whether they can comfortably afford this loan based on their financial situation and repayment capacity. LairaPlus provides a transparent fee structure and repayment options, and borrowers should carefully consider these factors.

5. Utilizing the Loan

Once they have access to the ₦50,000 loan, borrowers can use the funds according to their intended purpose. This might include covering medical expenses, addressing urgent household costs, making investments, or other pressing needs.

Conclusion

LairaPlus offers a range of loan options to borrowers, including meeting the ₦50,000 borrowing needs. Before applying for a loan, borrowers should clarify their needs, select an appropriate loan product, and ensure they have a feasible plan for repayments. Through prudent loan choices, borrowers can effectively address urgent financial needs while maintaining their financial stability.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT