Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In the fast-paced world of digital finance, where convenience often takes precedence, the emergence of loan apps without the Bank Verification Number (BVN) requirement has stirred both curiosity and skepticism. While these apps promise an alternative and hassle-free way to access loans, the question remains: Are loan apps without BVN in Nigeria reliable? In this article, we will explore the reliability of such apps, their pros and cons, and how to make an informed decision when considering them.

Understanding BVN and Its Role:

The Bank Verification Number (BVN) is a unique identifier for bank account holders in Nigeria. It was introduced to enhance security, reduce fraud, and provide a unified identification system. BVN has become a common requirement for various financial transactions and services, including loan applications.

The Appeal of Loan Apps Without BVN:

Loan apps that do not require BVN have gained attention for several reasons:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Privacy Concerns: BVN links personal information to loan applications, raising concerns about data privacy. Apps without BVN claim to offer more privacy.

Accessibility: These apps may provide access to loans for individuals without a BVN, making financial services more inclusive.

Simplified Application: The absence of BVN can simplify the application process, potentially speeding up loan approvals.

Reliability Considerations:

When evaluating the reliability of loan apps without BVN, several factors come into play:

Data Security: The primary concern revolves around the security of personal and financial data. Users must ensure that these apps have robust security measures in place to protect their information.

Verification Methods: While these apps don’t rely on BVN, they employ alternative methods to assess creditworthiness. Users should inquire about these methods and how reliable they are.

Interest Rates and Fees: Loan terms, interest rates, and fees may differ from traditional loans. Understanding these terms is vital to avoid surprises.

App Reputation: Research the reputation and user reviews of the app. A reliable app should have a history of successful lending and positive customer experiences.

Legal Compliance: Ensure that the app operates within the legal framework of Nigeria and is registered with relevant authorities.

Making an Informed Decision:

If you are considering using a loan app without BVN, here’s how to make an informed decision:

Research: Thoroughly research the app’s reputation, user feedback, and data security measures. Reading reviews and testimonials can provide valuable insights.

Review Terms and Conditions: Carefully go through the app’s terms and conditions, including interest rates, repayment periods, and any hidden fees.

Contact Support: If you have questions or concerns, don’t hesitate to contact the app’s customer support. Their responsiveness and willingness to assist can be indicative of reliability.

Alternative Verification: Understand how the app verifies your creditworthiness without BVN and assess the reliability of these methods.

User Experiences: Reach out to others who have used the app and inquire about their experiences. Real user testimonials can offer valuable insights.

Loan apps without BVN in Nigeria offer an alternative borrowing option, but their reliability hinges on various factors, including data security, verification methods, and user experiences. Users must exercise caution, conduct thorough research, and read the fine print of any loan app to ensure a reliable and safe borrowing experience. While these apps can provide convenience, responsible borrowing remains a crucial component of financial well-being.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

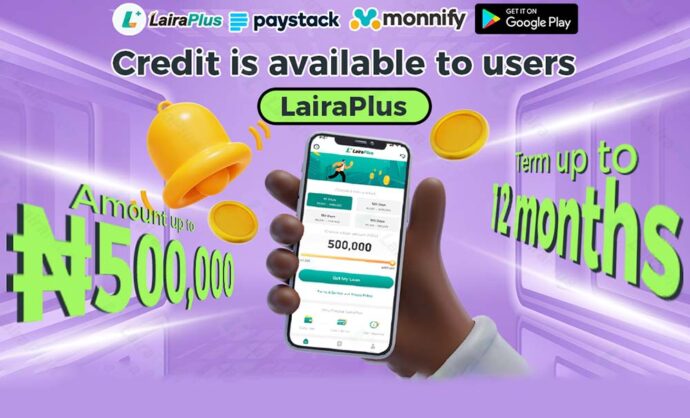

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT