Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Exploring Loan History in the LairaPlus App: Managing Your Borrowing Journey

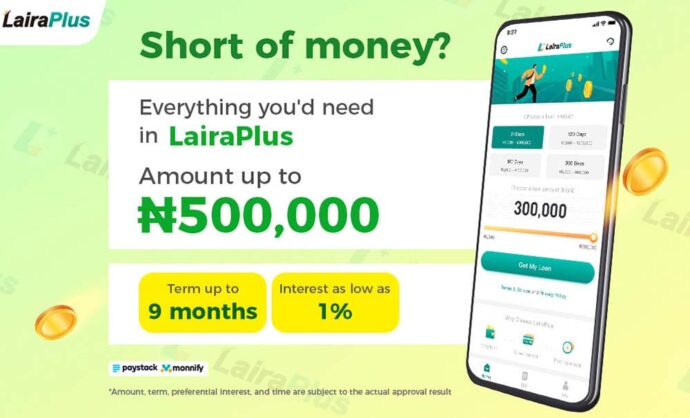

LairaPlus, as a convenient lending application, offers users an accessible borrowing experience. Understanding your loan history is a crucial part of financial management. In this article, we will delve into the loan history feature in the LairaPlus app and how you can use it to manage your personal finances.

Loan history is a comprehensive record of your borrowing experiences, including loan amounts, loan dates, repayment terms, and repayment status. This record not only helps you understand your borrowing habits but also aids in planning future borrowing needs. By reviewing your loan history, you can better understand:

Loan history allows you to clearly see the repayment status of each past loan. This helps ensure that all repayments are made on time, maintaining a positive credit history.

Analyzing loan history can help you identify your borrowing patterns. Did you borrow in emergencies or for specific projects? This insight assists in better planning future borrowing endeavors.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Loan history reflects your repayment capacity. Examining your past repayment behavior enables you to assess your financial situation for wiser borrowing decisions.

The LairaPlus app offers a convenient way to access your loan history. Follow these steps:

Open the LairaPlus app and log into your account.

Within the app interface, you’ll typically find an option labeled “History” or something similar. Click on this option to access your loan history.

On the history page, you can see detailed information about each loan, including loan dates, loan amounts, repayment terms, and repayment status.

Based on this information, you can analyze your borrowing journey and plan future borrowing needs. If you anticipate upcoming repayment requirements, you can proactively allocate funds to ensure timely repayments.

Regularly reviewing and managing your loan history allows you to stay informed about your borrowing journey, avoid missed repayments, and debt-related issues. Additionally, it helps maintain a positive credit history, which can lead to more favorable borrowing terms in the future.

The LairaPlus app provides a user-friendly feature to view loan history, enabling you to keep track of your borrowing journey. By reviewing your loan history, you can manage your finances more effectively, plan for future borrowing needs, and maintain a positive credit history. Utilizing this feature empowers you to confidently manage your borrowing and financial situation.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT