Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Calculating Monthly Repayment for Personal Consumer Loans: Method and Key Considerations

In modern life, personal consumer loans have become a crucial means to achieve various consumption goals. Whether it’s purchasing a car, appliances, traveling, or investing in education, consumers may need to utilize loans to make payments in installments. Understanding how to calculate the monthly repayment for personal consumer loans, along with related crucial factors, is essential for effectively managing personal finances.

Method for Calculating Monthly Repayment for Personal Consumer Loans:

The monthly repayment for personal consumer loans is typically calculated using the equal installment method, also known as the equal amortization method. This approach ensures that the repayment amount remains relatively consistent each month, encompassing both the principal amount and gradually reducing interest.

The formula for calculating the monthly repayment is as follows:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Monthly Repayment = [Loan Principal × Monthly Interest Rate × (1 + Monthly Interest Rate)^Loan Term] / [(1 + Monthly Interest Rate)^Loan Term – 1]

Here, the Monthly Interest Rate = Annual Interest Rate / 12, and the Loan Term is the total number of months for the loan.

Key Considerations:

Loan Amount: The loan amount is a critical factor in determining the monthly repayment. A larger loan amount leads to a higher monthly repayment. When deciding on the loan amount, it’s important to make a wise choice based on one’s financial situation and repayment capacity.

Annual Interest Rate: The annual interest rate directly impacts the loan cost and monthly repayment. A higher interest rate results in a larger portion of each monthly payment being allocated to interest, leading to an increase in the monthly repayment. When selecting a loan product, it’s important to compare interest rates offered by different banks or financial institutions to secure favorable terms.

Loan Term: The loan term refers to the duration of the loan repayment. A longer loan term leads to lower monthly repayments but higher total interest payments. Shorter loan terms reduce overall interest costs but may result in higher monthly repayments. Selecting a loan term that aligns with one’s repayment capacity and plans is crucial.

Repayment Capacity: Assessing one’s repayment capacity is essential before calculating the monthly repayment. The monthly repayment should be within one’s financial capabilities to avoid delayed payments, penalties, and damage to credit history.

Early Repayment Policy: In some cases, you might intend to repay the loan earlier than planned. Therefore, when choosing a loan product, understanding the bank’s or financial institution’s policy on early repayment is important. Some institutions may impose early repayment fees, impacting your repayment strategy.

Conclusion:

Personal consumer loans play a significant role in modern life, but while selecting and utilizing loans, it’s crucial to consider factors such as loan amount, annual interest rate, loan term, repayment capacity, and early repayment policies. Calculating the monthly repayment for personal consumer loans helps in sound financial planning, ensuring a reasonable and feasible repayment plan. Ultimately, managing personal finances wisely, utilizing loans sensibly, and achieving consumption goals while maintaining a strong credit record are all achievable through prudent financial management.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

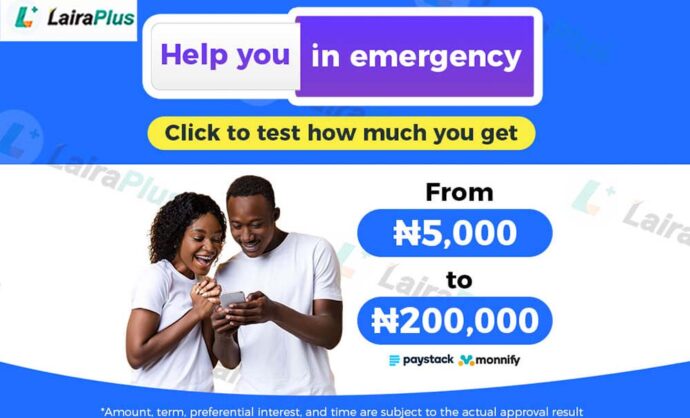

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT