Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Step-by-Step Guide to Applying for a Personal Credit Loan on LairaPlus

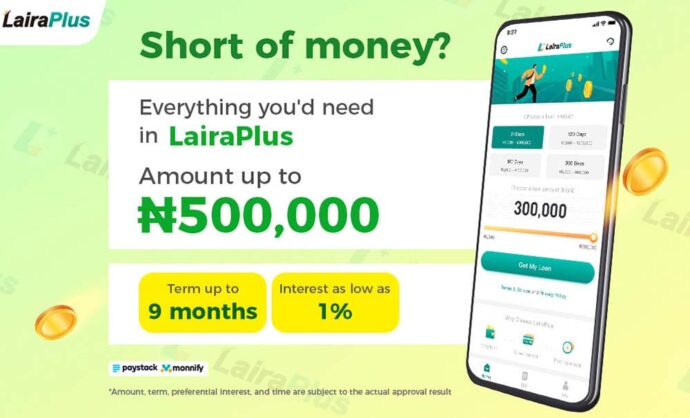

In today’s modern society, personal credit loans have become a vital avenue for addressing urgent financial needs and achieving personal goals. As a loan application, LairaPlus provides users with a convenient platform for applying for credit loans. This article will offer a comprehensive guide on how to apply for a personal credit loan on LairaPlus, highlighting key steps to keep in mind.

Step 1: Download and Install the LairaPlus App: Firstly, ensure that you have downloaded and installed the LairaPlus app on your smartphone or tablet, as mentioned earlier. Open the app and log in to your account or register a new account following the steps outlined in the previous article.

Step 2: Browse Loan Options: Once logged into the LairaPlus app, you will enter the main interface. On this screen, you’ll find various loan options such as personal loans, emergency loans, and more. Click on the “Personal Credit Loan” option to initiate your application process.

Step 3: Fill in Personal Information: On the loan application page, you’ll be prompted to fill in personal details including your name, date of birth, gender, residential address, and contact information. Ensure you provide accurate information for LairaPlus to process your application.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Step 4: Provide Financial Information: LairaPlus might request information regarding your financial situation, such as income, employment status, and expenses. Ensure you provide truthful and comprehensive information to assist LairaPlus in evaluating your loan eligibility.

Step 5: Select Loan Amount and Term: Based on your requirements, choose an appropriate loan amount and repayment term. The LairaPlus app may offer a loan calculator to help you understand monthly repayment amounts and total interest.

Step 6: Upload Necessary Documents: As per LairaPlus’s requirements, you might need to upload certain essential documents, such as your identification card, employment proof, bank statements, etc. Make sure these documents’ copies are clear and legible.

Step 7: Read and Agree to Terms: Before submitting your application, carefully read LairaPlus’s loan terms and conditions. Ensure you understand crucial information such as interest rates, repayment terms, and prepayment policies.

Step 8: Submit Your Application: Once you’ve completed filling in all the necessary information and uploading documents, click the “Submit Application” button. Your application will be sent to LairaPlus for review and processing.

Step 9: Await Approval and Notification: After submitting your loan application, you’ll need to patiently wait for LairaPlus’s review and approval process. Typically, you’ll receive notifications informing you whether your application has been approved.

Step 10: Accept the Loan and Sign Documents: If your application is approved, you’ll need to accept the loan terms and sign relevant documents. Ensure you carefully read all documents and sign only after understanding the terms clearly.

Applying for a personal credit loan on LairaPlus is a relatively straightforward process that requires you to provide accurate personal and financial information. By following the steps and guidelines outlined above, you can easily apply for a credit loan on LairaPlus, thereby achieving your financial goals and needs.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT