Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

How to Repay Personal Cash Loans on a Mobile Device

With the rapid advancement of mobile technology, many financial activities, including repaying personal cash loans, have transitioned to mobile devices. Recognizing this trend, LairaPlus offers users a convenient way to repay personal cash loans using their mobile devices. In this article, we will provide a detailed guide on how to use the LairaPlus platform to repay personal cash loans on a mobile device, along with the benefits and steps involved.

Firstly, you need to download and install the LairaPlus mobile app on your mobile device. You can search for “LairaPlus” in your device’s app store (Google Play Store) and download the app.

Once you’ve opened the LairaPlus mobile app, you will need to log into your account using your username and password. If you’re using the mobile app for the first time, you might need to go through the account registration process.

Within the mobile app, you’ll typically find an option in the main menu or on the home screen labeled “Repayment” or “My Repayments.” Tap on this option to access the repayment page.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

On the repayment page, you will see different repayment method options such as manual repayment, automatic deduction, and more. Choose the repayment method that suits your preference.

Depending on the repayment method you select, you might need to input relevant repayment information such as the repayment amount, payment method, payment account, etc. Ensure you input accurate information to avoid errors.

After entering the repayment details, you’ll usually be prompted to confirm the repayment action. Double-check the repayment amount and relevant details, then click “Confirm” or a similar button.

Once the repayment is successful, you’ll receive a confirmation notification on the mobile app. This notification will typically display the success message along with relevant repayment proof or reference numbers.

If you opt for automatic deduction, you’ll need to set up relevant information for automatic repayment within the mobile app. This might include payment account details and deduction dates. This way, future repayments will be automated.

LairaPlus mobile app often provides an option that allows you to view your repayment history at any time. You can find an option labeled “Repayment Records” or a similar name within the app to review your past repayment records.

When using a mobile device for repayment, ensure your device is in a secure environment. Avoid making repayments on public networks or insecure connections to prevent information leaks and security risks.

Repaying personal cash loans using a mobile device is an efficient and convenient way to complete repayment tasks anytime and anywhere. The LairaPlus mobile app offers multiple repayment methods, allowing borrowers to choose based on their preferences and needs. Through this approach, borrowers can better manage their loans, ensure timely and accurate repayments, and maintain good financial habits in their mobile lifestyles.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

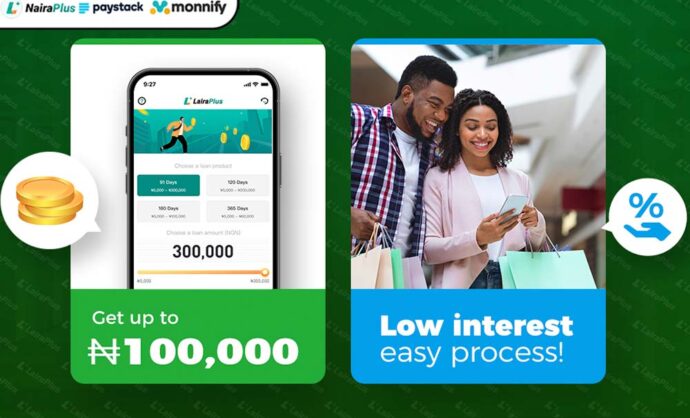

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT