Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Repaying Personal Credit Loans via Bank Transfer

After obtaining a loan on the LairaPlus lending platform, making timely repayments is crucial for maintaining a good credit record and financial stability. While LairaPlus offers various repayment methods, repaying through a bank transfer is a common and secure option. In this article, we will provide a detailed guide on how to make repayments for personal credit loans using bank transfers and offer some useful tips and considerations.

Before using a bank transfer for repayment, you need to gather some essential information to ensure that the funds reach their intended destination accurately. This information may include:

Log in to your bank account’s online banking system or mobile application.

In general, you’ll need to select the “Transfer” or “Remittance” option within your bank’s online banking interface to initiate a bank transfer.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

On the transfer page, you’ll need to input the payee’s information, including the payee’s name, bank account number, and bank name. Make sure you input the correct information to prevent funds from being transferred to the wrong account.

Input the amount you wish to repay and make sure to enter the payment reference number provided by LairaPlus in the appropriate field. This helps identify your repayment.

Before submitting the transfer, carefully review the information you’ve entered to ensure there are no errors. Transfers are typically irreversible or hard to modify after completion.

Once you’re certain the information is accurate, you can choose to confirm and submit the transfer. Your bank will process the transfer and move the funds to the payee’s bank account.

After completing the transfer, be sure to keep evidence of the payment, such as transfer confirmation receipts, transaction numbers, or electronic receipts. This information helps verify your repayment when needed.

Repaying personal credit loans via a bank transfer is a secure and common method. Ensure you gather accurate payee information, double-check transfer details, and retain payment evidence. By following the correct steps and considerations, you can easily navigate the repayment process, maintain a strong credit record, and uphold financial stability.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

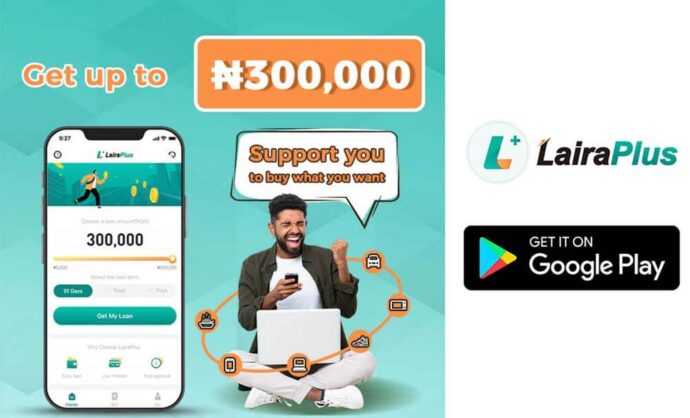

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT