Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The Approval Process for Personal Instant Loans on LairaPlus:

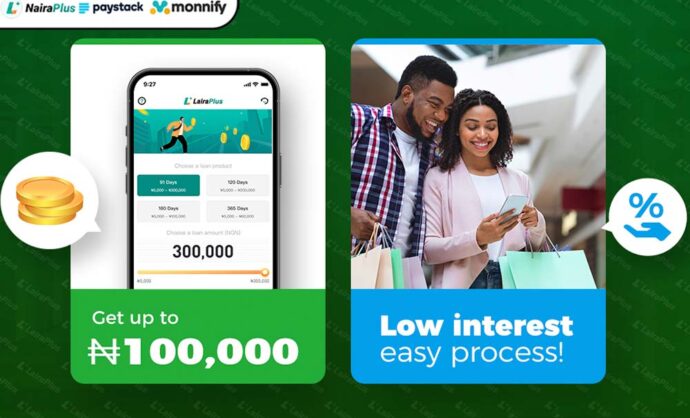

LairaPlus is a widely used online loan platform that offers a convenient way to apply for personal instant loans through its official app. However, many people might have questions about the approval process for personal instant loans on LairaPlus. In this article, we will provide a detailed overview of the approval process for personal instant loans on LairaPlus, helping you better understand the process.

The first step to applying for a personal instant loan on LairaPlus is to fill out the loan application form on its official app. You’ll need to provide basic personal information such as your name, contact details, identification, as well as financial information including income, expenses, and more. Filling out the application form marks the beginning of your loan application process.

In addition to basic information, LairaPlus might ask for additional documents and information to verify your identity and financial situation. This could include pay stubs, bank statements, proof of residence, and more. Providing accurate and complete documentation is crucial for a smooth approval process.

Once you’ve submitted your loan application and the required documents, LairaPlus will conduct a credit assessment and risk analysis. They’ll evaluate your credit history, income, expenses, and other financial factors to determine your repayment capacity and risk level.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

After completing the credit assessment and risk analysis, LairaPlus will proceed with the loan approval process. They’ll take into account your credit score, financial status, and application information to decide whether to approve your loan application.

If your loan application is approved, LairaPlus will present you with the loan terms. These terms will include important information such as the loan amount, interest rate, repayment period, and more. Upon agreeing to the loan terms, you can choose to accept the loan.

If you agree to the loan terms, you’ll need to sign relevant loan documents on the LairaPlus platform. This might involve using electronic signatures to confirm your agreement with the loan terms.

Once the documents are signed, LairaPlus will disburse the loan amount to your designated bank account. This is typically done within a short period of time after you’ve agreed to the loan terms.

Upon loan disbursement, you’ll need to make repayments on time according to the agreed-upon repayment schedule. LairaPlus usually offers multiple repayment methods, allowing you to choose the most convenient way to make repayments.

The approval process for personal instant loans on LairaPlus is a well-structured journey designed to provide borrowers with a convenient and transparent loan experience. From filling out the application form to fund disbursement, each step is carefully designed to ensure users can access the needed funds smoothly. Whether you’re dealing with unexpected expenses or working toward financial goals, LairaPlus’ personal instant loans offer a convenient and fast borrowing solution.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT