Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

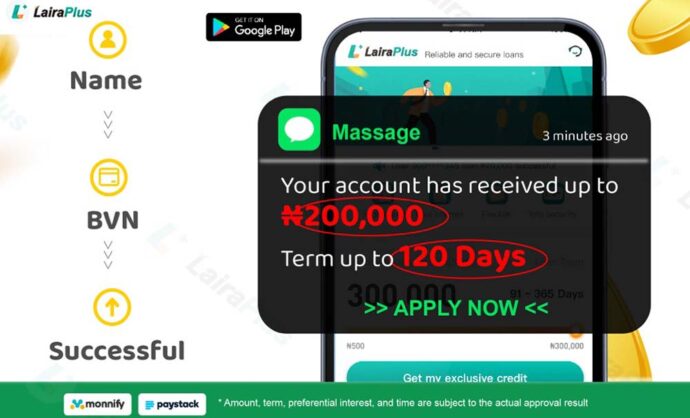

LairaPlus Personal Credit Loan Approval Time

In times of urgency, obtaining swift approval for a personal credit loan is the borrower’s desire. As a loan application platform, LairaPlus offers users a convenient gateway for credit loans. However, loan approval time can be influenced by various factors. This article delves into the time required for personal credit loan approval on LairaPlus, along with key factors that impact approval time.

Factors Affecting Approval Time:

Completeness of Application Information: Submitting complete and accurate application information can expedite the approval process. Ensure that all documents and information you provide are clear and visible for the review team to process swiftly.

Volume of Loan Applications: If LairaPlus receives a high volume of loan applications, the approval process might be extended due to the number of applications being processed. During peak periods, more time may be needed to address all applications.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Document Review Time: Uploaded documents need to be reviewed to verify their authenticity and accuracy. If documents need to be re-uploaded or if the review process takes longer, it can affect approval time.

Credit Assessment: Credit assessment is a crucial step in determining borrower credit risk. If a more in-depth credit assessment is required, it could extend the approval time.

Loan Amount and Term: Larger loan amounts or longer repayment terms might require more time for thorough review and evaluation.

Additional Verification Processes: Depending on LairaPlus policies, additional verification processes like income verification, employment verification, etc., might be required. These processes can impact approval time.

Expected Approval Time:

In general, LairaPlus’ personal credit loan approval time can range from a few hours to several business days. This is a general timeframe, and the actual approval time may vary based on the aforementioned factors. Some quick approval loans may be completed within a few hours, while more complex applications might take longer.

Ways to Expedite Approval:

Submit a Complete Application: Ensure that you provide all necessary information and documents in your application to reduce the need for later information supplementation and review time.

Maintain a Good Credit: Having a good credit history can expedite your credit assessment process, thus reducing approval time.

Choose Appropriate Loan Amount and Term: Select loan amounts and repayment terms that align with your actual needs, avoiding unnecessary delays.

Monitor Notifications Closely: If LairaPlus requires additional information or documents from you, ensure prompt response to avoid delays in the approval process.

The approval time for LairaPlus’ personal credit loans can be influenced by various factors, but it generally ranges from a few hours to several business days. Understanding the factors impacting approval time and taking appropriate steps to expedite the process can help you obtain the desired loan more quickly.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT