Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

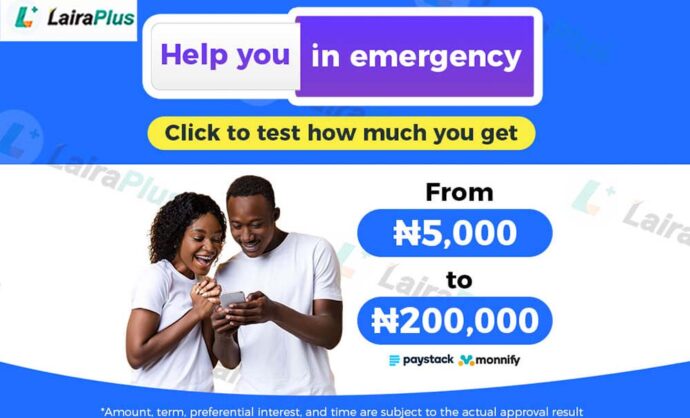

Choosing Online Borrowing Over Traditional Bank Loans: The LairaPlus Advantage

The financial landscape is evolving at an unprecedented pace, driven by technology and changing consumer preferences. One significant shift has been the emergence of online borrowing platforms as a viable alternative to traditional bank loans. LairaPlus, a prominent player in the online lending sphere, offers a compelling case for why individuals are increasingly opting for online borrowing over the conventional routes offered by banks.

The digital revolution has reshaped how we interact with financial services. Traditional bank loans, while reliable, often come with a lengthy application process, strict eligibility criteria, and an extensive documentation trail. In contrast, online borrowing platforms like LairaPlus provide a streamlined and efficient borrowing experience that resonates with the demands of modern life.

1. Convenience and Accessibility

Online borrowing platforms offer the convenience of accessing financial services from the comfort of your own home. With a few clicks on your device, you can complete the entire borrowing process, eliminating the need for multiple visits to a bank branch. This accessibility is particularly advantageous for individuals with busy schedules or those living in remote areas.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

2. Speedy Approval

Traditional bank loans can entail weeks of waiting for approval, leaving borrowers in a state of uncertainty. In contrast, online borrowing platforms like LairaPlus are designed for quick approvals. Many borrowers receive notifications of approval within hours, ensuring that urgent financial needs are promptly addressed.

3. Simplified Application Process

LairaPlus excels at simplifying the application process. Traditional loans often require extensive paperwork, credit checks, and collateral assessment. In contrast, online platforms like LairaPlus streamline the application by focusing on essential details, making it accessible to a broader range of borrowers.

4. Customized Borrowing Experience

Online borrowing platforms allow borrowers to choose loan amounts and repayment terms that suit their individual needs. This flexibility empowers borrowers to tailor their borrowing experience to align with their financial circumstances, offering a level of personalization that traditional banks may struggle to provide.

5. Inclusivity and Accessibility

Online platforms often have a broader acceptance criteria, making borrowing accessible to a wider audience. This inclusivity extends to individuals with varying credit scores or limited credit history, who may find it challenging to secure loans through traditional channels.

LairaPlus stands out as a frontrunner in the online borrowing space, offering numerous advantages that align with the changing preferences of borrowers. With a user-friendly interface, simplified application process, swift approvals, and flexible repayment options, LairaPlus redefines the borrowing experience.

The rise of online borrowing platforms like LairaPlus reflects a fundamental shift in the borrowing landscape. Convenience, speed, flexibility, and inclusivity are the cornerstones of this change. As technology continues to reshape financial services, individuals are increasingly embracing online borrowing as a more tailored, accessible, and efficient alternative to traditional bank loans. LairaPlus exemplifies this transformation by providing a seamless, user-focused borrowing experience that addresses the evolving needs of today’s borrowers.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT